10-Year Note Non-Commercial Speculator Positions:

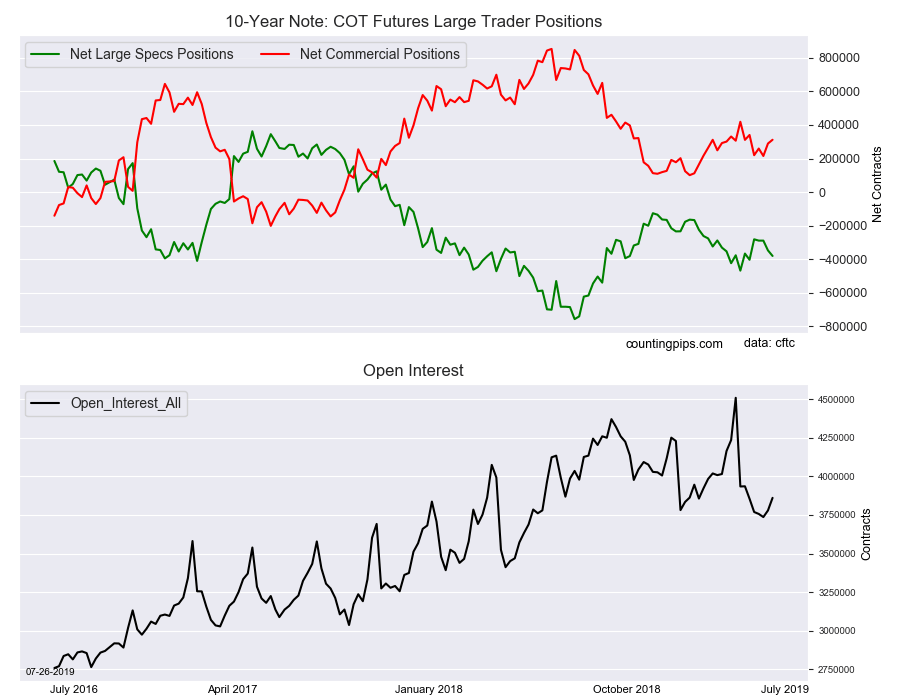

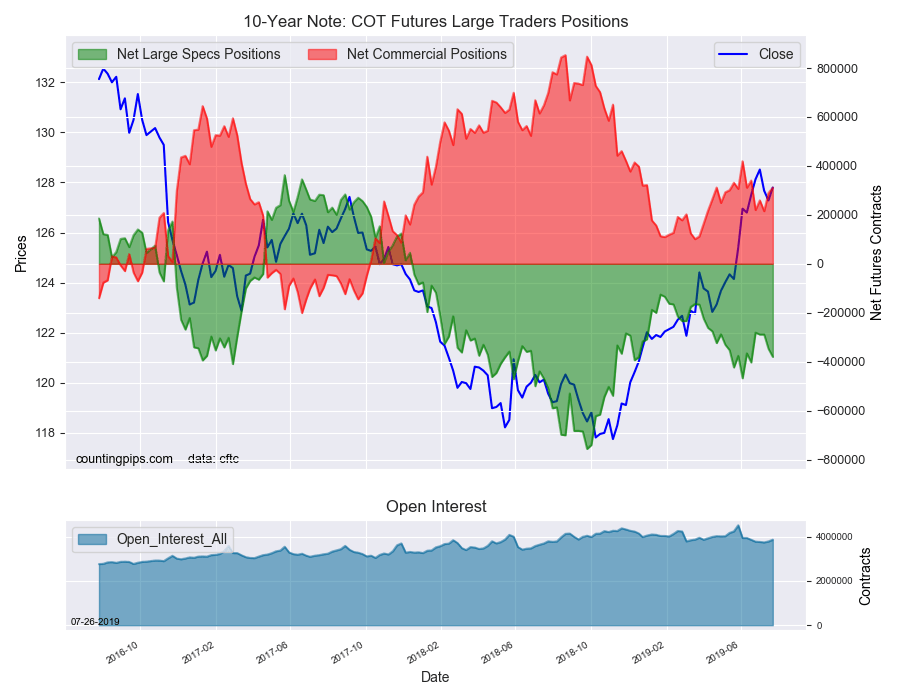

Large bond speculators increased their bearish net positions for a second straight week in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -380,169 contracts in the data reported through Tuesday, July 23rd. This was a weekly change of -32,947 net contracts from the previous week which had a total of -347,222 net contracts.

The week’s net position was the result of the gross bullish position (longs) decreasing by -2,482 contracts (to a weekly total of 678,489 contracts) in addition to the gross bearish position (shorts) gaining by 30,465 contracts for the week (to a total of 1,058,658 contracts).

Large speculators continued their bearish ways in the 10-Year Note futures this week with higher bearish bets for a second straight week and for the third time in four weeks.

The speculative position has been bearish dating all the way back to December of 2017 and reached an all-time record high bearish level on September 25th of 2018 with a total of -756,316 net contracts. Since then, speculator bearish positions have declined but have continued to remain overall bearish despite bonds being heavily bid throughout 2019. Speculators are usually reliable trend-followers but have been caught on the wrong side of this market so far this year.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 311,782 contracts on the week. This was a weekly boost of 22,458 contracts from the total net of 289,324 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $127.79 which was an uptick of $0.51 from the previous close of $127.28, according to unofficial market data.