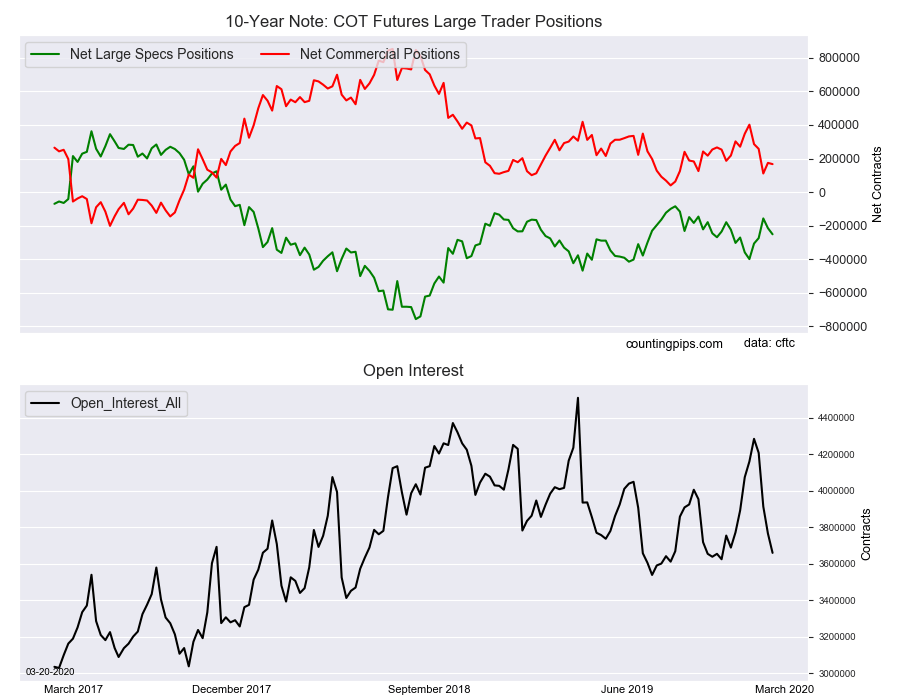

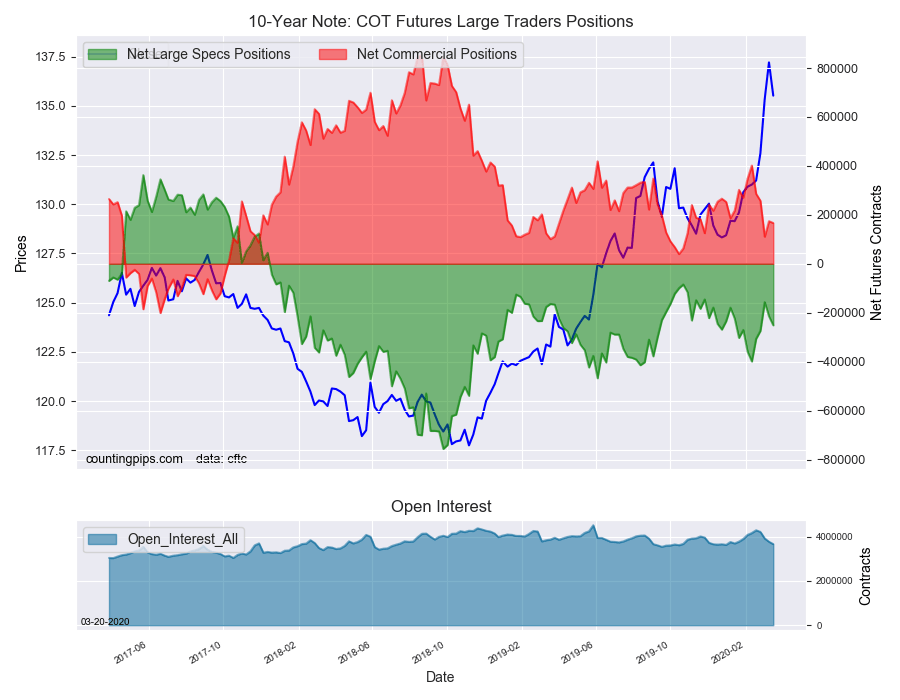

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -251,113 contracts in the data reported through Tuesday, March 17th. This was a weekly change of -36,530 net contracts from the previous week which had a total of -214,583 net contracts.

The week’s net position was the result of the gross bullish position (longs) lowering by -134,093 contracts (to a weekly total of 527,245 contracts) while the gross bearish position (shorts) fell by -97,563 contracts for the week (to a total of 778,358 contracts).

Ten-year bond speculators added to their bearish bets for the second consecutive week and by a total of -94,429 contracts over that time-frame. The ten-year bond has mostly provided a strong safe haven in the current market turmoil (COVID-19 outbreak) as the yield on the ten-year bond recently hit record lows under 0.40 percent on March 9th (As bond prices rise, yields fall). Previously, speculators had sharply cut their bearish positions by a total of +242,235 contracts over the prior three weeks.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 166,737 contracts on the week. This was a weekly loss of -7,491 contracts from the total net of 174,228 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $135.51 which was a loss of $-1.69 from the previous close of $137.20, according to unofficial market data.