10-Year Note Non-Commercial Speculator Positions:

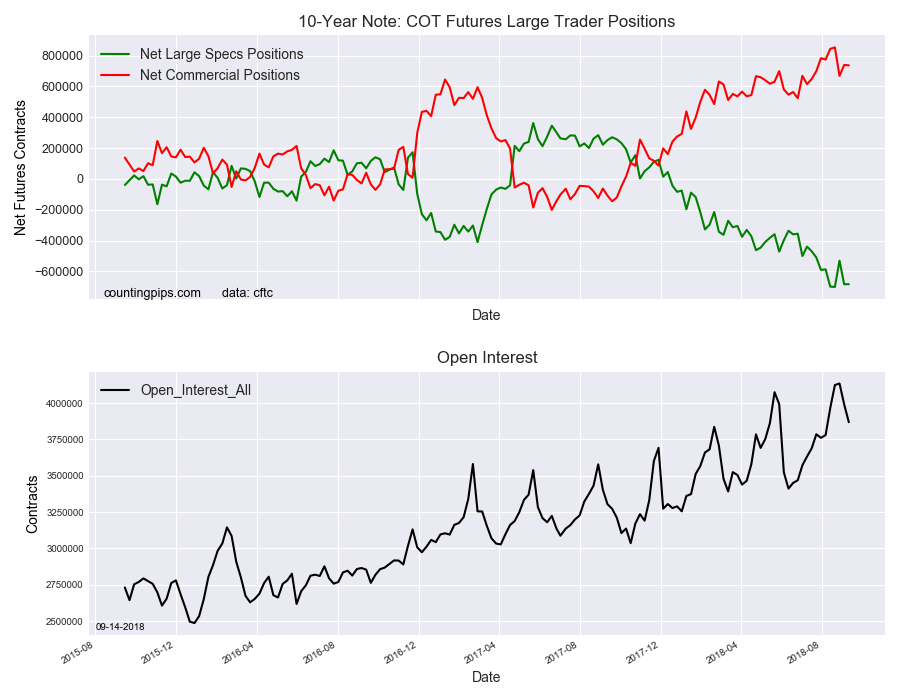

Large bond speculator’s bearish net positions were virturally unchanged in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -682,684 contracts in the data reported through Tuesday September 11th. This was a weekly edge higher of 73 contracts from the previous week which had a total of -682,757 net contracts.

This week’s tiny movement in the speculator bets follows last week’s -152,937 jump in bearish bets that pushed the overall bearish position back over the -600,000 net contract level. The 10-Year spec level has now been over at least -680,000 contracts for four out of the past five weeks with the exception of a total of -529,820 contracts on August 28th. The all-time record high bearish position was just recently set on August 21st with a total of -700,514 contracts.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 736,595 contracts on the week. This was a weekly loss of -2,312 contracts from the total net of 738,907 contracts reported the previous week.

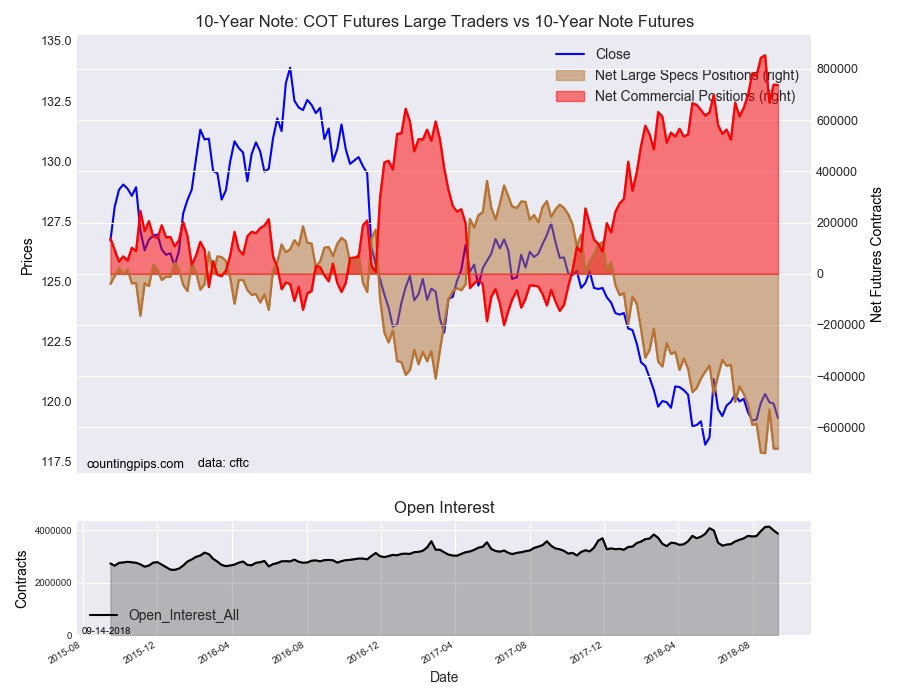

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $119.32 which was a loss of $-0.60 from the previous close of $119.92, according to unofficial market data.