10-Year Note Non-Commercial Speculator Positions:

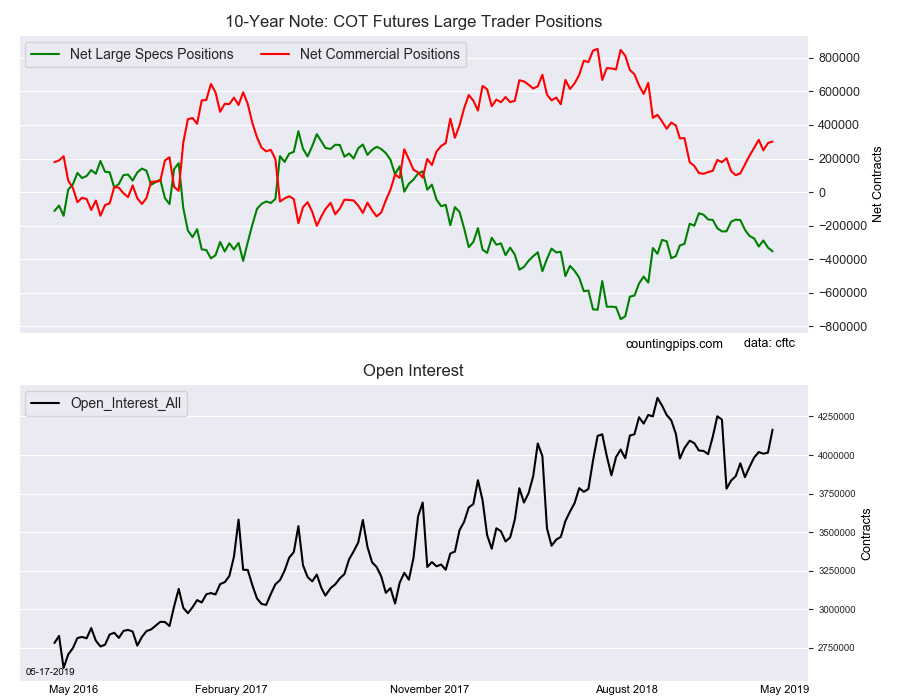

Large bond speculators increased their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -352,817 contracts in the data reported through Tuesday, May 14th. This was a weekly change of -22,255 net contracts from the previous week which had a total of -330,562 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 38,795 contracts to a weekly total of 616,402 contracts but was overcome by the gross bearish position (shorts) that rose by 61,050 contracts for the week to a total of 969,219 contracts.

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -352,817 contracts in the data reported through Tuesday May 14th. This was a weekly change of -22,255 net contracts from the previous week which had a total of -330,562 net contracts.

The week’s net position was the result of the gross bullish position (longs) gaining by 38,795 contracts to a weekly total of 616,402 contracts but was overcome by the gross bearish position (shorts) that rose by 61,050 contracts for the week to a total of 969,219 contracts.

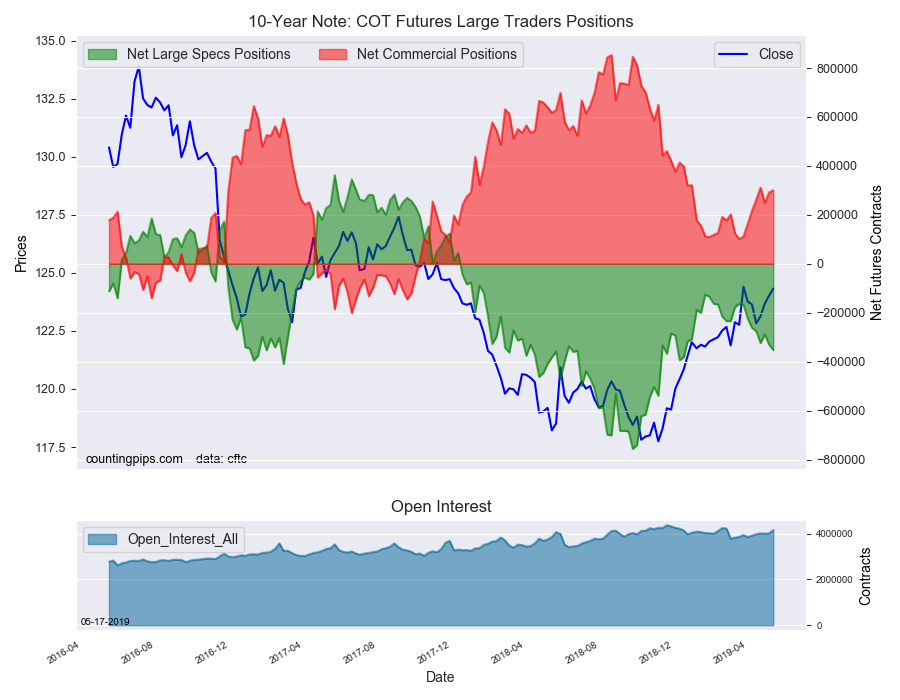

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $124.32 which was an uptick of $0.31 from the previous close of $124.01, according to unofficial market data.