10-Year Note Non-Commercial Speculator Positions:

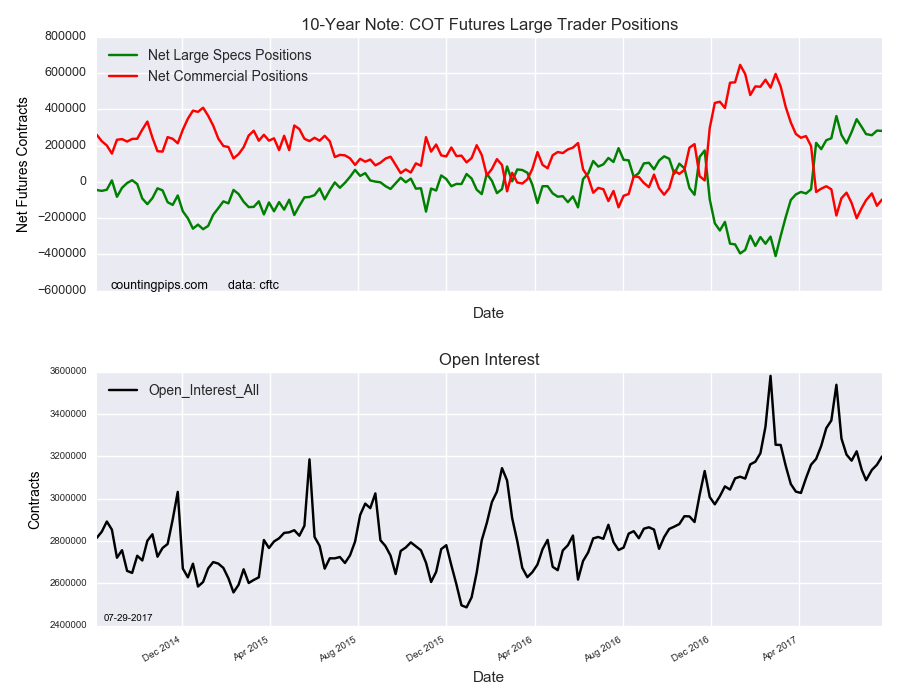

Treasury speculators edged their bullish net positions lower in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 280,684 contracts in the data reported through Tuesday July 25th. This was a weekly decline of -1,645 contracts from the previous week which had a total of 282,329 net contracts.

The 10-year note speculative positions have fallen four of the past five weeks but remain in highly bullish territory above the +250,000 net contract level for seven straight weeks.

10-Year Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -97,813 contracts on the week. This was a weekly advance of 34,231 contracts from the total net of -132,044 contracts reported the previous week.

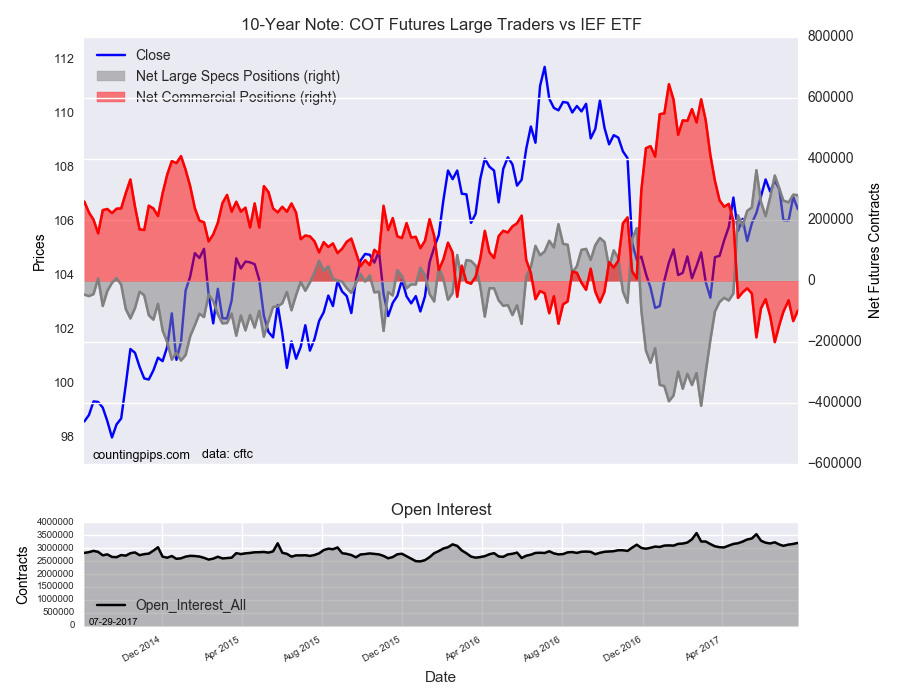

iShares 7-10 Year Treasury Bond (NYSE:IEF) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $106.47 which was a rise of $0.45 from the previous close of $106.92, according to unofficial market data.