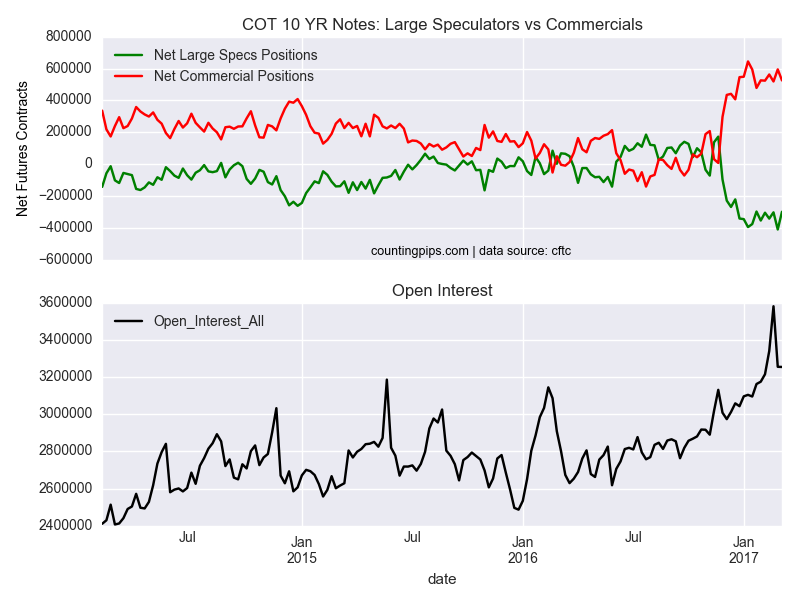

10 Year Treasury Note Non-Commercial Positions:

Large speculators sharply decreased their bearish net positions in the 10-year treasury note futures markets last week just one week after significantly boosting those bearish positions to a new record high level, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of -298,514 contracts in the data reported through March 7th. This was a weekly change of 111,145 contracts from the previous week which had a total of -409,659 net contracts.

Speculative positions, having come off the record bearish position, are now under the -300,000 level for the first time since January 24th.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 525,309 contracts last week. This is a weekly fall of -69,402 contracts from the total net of 594,711 contracts reported the previous week.

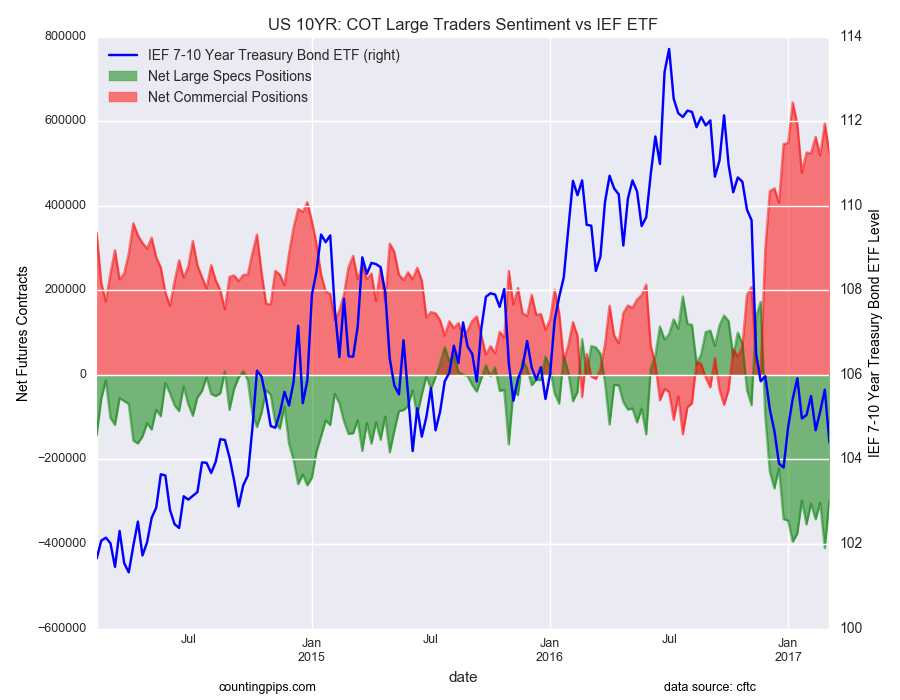

IEF 7-10 Year Bond ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (NYSE:IEF) closed at approximately $104.4 which was a decline of $-1.25 from the previous close of $105.65, according to ETF market data.