10-Year Note Non-Commercial Speculator Positions:

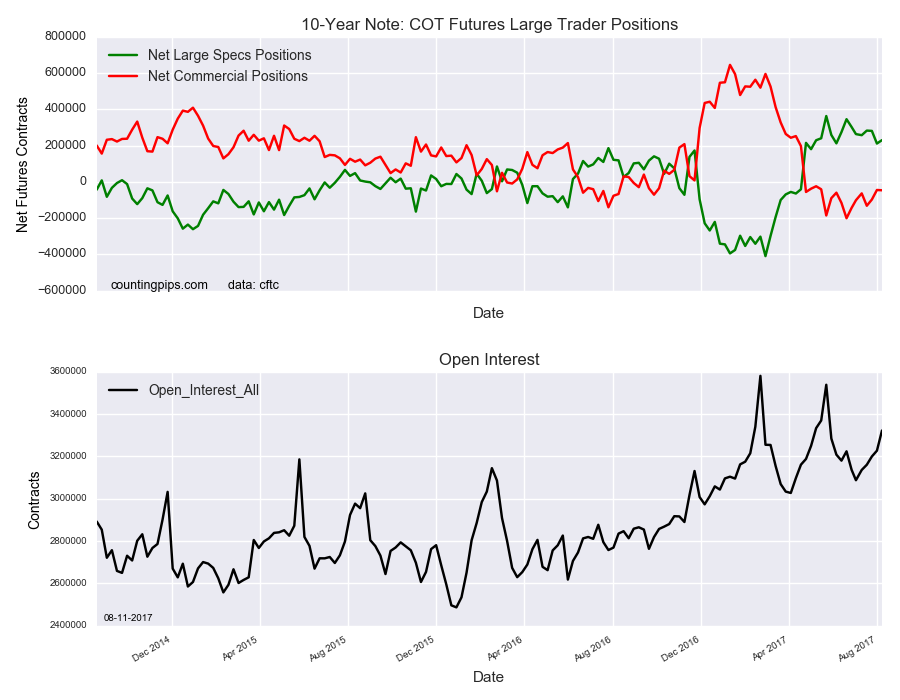

Large speculators lifted their bullish net positions in the 10-Year Note futures markets this week for the first time in three weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 229,836 contracts in the data reported through Tuesday August 8th. This was a weekly increase of 18,956 contracts from the previous week which had a total of 210,880 net contracts.

Speculative bets had fallen the previous two weeks by a total of -71,449 net positions before this week’s turnaround. The overall spec level is now under the +250,000 contract level for a second week after staying above this level for the previous seven weeks in a row.

10-Year Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -46,704 contracts on the week. This was a weekly drop of -1,648 contracts from the total net of -45,056 contracts reported the previous week.

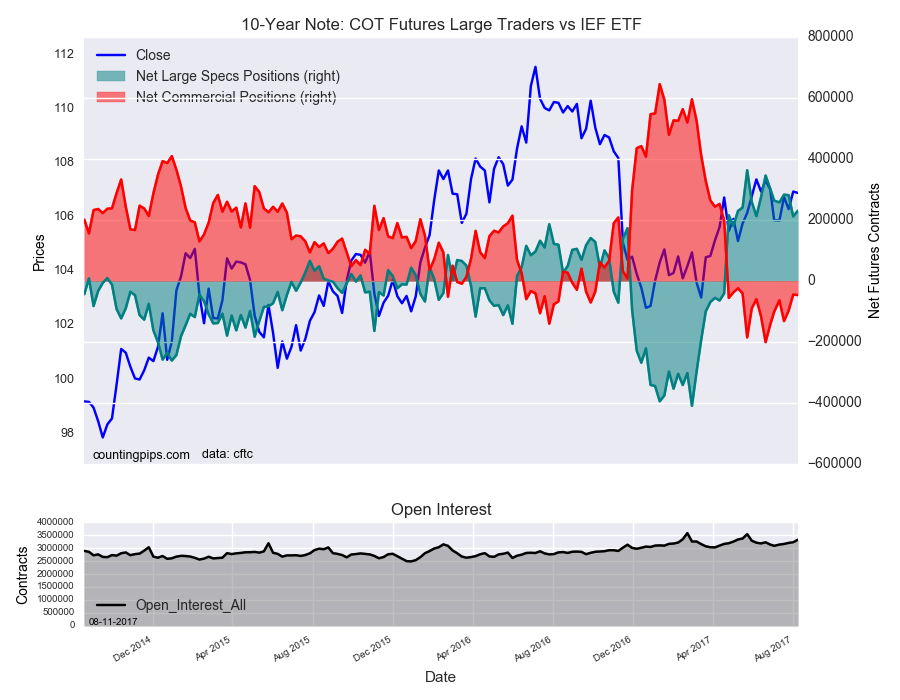

NYSE:IEF ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $106.90 which was a shortfall of $-0.05 from the previous close of $106.95, according to unofficial market data.