Weekly Large Trader COT Report: 10 Year US Treasury Note

CFTC Futures data shows speculators decreased bearish bets for first time in 6 weeks

10 Year Treasury Note Non-Commercial Positions:

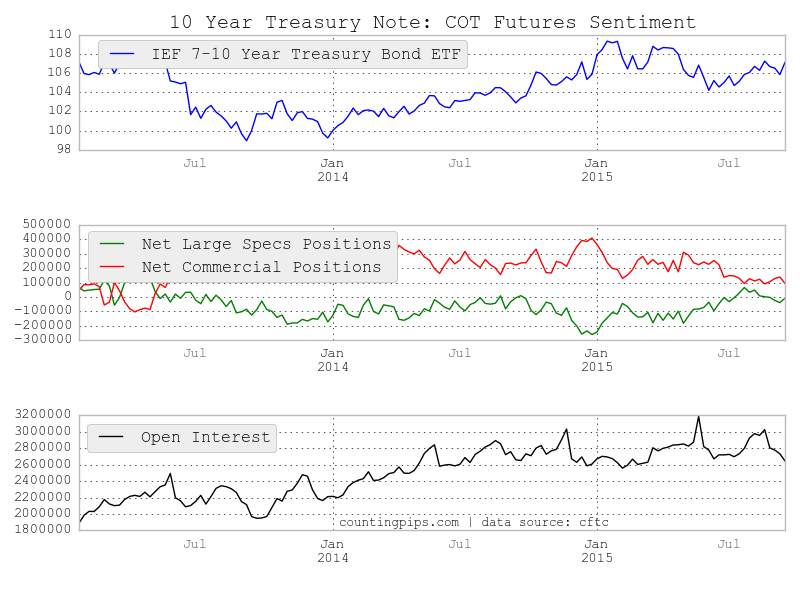

Large 10-year treasury note futures traders and speculators reduced their overall bearish positions last week after increasing their bearish bets for the previous five weeks, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

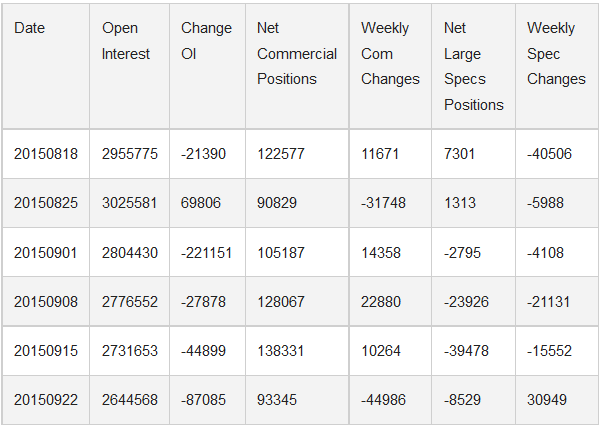

The non-commercial futures contracts of the 10-year treasury notes, primarily traded by large speculators and hedge funds, totaled a net position of -8,529 contracts in the data reported for September 22nd. This was a weekly change of +30,949 net contracts from the previous week’s total of -39,478 net contracts that was recorded on September 15th.

For the week, the overall standing long positions in 10-year futures advanced by 33,712 contracts and overcame a small rise in the short positions by 2,763 contracts to register the overall net change of +30,949 contracts for the week.

10 Year US Treasury Note Commercial Positions:

In the commercial positions for the 10-year note on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) cut back on their overall bullish positions to a total net position of +93,345 contracts through September 22nd. This is a weekly change of -44,986 contracts from the total net position of +138,331 contracts on September 15th.

IEF 7-10 Year Bond ETF:

Over the same weekly reporting time-frame, from Tuesday September 15th to Tuesday September 22nd, the 7-10 Year Treasury Bond ETF gained from 105.84 to 107.11, according to ETF data for the iShares 7-10 Year Treasury Bond ETF (NYSE:IEF).

Last 6 Weeks of Large Trader Positions

COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Risk Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment. Due to the level of risk and market volatility, Foreign Currency trading may not be suitable for all investors and you should not invest money you cannot afford to lose. Before deciding to invest in the foreign currency exchange market you should carefully consider your investment objectives, level of experience, and risk appetite. You should be aware of all the risks associated with foreign currency exchange trading, and seek advice from an independent financial advisor should you have any doubts. All information and opinions on this website are for general informational purposes only and do not constitute investment advice.