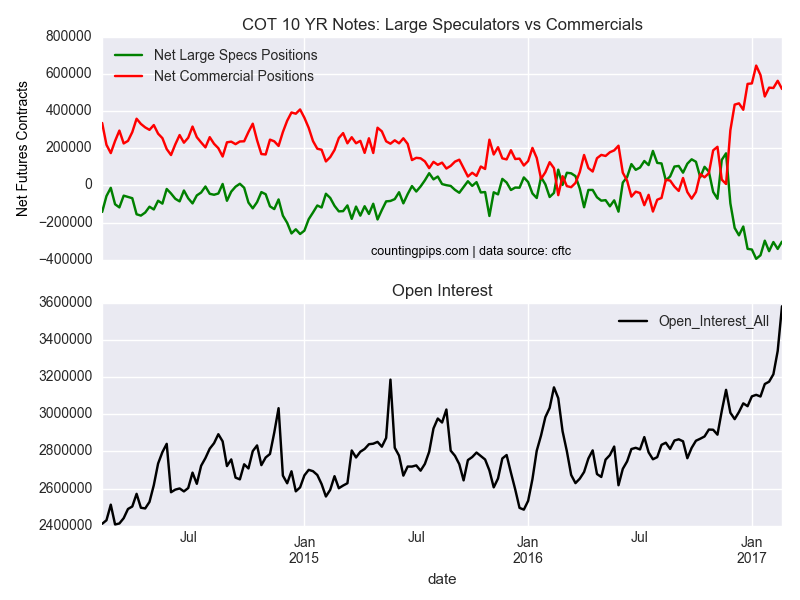

10 Year Treasury Note Non-Commercial Positions:

Large speculators cut back on their bearish net positions in the 10-year treasury note futures markets last week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of -302,299 contracts in the data reported through February 21st. This was a weekly gain of 39,225 contracts from the previous week which had a total of -341,524 net contracts.

Speculative positions in the 10-year notes fell to the lowest bearish level in four weeks but continue to remain over the -300,000 net contract level for the fourth week in a row.

Open interest (2nd pane in chart above), the amount of futures contracts outstanding (i.e., traders currently in the market), has been surging higher in this market since the new year and has now reached a record high level. With a record number of participants in this market, it will be worth watching to see how this market develops over the coming weeks and what the effect on 10-year bonds/yields will be.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 518,981 contracts last week. This is a weekly drop of -43,719 contracts from the total net of 562,700 contracts reported the previous week.

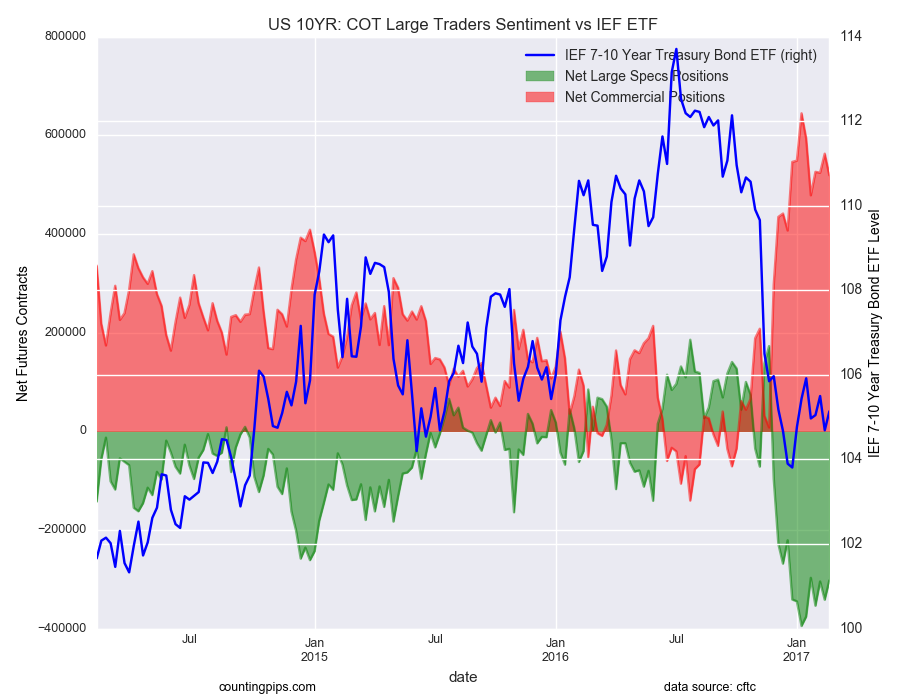

iShares 7-10 Year Treasury Bond (NYSE:IEF):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $105.14 which was a gain of $0.45 from the previous close of $104.69, according to ETF market data.