Weekly Large Trader COT Report: 10-Year US Treasury Note

CFTC COT data released on Monday due to a holiday schedule

10 Year Treasury Note Non-Commercial Positions:

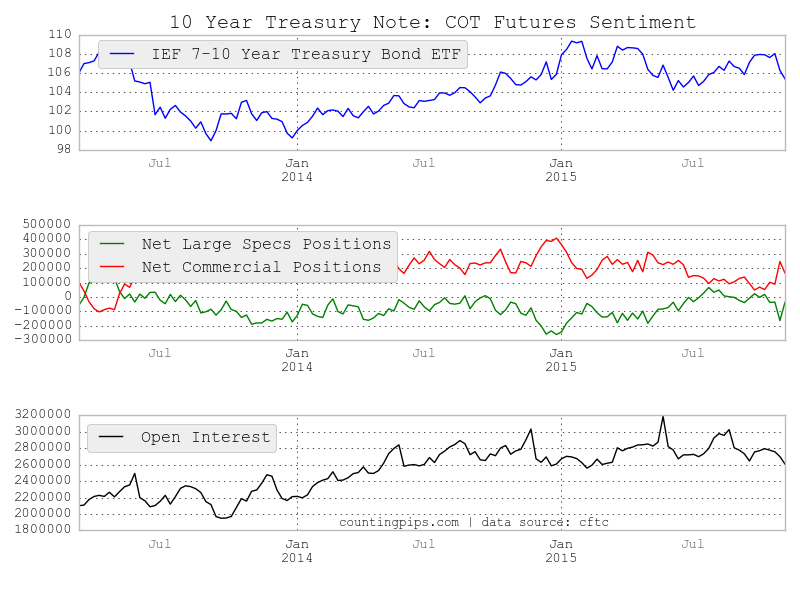

Large 10-year treasury note futures traders and speculators sharply cut their overall bearish positions last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Monday due to a holiday schedule.

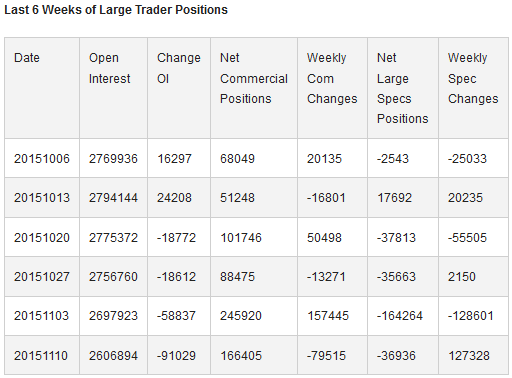

The non-commercial futures contracts of the 10-year treasury notes, primarily traded by large speculators and hedge funds, totaled a net position of -36,936 contracts in the data reported for November 10th. This was a weekly change of +127,328 net contracts from the previous week’s total of -164,264 net contracts that was recorded on November 3rd.

For the week, the overall standing long positions in 10-year futures rose by 5,082 contracts and combined with a large decline in the short positions by -122,246 contracts to register the overall net change of +127,328 contracts for the week.

10 Year US Treasury Note Commercial Positions:

In the commercial positions for the 10-year note on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) decreased their overall bullish positions to a total net position of +166,405 contracts through November 10th. This is a weekly change of -79,515 contracts from the total net position of +245,920 contracts on November 3rd.

iShares 7-10 Year Treasury Bond (N:IEF):

Over the same weekly reporting time-frame, from Tuesday November 3rd to Tuesday November 10th, the 7-10 Year Treasury Bond ETF fell from 106.27 to 105.39, according to ETF data for the iShares 7-10 Year Treasury Bond ETF (N:IEF).

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Risk Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment. Due to the level of risk and market volatility, Foreign Currency trading may not be suitable for all investors and you should not invest money you cannot afford to lose. Before deciding to invest in the foreign currency exchange market you should carefully consider your investment objectives, level of experience, and risk appetite. You should be aware of all the risks associated with foreign currency exchange trading, and seek advice from an independent financial advisor should you have any doubts. All information and opinions on this website are for general informational purposes only and do not constitute investment advice.