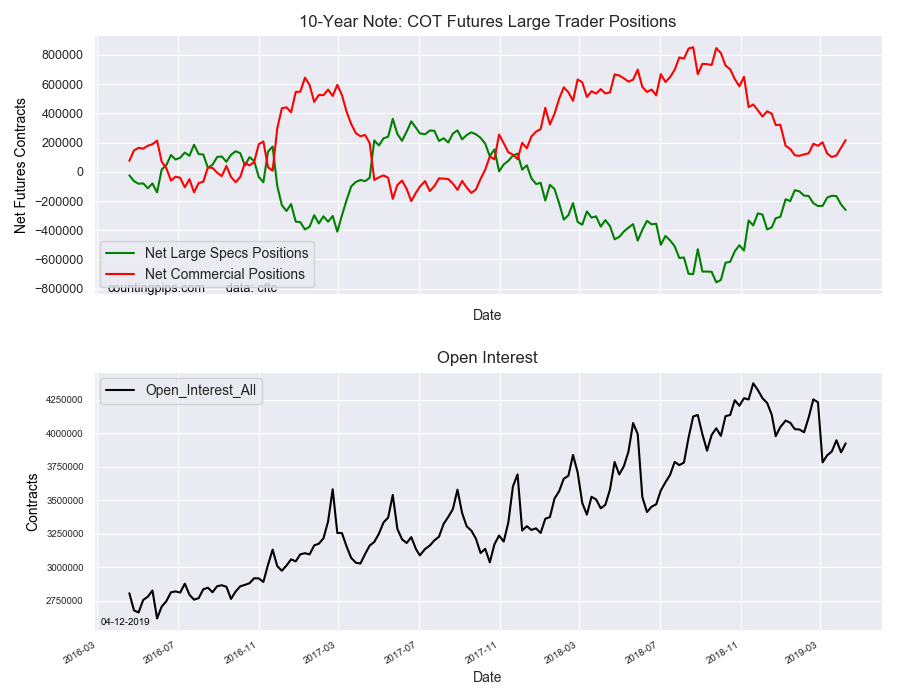

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators added to their bearish net positions in the 10-Year Note futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -261,564 contracts in the data reported through Tuesday, April 9th. This was a weekly change of -37,341 net contracts from the previous week which had a total of -224,223 net contracts.

The week’s net position was the result of the gross bullish position (longs) dropping by -14,217 contracts to a weekly total of 630,253 contracts in addition to the gross bearish position (shorts) which saw a gain by 23,124 contracts for the week to a total of 891,817 contracts.

The net speculative bearish bets rose higher for a third straight week and by a total of -97,590 contracts over that period. Speculators are now at their most bearish level of the new year as bearish bets haven’t been this high since December 31st when the net position totaled -308,287 contracts.

10-Year Note Commercial Positions:

Meanwhile, the commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 217,234 contracts on the week. This was a weekly boost of 52,968 contracts from the total net of 164,266 contracts reported the previous week.

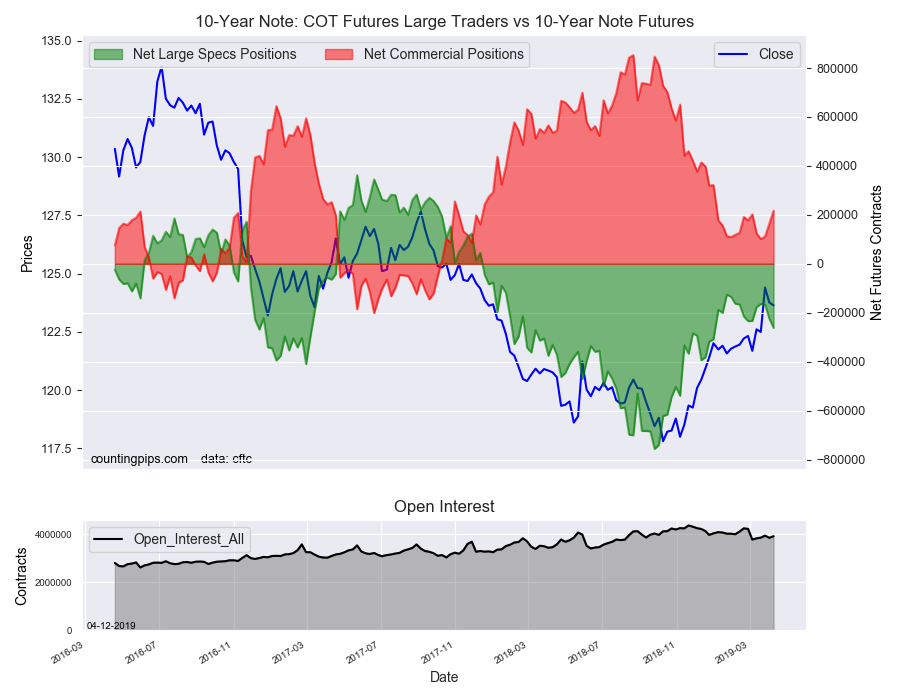

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $123.64 which was a fall of $-0.12 from the previous close of $123.76, according to unofficial market data.