10-Year Note Non-Commercial Speculator Positions:

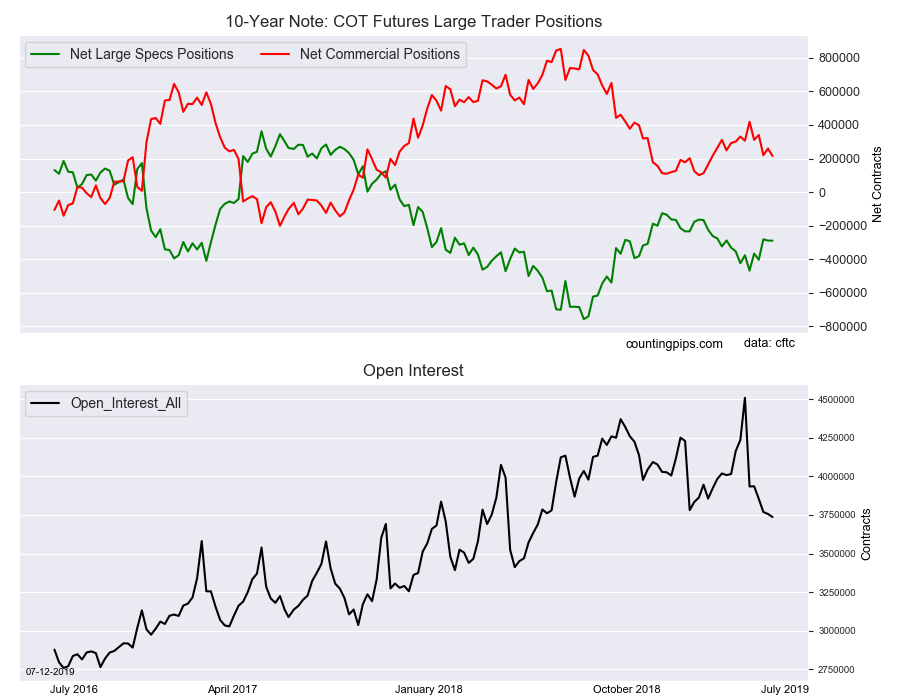

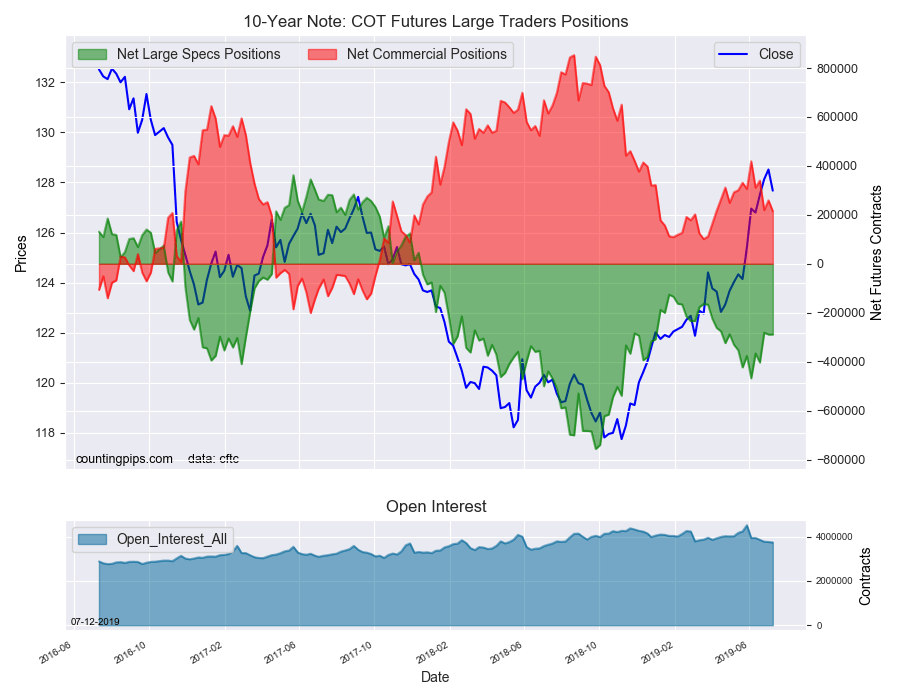

Large bond speculator’s bearish net positions barely moved this week in the 10-Year Note futures markets, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -288,836 contracts in the data reported through Tuesday, July 9th. This was a weekly rise of just 48 net contracts from the previous week which had a total of -288,884 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 44,268 contracts (to a weekly total of 682,406 contracts) while the gross bearish position (shorts) gained by a similar 44,220 contracts for the week (to a total of 971,242 contracts).

The large speculators ever so slightly edged their bearish bets lower this week after a small increase last week. Speculator bets recently had some very sharp reductions of their bearish positions on June 11th by +101,714 contracts and on June 25th by +121,885 contracts that has helped bring the overall bearish standing to under the -300,000 net contract level.

The current bearish position continues to remain under the -300,000 net contract level for the third week.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 215,177 contracts on the week. This was a weekly shortfall of -44,266 contracts from the total net of 259,443 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $127.67 which was a fall of $-0.84 from the previous close of $128.51, according to unofficial market data.