As follows from the minutes published on Tuesday (01:30 GMT) from the meeting of the RBA, held on June 4, the bank's management signaled a tendency to further easing of monetary policy. Governor of the Reserve Bank of Australia, Philip Lowe, stated that "there is reason to expect a lower key rate". According to the leaders of the central bank, unemployment should fall from the current level of 5.2% to 4.5% in order for inflation to accelerate to the target range of 2% -3%.

Many economists predict two or more rate cuts this year and a key rate reaching a record minimum of 0.75%.

This is a strong fundamental factor in favor of further weakening AUD.

Meanwhile, the attention of financial market participants is shifted to the 2-day Fed meeting, which will end on Wednesday with the publication (at 18:00 GMT) of the interest rate decision. Probably, the rate will remain at the same level of 2.5%. However, signals from the leadership of the Fed in favor of lowering the rate by the end of this year will put downward pressure on the dollar. At the same time, the demand for the US dollar is likely to save.

The US economy looks more resilient in international trade conflicts.

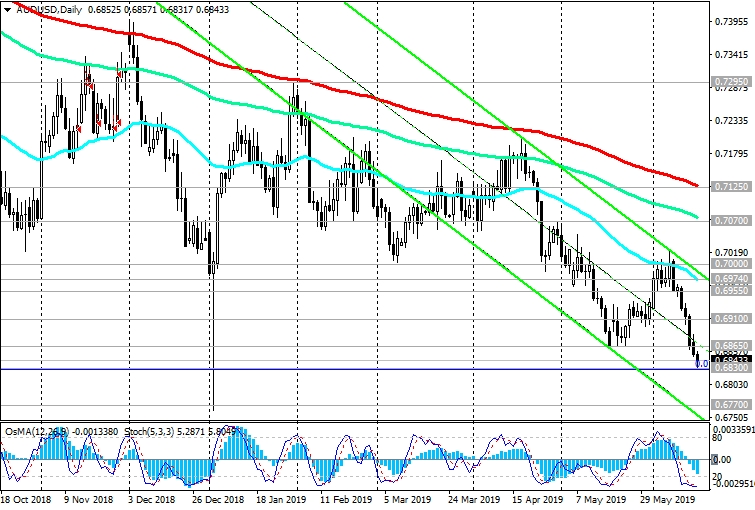

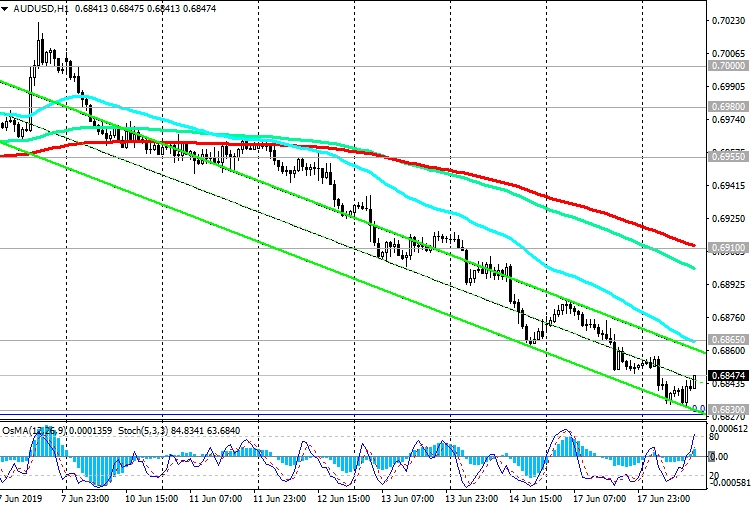

AUD/USD continues to decline, remaining in a long-term bearish trend since July 2014. The lows of the last wave of decline are located near the mark of 0.6830. A strong negative impulse prevails in anticipation of a further reduction in the RBA interest rate. The immediate goal of the decline is located at around 0.6770 (2019 lows).

Below the key resistance levels of 0.7070 (EMA144 on the daily chart), 0.7125 (EMA200 on the daily chart) short positions remain preferable.

Support Levels: 0.6830, 0.6800, 0.6770

Resistance Levels: 0.6865, 0.6910, 0.6955, 0.6980, 0.7000, 0.7070, 0.7125

Trading Recommendations

Sell in the market. Stop Loss 0.6880. Take-Profit 0.6830, 0.6800, 0.6770

Buy Stop 0.6880. Stop Loss 0.6820. Take-Profit 0.6910, 0.6955, 0.6980, 0.7000