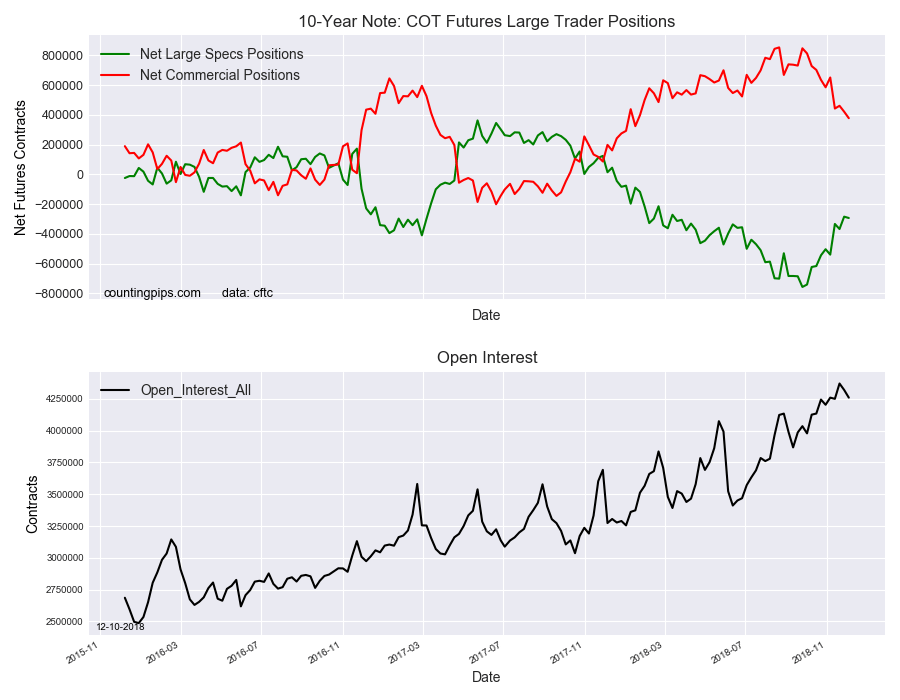

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bearish net positions in the US 10 Year T-Note Futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday which was a delay due to former President George H.W. Bush’s funeral last week.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -293,186 contracts in the data reported through Tuesday December 4th. This was a weekly change of -8,963 net contracts from the previous week which had a total of -284,223 net contracts.

The week’s net position was the result of the gross bullish position ascending by 76,069 contracts to a weekly total of 657,199 contracts compared to the gross bearish position which saw a rise by 85,032 contracts for the week to a total of 950,385 contracts.

The speculative net position saw a slight boost in the bearish level after specs had severely contracted their bearish bets by a total of 254,963 contracts in the previous three weeks. The current standing remains under the -300,000 net contract level for a second straight week after numbering over -700,000 contracts just ten weeks ago.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 377,307 contracts on the week. This was a weekly fall of -43,615 contracts from the total net of 420,922 contracts reported the previous week.

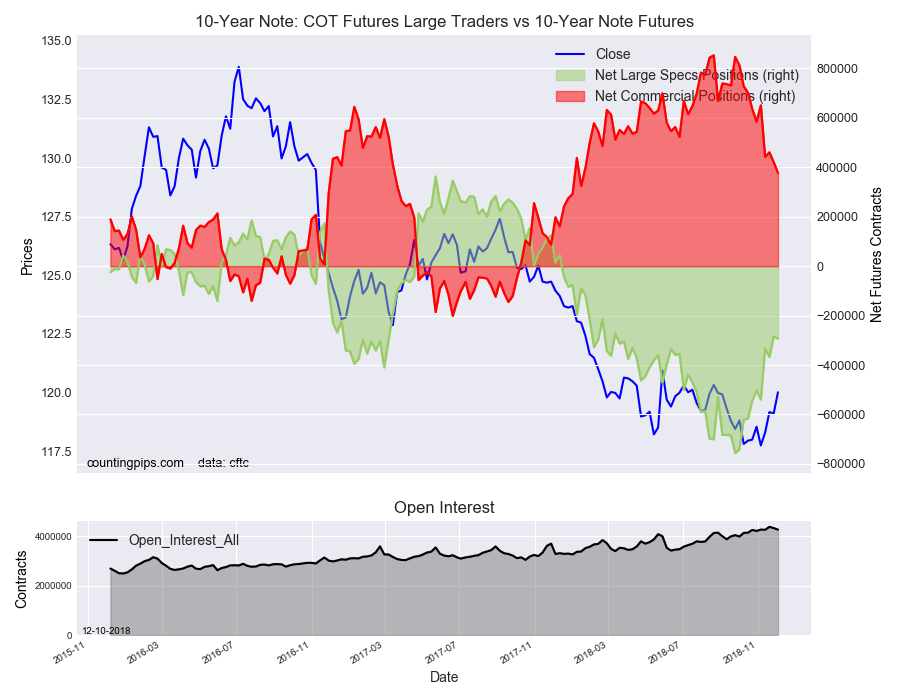

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $120.01 which was an uptick of $0.90 from the previous close of $119.10, according to unofficial market data.