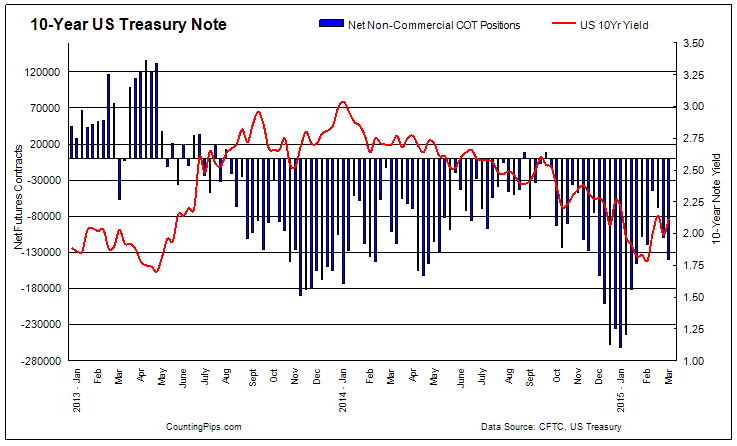

Weekly CFTC COT Net Speculator Report | 10-Year US Treasury Note

CFTC Futures data shows speculators pushed net bearish positions to highest since January

10 Year Treasuries: Large 10-year Treasury note futures traders added sharply to their overall bearish bets last week for a third straight week and pushed bearish positions to the highest level since January, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of the 10-year Treasury notes, primarily traded by large speculators and hedge funds, totaled a net position of -139,474 contracts in the data reported for March 3rd. This was a weekly change of -29,764 net contracts from the previous week’s total of -109,710 net contracts that was recorded on February 24th.

For the week, the overall standing long positions in 10-year futures fell by -6,497 contracts while the short positions surged by 23,267 contracts to register the overall net change of -29,764 contracts for the week.

The 10-year futures speculator positions are now at the most bearish level since January 20th when net positions stood at -145,598 contracts.

Over the weekly reporting time-frame, from Tuesday February 24th to Tuesday March 3rd, the yield on the 10-Year Treasury note increased from 1.99 percent to 2.12 percent, according to data from the United States Treasury Department.

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).