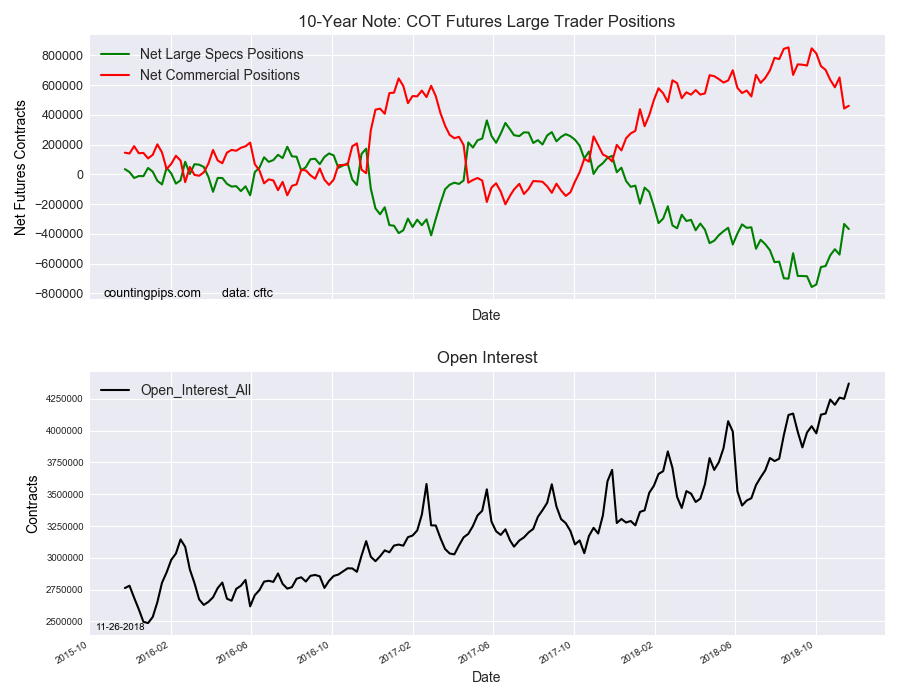

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators increased their bearish net positions in the US 10 Year T-Note Futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday due to the Thanksgiving day holiday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -367,265 contracts in the data reported through Tuesday November 20th. This was a weekly change of -34,070 net contracts from the previous week which had a total of -333,195 net contracts.

This week’s net position was the result of the gross bullish position falling by -51,450 contracts to a weekly total of 614,841 contracts compared to the gross bearish position total of 982,106 contracts which only saw a decrease by -17,380 contracts for the week.

The speculators added to their bearish position last week following the huge cut down of the overall bearish level in the previous week by +205,991 contracts (this marked the largest 1-week gain in a year and a half). The bearish position now remains under the -400,000 net contract level for a second straight week. The is the first time since June that bearish bets have been under that level for consecutive weeks.

10-Year Note Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 460,615 contracts on the week. This was a weekly rise of 18,449 contracts from the total net of 442,166 contracts reported the previous week.

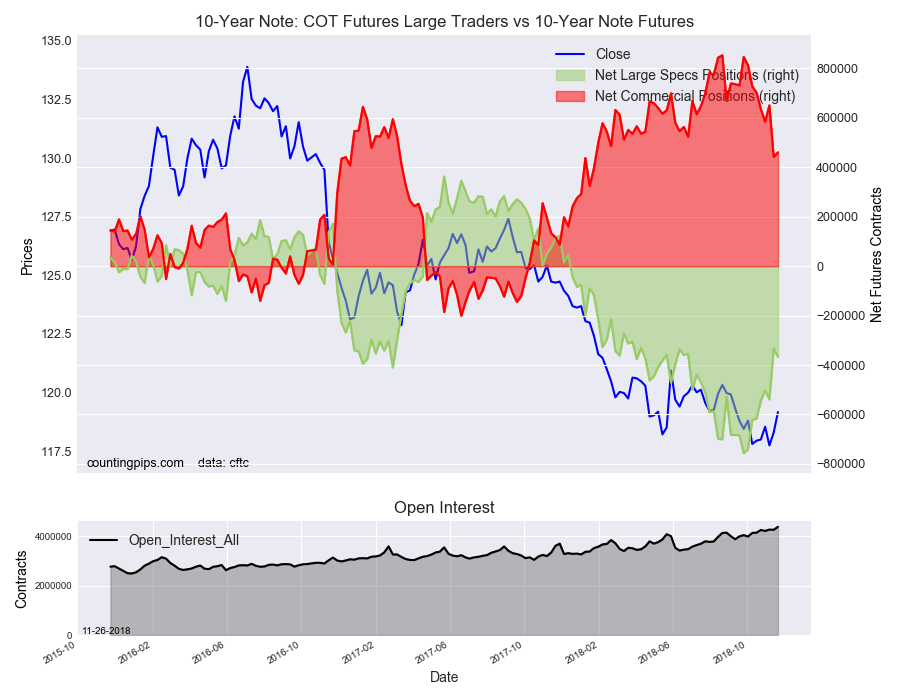

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $119.17 which was an increase of $0.87 from the previous close of $118.29, according to unofficial market data.