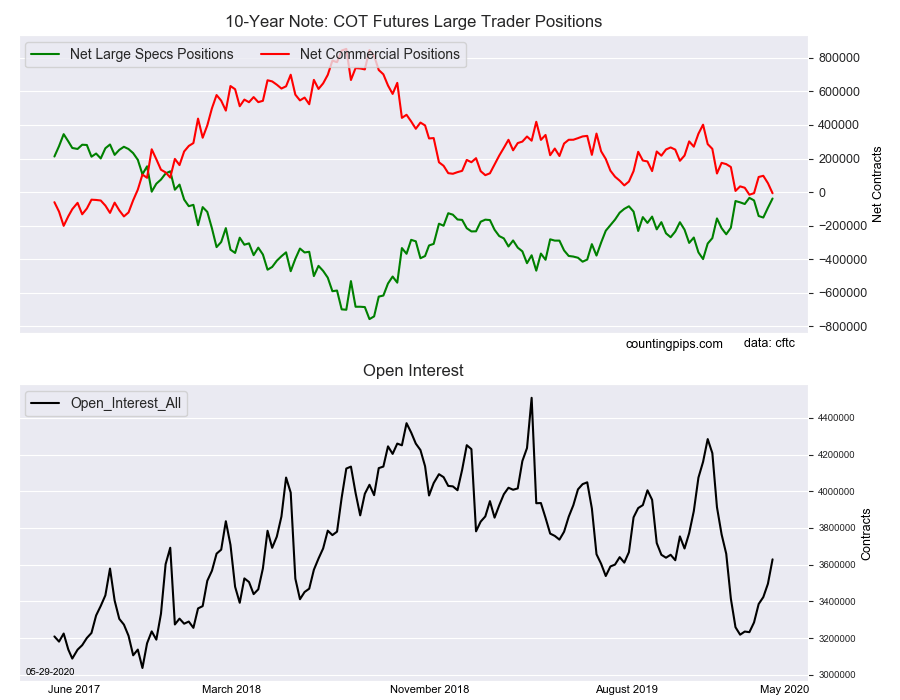

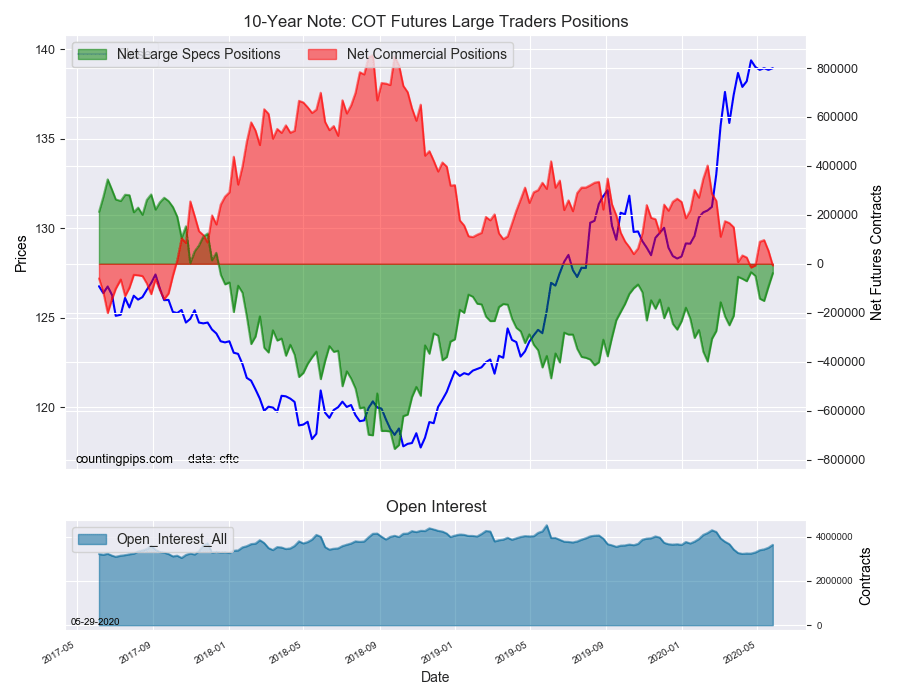

10-Year Note Non-Commercial Speculator Positions:

Large bond speculators cut back on their bearish net positions in the 10-Year Note futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of -38,056 contracts in the data reported through Tuesday, May 26th. This was a weekly change of 55,076 net contracts from the previous week which had a total of -93,132 net contracts.

The week’s net position was the result of the gross bullish position (longs) rising by 4,822 contracts (to a weekly total of 658,626 contracts) while the gross bearish position (shorts) dropped by -50,254 contracts for the week (to a total of 696,682 contracts).

Speculators reduced their 10-Year bearish bets by at least 50,000 contracts for the second straight week. This decline by over 110,000 contracts in the past two weeks has brought the current bearish standing (-38,056 contracts) to the second lowest level since the coronavirus pandemic began (April 21st marked the lowest level with a total of -34,098 contracts). Speculative positions have not been in a net bullish position since December 12th of 2017, which is a span of one hundred and twenty-eight weeks.

10-Year Note Commercial Positions:

The commercial traders' position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -6,794 contracts on the week. This was a weekly decrease of -60,166 contracts from the total net of 53,372 contracts reported the previous week.

10-Year Note Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 10-Year Note Futures (Front Month) closed at approximately $138.95 which was a rise of $0.09 from the previous close of $138.85, according to unofficial market data.