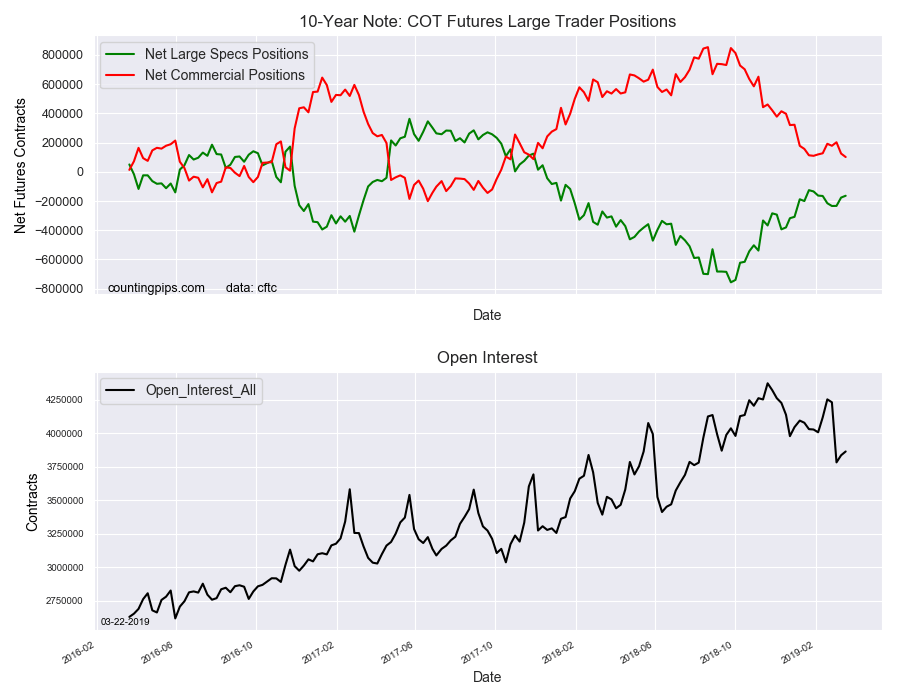

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators continued to decrease their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -163,974 contracts in the data reported through Tuesday, March 19th. This was a weekly gain of 12,460 net contracts from the previous week which had a total of -176,434 net contracts.

The week’s net position was the result of the gross bullish position (the longs) ascending by 68,105 contracts to a weekly total of 704,564 contracts compared to the gross bearish position (the shorts) which saw an increase by 55,645 contracts for the week to a total of 868,538 contracts.

The speculators have now trimmed their net position for three straight weeks after boosting their bearish bets in the previous five consecutive weeks. The current standing shows that speculators have brought their net positioning under the -200,000 contract level for a second straight week and with the treasury yield curve inverting on Friday, we could see this position go even lower in weeks or months to come.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 101,027 contracts on the week. This was a weekly decline of -23,702 contracts from the total net of 124,729 contracts reported the previous week.

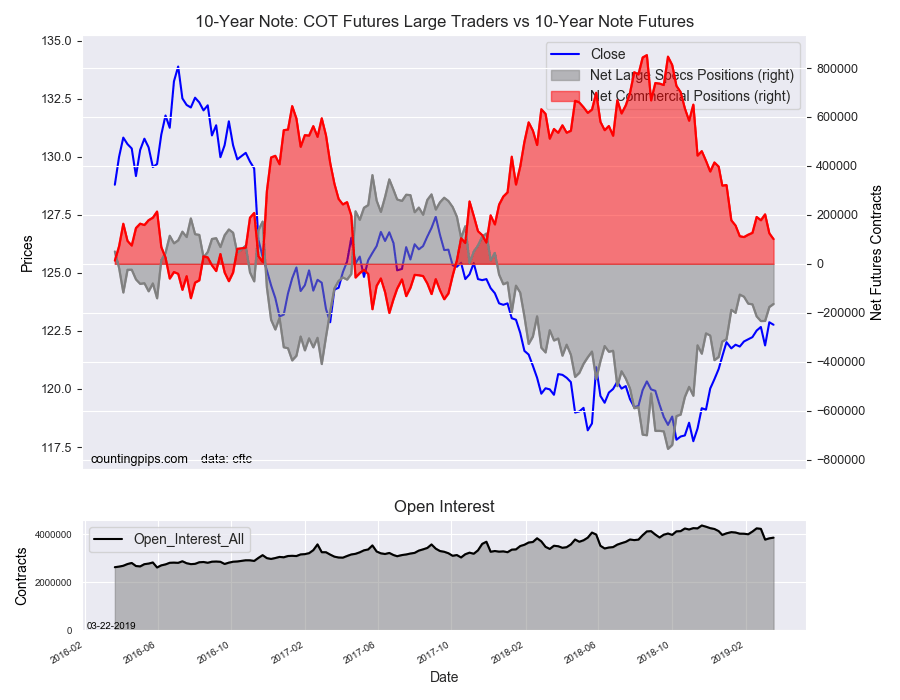

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $122.77 which was a decrease of $-0.10 from the previous close of $122.87, according to unofficial market data.