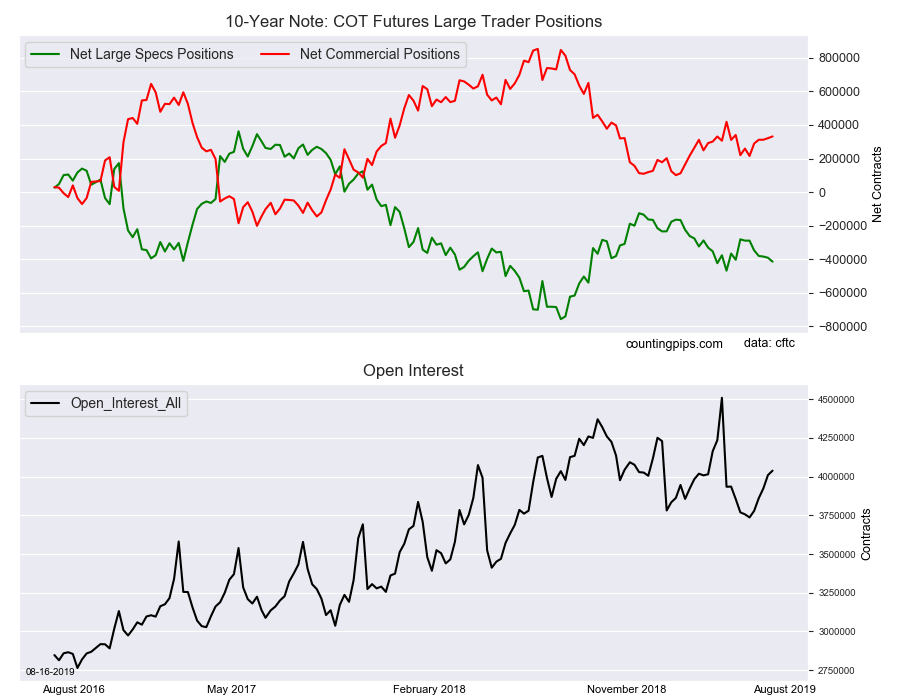

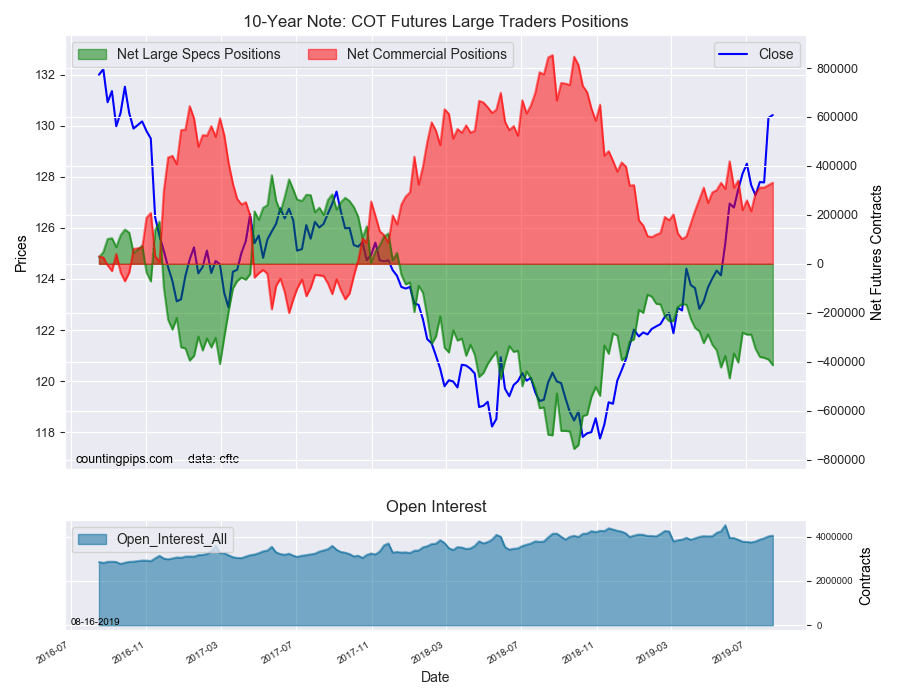

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators once again increased their bearish net positions in the US 10 Year T-Note Futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -414,346 contracts in the data reported through Tuesday August 13th. This was a weekly change of -23,460 net contracts from the previous week which had a total of -390,886 net contracts.

The week’s net position was the result of the gross bullish position (longs) lowering by -23,062 contracts (to a weekly total of 635,384 contracts) while the gross bearish position (shorts) increased by just 398 contracts for the week (to a total of 1,049,730 contracts).

The large speculators kept on raising their bearish bets for a fifth straight week this week and by a total of -125,510 contracts over that time-frame. Speculators have been consistently bearish on the 10-year note all year and continue to bet against the price trend of the 10-year note. The price has sharply risen higher since November while the 10-year yield has fallen to approximately 1.55 percent.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 331,680 contracts on the week. This was a weekly increase of 10,267 contracts from the total net of 321,413 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $130.42 which was an increase of $0.10 from the previous close of $130.31, according to unofficial market data.