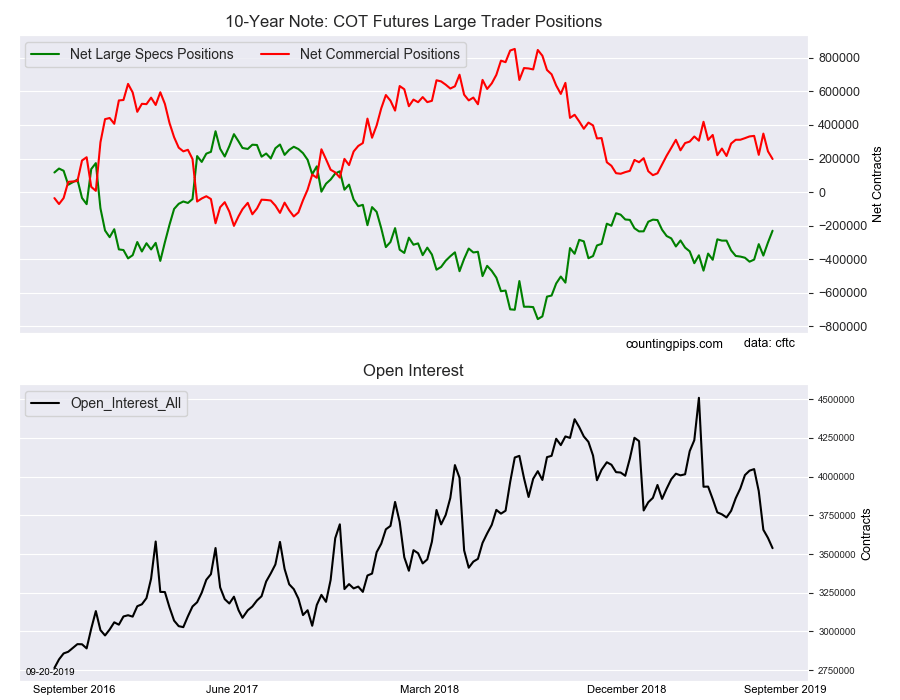

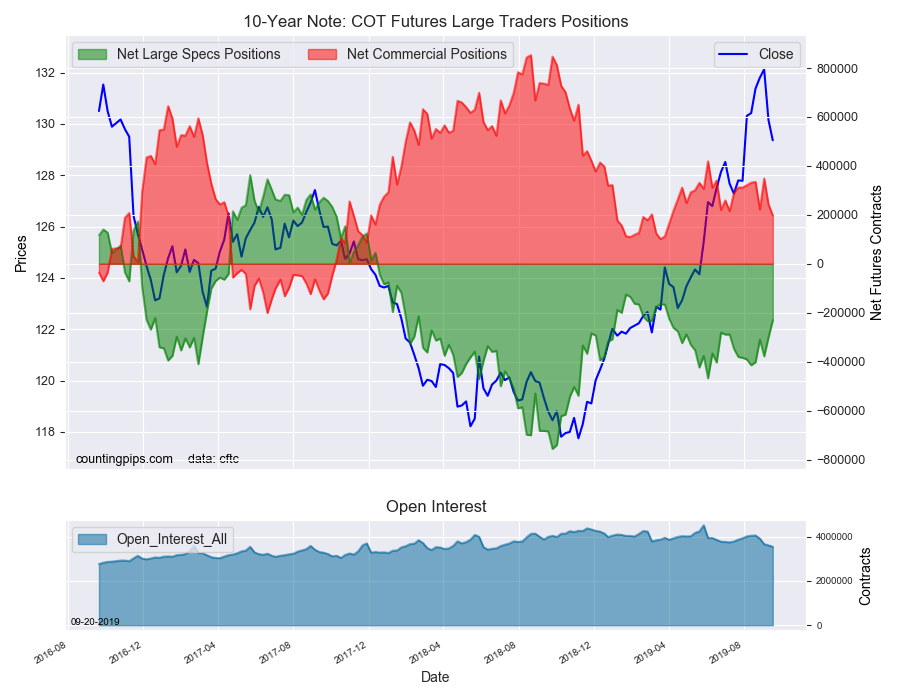

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators decreased their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -229,963 contracts in the data reported through Tuesday September 17th. This was a weekly change of 70,470 net contracts from the previous week which had a total of -300,433 net contracts.

The week’s net position was the result of the gross bullish position (longs) going up by just 444 contracts (to a weekly total of 623,614 contracts) while the gross bearish position (shorts) dropped by -70,026 contracts for the week (to a total of 853,577 contracts).

The 10-year speculators reduced their bearish positions by over twenty percent this week for a second straight week and by a total of 147,904 net contracts over these past 2 weeks. In fact, the bearish position has also declined in four out of the past five weeks and by a total of 184,383 contracts in that time-frame.

Despite the recent pullbacks, the speculator net position remains in bearish territory although at the least bearish level since April 2nd.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 197,395 contracts on the week. This was a weekly decline of -45,689 contracts from the total net of 243,084 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $129.35 which was a drop of $-0.79 from the previous close of $130.15, according to unofficial market data.