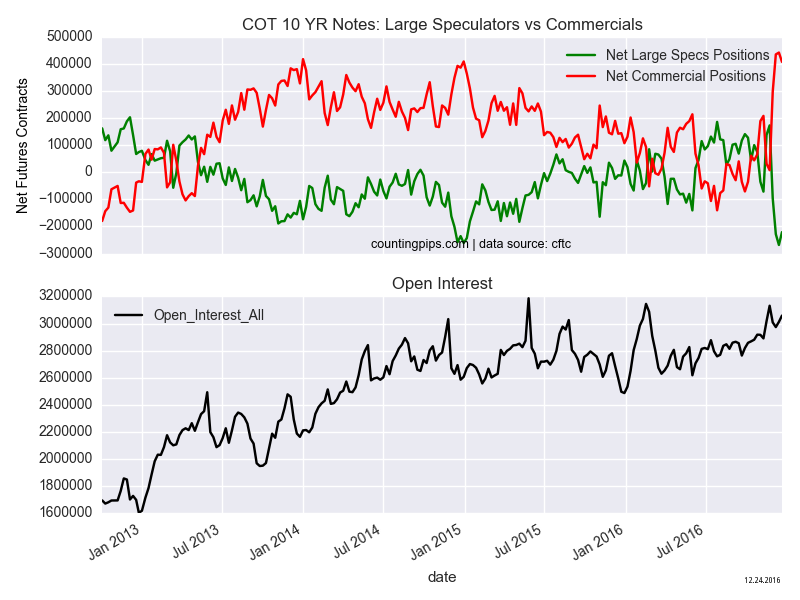

U.S. 10-Year Treasury Note Non-Commercial Positions:

Large speculators and traders increased their net positions in the 10-year treasury note futures markets last week for the first time in four weeks and following three weeks of sharp declines, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of -221,058 contracts in the data reported through December 20th. This was a weekly increase of 47,337 contracts from the previous week which had a total of -268,395 net contracts.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 406,984 contracts last week. This is a weekly decline of -34,420 contracts from the total net of 441,404 contracts reported the previous week.

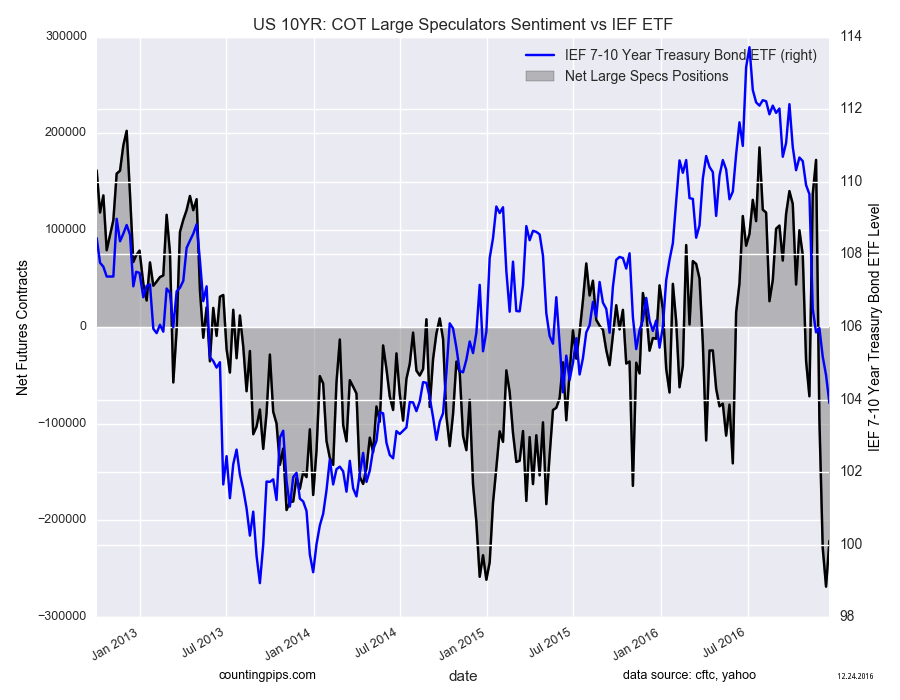

iShares 7-10 Year Treasury Bond (NYSE:IEF):

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $103.9 which was a change of $-0.77 from the previous close of $104.67, according to market data from Yahoo Finance.