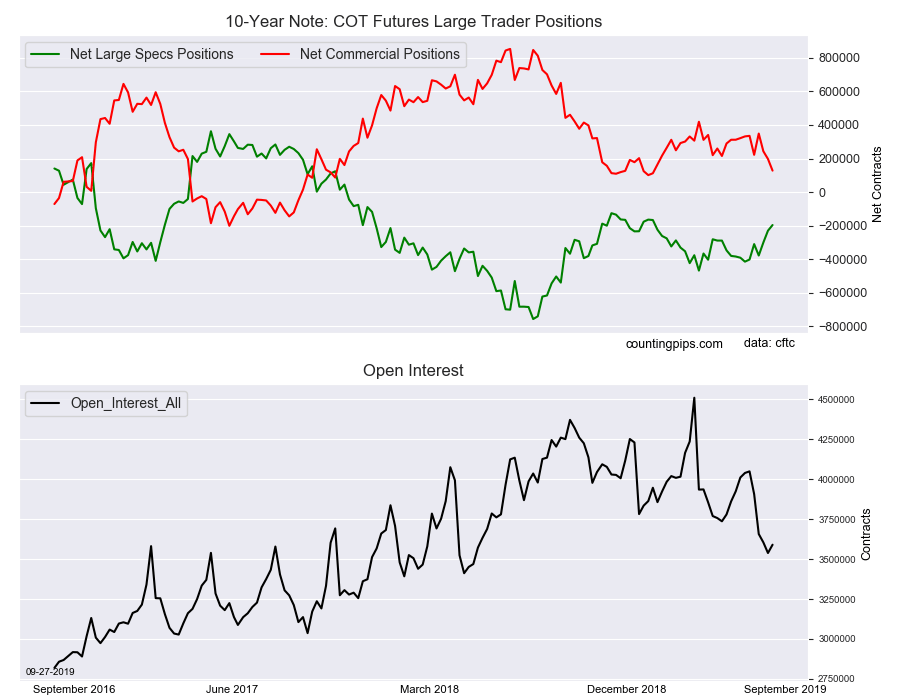

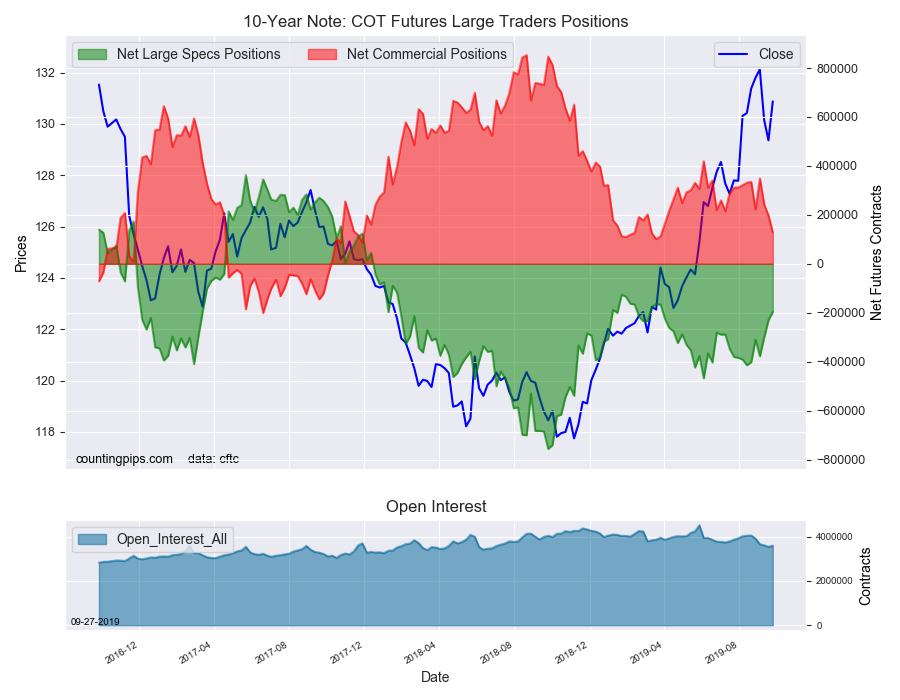

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators cut back on their bearish net positions in the 10 Year Note futures markets once again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -196,306 contracts in the data reported through Tuesday September 24th. This was a weekly change of 33,657 net contracts from the previous week which had a total of -229,963 net contracts.

The week’s net position was the result of the gross bullish position (longs) ascending by 848 contracts (to a weekly total of 624,462 contracts) while the gross bearish position (shorts) dropped by -32,809 contracts for the week (to a total of 820,768 contracts).

Speculators reduced their bearish bets for a third straight week and for the fifth time out of the past six weeks. This recent downtrend in bearish bets has now shaved off a total of 218,040 contracts from the bearish level in just the last six weeks. The current standing of speculative positions is at the least bearish level since March 26th, a span of twenty-six weeks.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 127,868 contracts on the week. This was a weekly shortfall of -69,527 contracts from the total net of 197,395 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $130.87 which was a boost of $1.51 from the previous close of $129.35, according to unofficial market data.