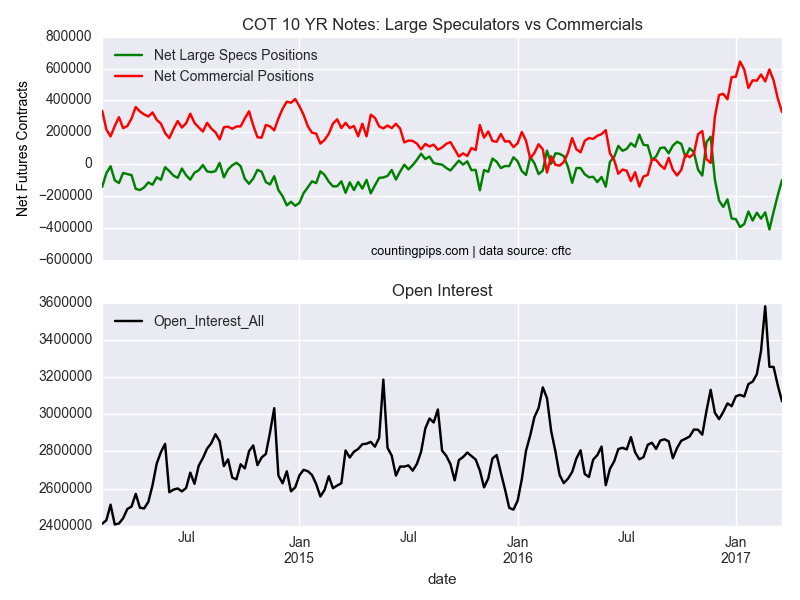

10 Year Treasury Note Non-Commercial Positions:

Large speculators sharply decreased their bearish net positions in the 10-year treasury note futures markets last week for the third straight week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of -100,354 contracts in the data reported through March 21st. This was a weekly change of 94,038 contracts from the previous week which had a total of -194,392 net contracts.

Speculative bearish positions have been cut by roughly 100,000 contracts each of the past three weeks and bearish levels are now at the lowest point since November 29th when bearish net positions equaled -96,267 contracts.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 327,185 contracts last week. This is a weekly change of -84,804 contracts from the total net of 411,989 contracts reported the previous week.

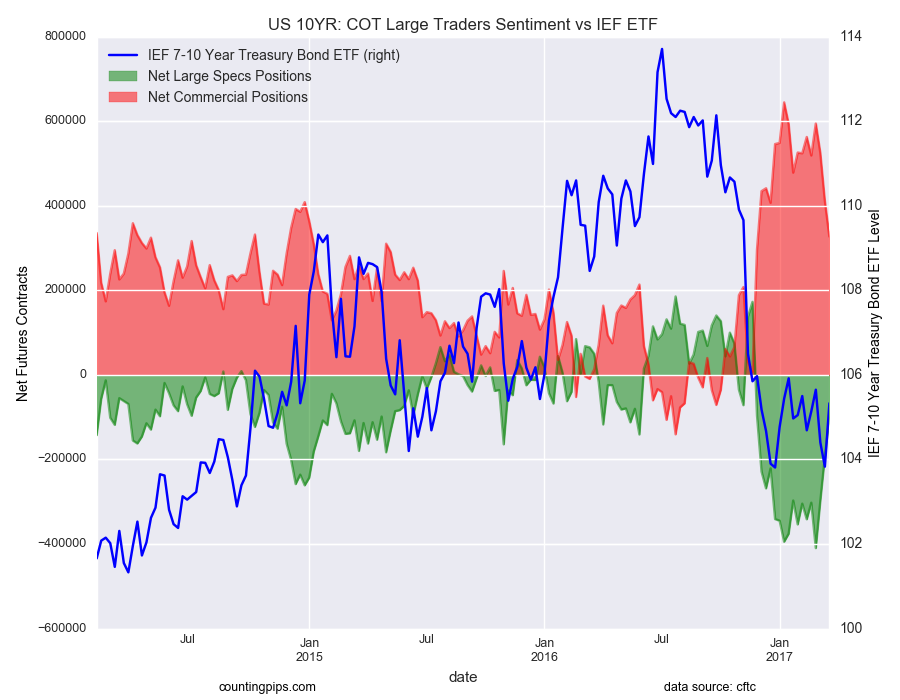

iShares 7-10 Year Treasury Bond (NYSE:IEF):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $105.33 which was a gain of $1.50 from the previous close of $103.83, according to ETF market data.