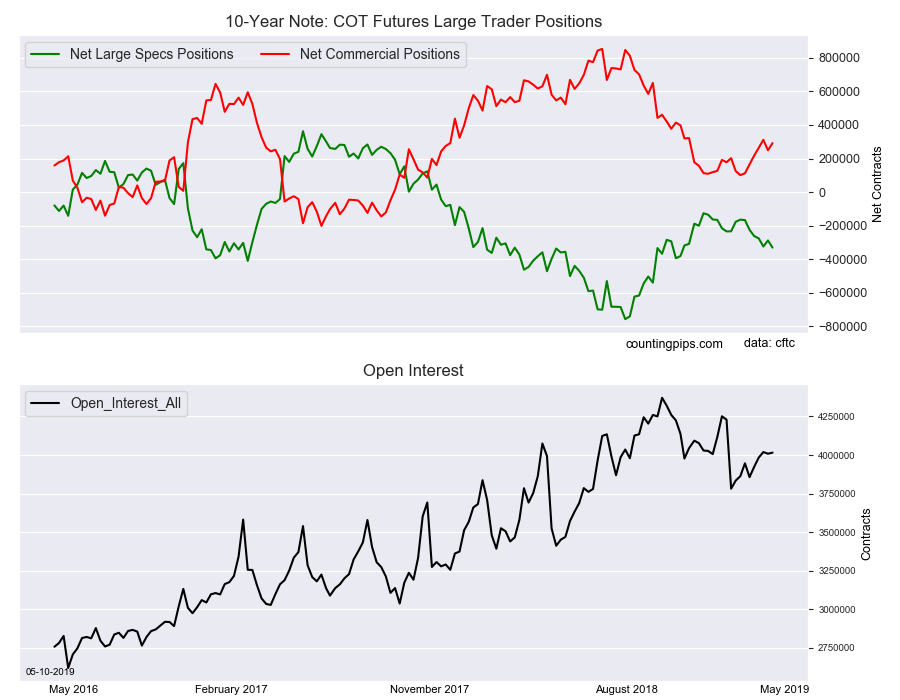

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators boosted their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -330,562 contracts in the data reported through Tuesday, May 7th. This was a weekly change of -42,641 net contracts from the previous week which had a total of -287,921 net contracts.

The week’s net position was the result of the gross bullish position (longs) sinking by -11,479 contracts to a weekly total of 577,607 contracts in addition to the gross bearish position (shorts) which saw an increase by 31,162 contracts for the week to a total of 908,169 contracts.

The large speculators pushed their bearish bets further along this week after a pause last week. The spec position has now had rising bearish bets in six out of the last seven weeks as sentiment is seeing renewed bearishness after cooling off from late December through March. The overall standing is now at the most bearish level since December 18th when the net position was -380,779 contracts.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 292,190 contracts on the week. This was a weekly uptick of 43,176 contracts from the total net of 249,014 contracts reported the previous week.

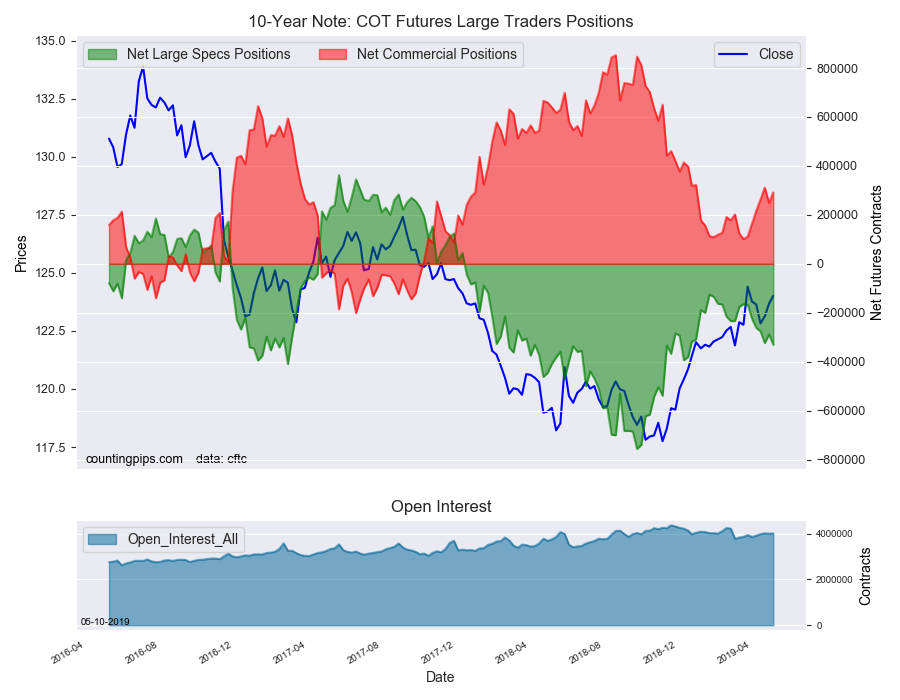

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $124.01 which was a boost of $0.34 from the previous close of $123.67, according to unofficial market data.