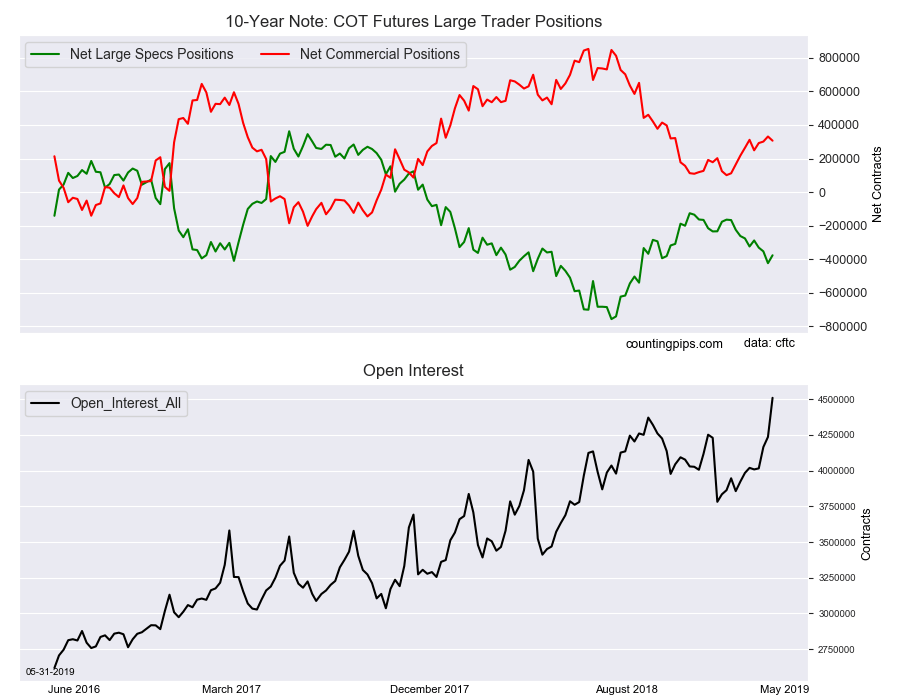

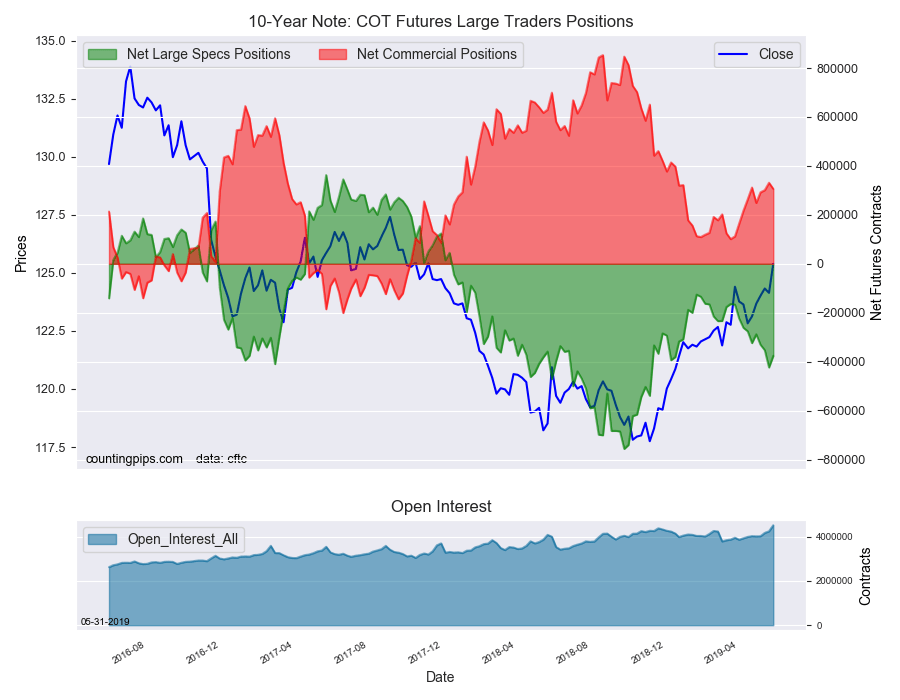

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators reduced their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -376,173 contracts in the data reported through Tuesday, May 28th. This was a weekly change of 47,178 net contracts from the previous week which had a total of -423,351 net contracts.

The week’s net position was the result of the gross bullish position (longs) falling by -11,538 contracts (to a weekly total of 607,956 contracts) while the gross bearish position (shorts) dropped by larger amount of -58,716 contracts for the week (to a total of 984,129 contracts).

Speculators decreased their bearish bets this week following three weeks of rising shorts (and a gain of -135,430 contracts over that period). The current speculator bearish standing has been expanding recently and remains strongly bearish despite the strength in the 10-Year bond price (the decline of 10-Year yield).

Overall, the 10-Year bond speculator position has now been in bearish territory for 76 straight weeks dating back to December of 2017.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 306,309 contracts on the week. This was a weekly decline of -24,909 contracts from the total net of 331,218 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $125.39 which was a boost of $1.25 from the previous close of $124.14, according to unofficial market data.