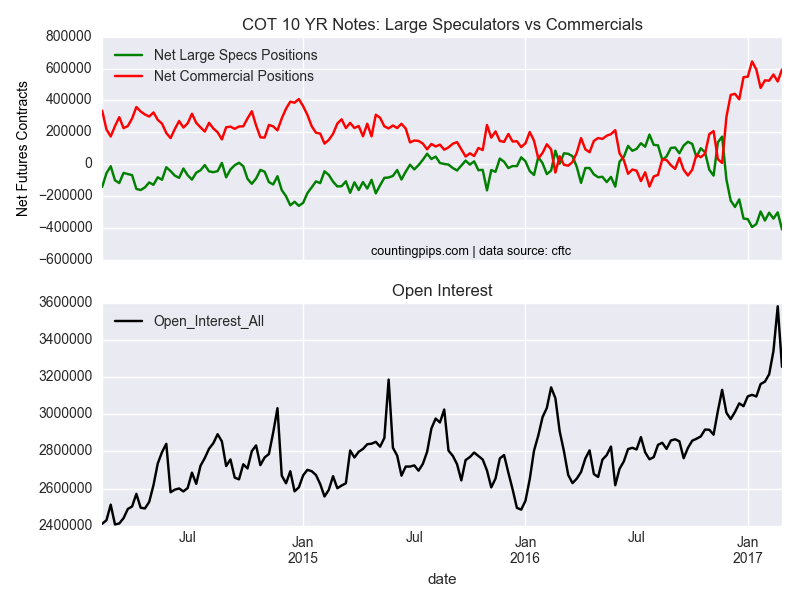

10 Year Treasury Note Non-Commercial Positions:

Large speculators and traders sharply raised their net bearish positions in the 10-year treasury note futures markets last week to a new record high position, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-year treasury note futures, traded by large speculators and hedge funds, totaled a net position of -409,659 contracts in the data reported through February 28th. This was a weekly change of -107,360 contracts from the previous week which had a total of -302,299 net contracts.

Speculative net bearish positions have now eclipsed their previous record of -394,689 contracts recorded on January 10th.

10 Year Treasury Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net bullish position of 594,711 contracts last week. This is a weekly rise of 75,730 contracts from the total net of 518,981 contracts reported the previous week.

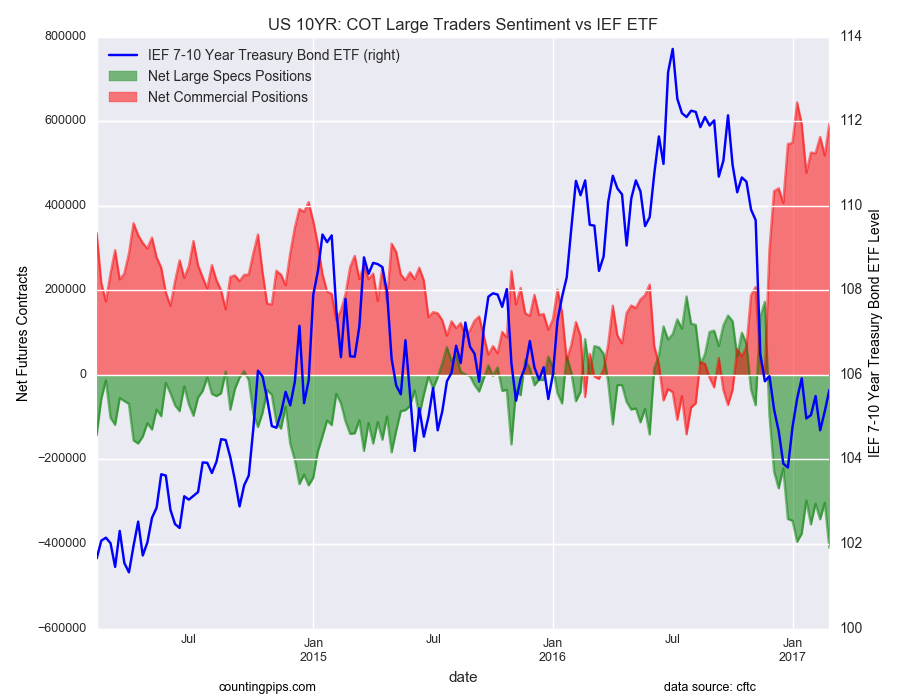

IEF 7-10 Year Bond ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $105.65 which was a gain of $0.51 from the previous close of $105.14, according to ETF market data.