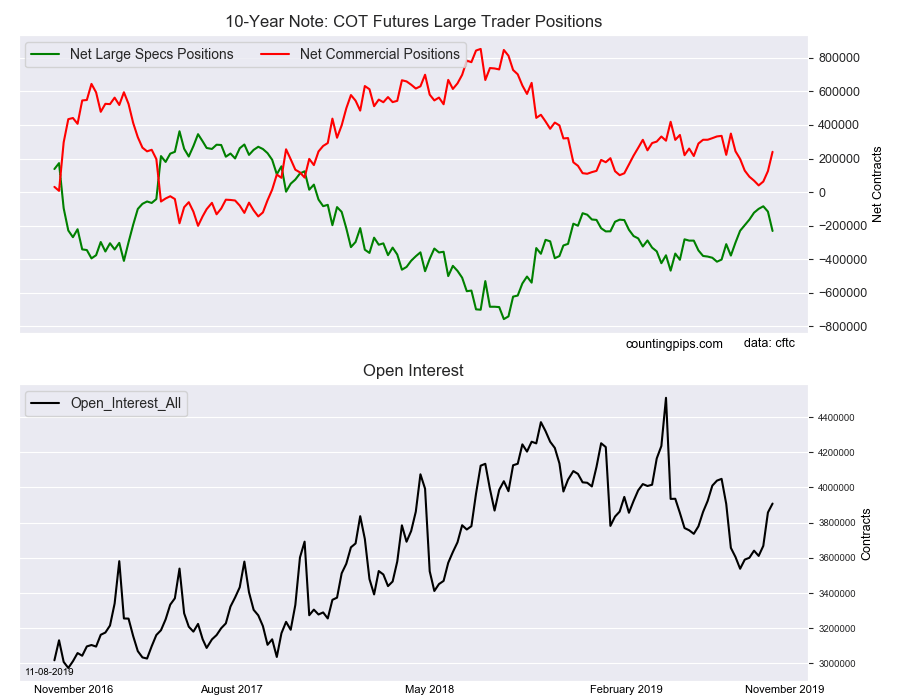

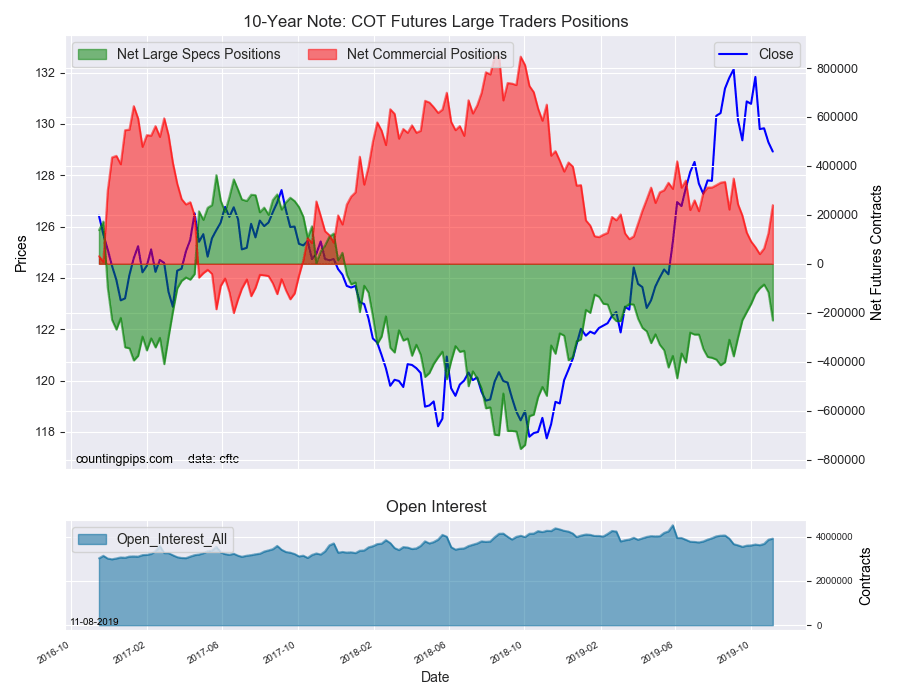

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators sharply increased their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -231,456 contracts in the data reported through Tuesday, November 5th. This was a weekly change of -115,390 net contracts from the previous week which had a total of -116,066 net contracts.

The week’s net position was the result of the gross bullish position (longs) falling by -62,945 contracts (to a weekly total of 653,270 contracts) in addition to the gross bearish position (shorts) rising by 52,445 contracts for the week (to a total of 884,726 contracts).

10-Year speculators raised their bearish bets for a second straight week and by largest one-week amount (-115,390 contracts) in over a year, dating back to September of 2018. This recent bearishness pushes the overall position to the most bearish level in eight weeks with contracts back over the -200,000 net contract standing.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 240,121 contracts on the week. This was a weekly boost of 114,893 contracts from the total net of 125,228 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $128.92 which was a fall of $-0.35 from the previous close of $129.28, according to unofficial market data.