10 Year Treasury Note Non-Commercial Positions:

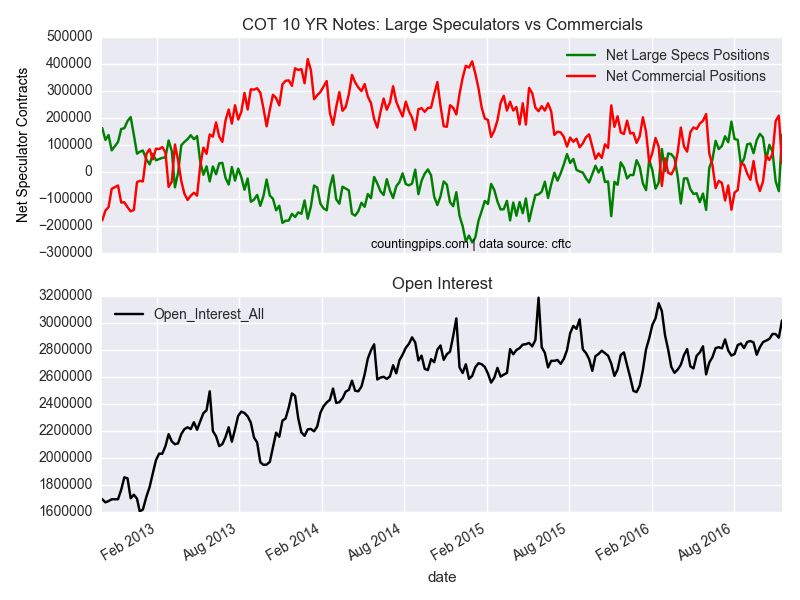

Large speculators and traders sharply increased their buying in the 10-year treasury note futures markets last week and now have an overall bullish position in 10-year futures for the first time in three weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of 137,396 contracts in the data reported through November 15th. This was a weekly surge higher by 209,056 contracts from the previous week which had a total of -71,660 net contracts.

Speculators had totaled a net bearish position in the previous two weeks before last week’s surge higher and now the net bullish position is at its highest level since September 27th when positions equaled 140,413 contracts.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, dropped to a total net position of 31,258 contracts last week. This is a weekly downfall by -176,537 contracts from the total net of 207,795 contracts reported the previous week.

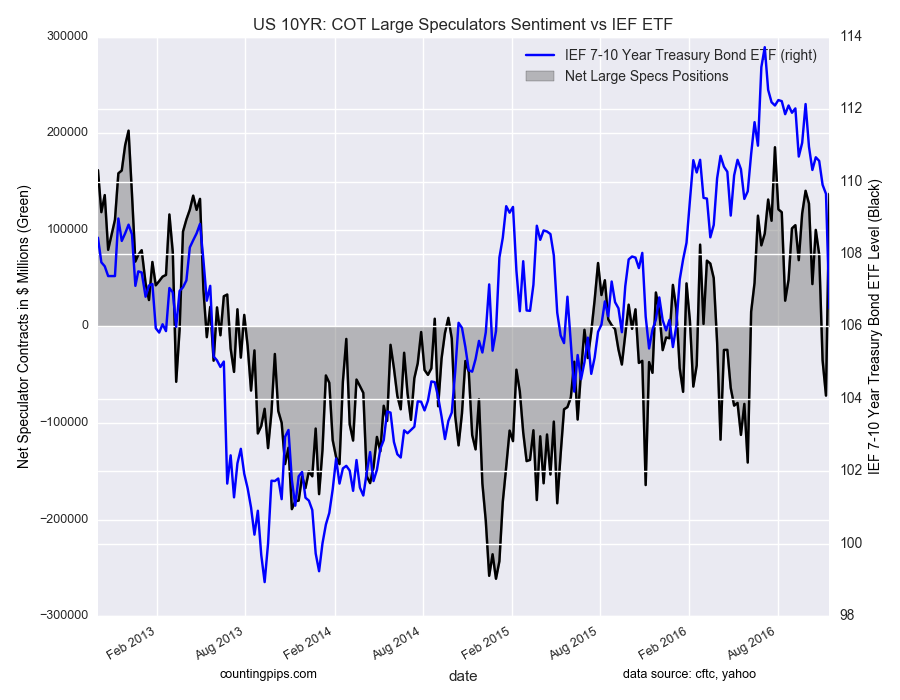

iShares 7-10 Year Treasury Bond (NYSE:IEF):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $106.50 which was a decline of $-3.16 from the previous close of $109.66, according to market data from Yahoo Finance.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the previous Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).