10-Year Note Non-Commercial Speculator Positions:

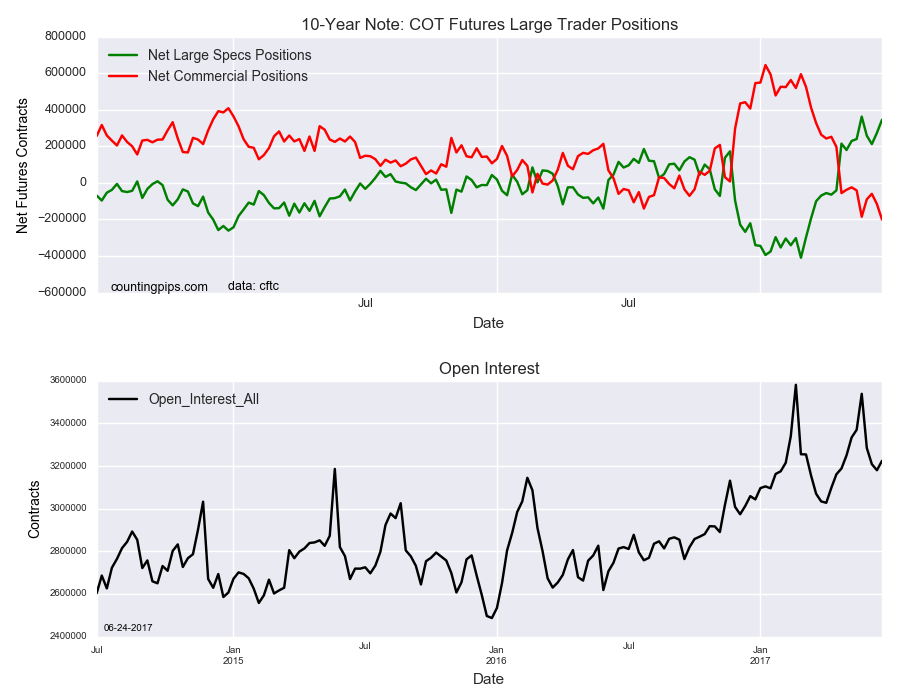

Large speculators sharply pushed bullish net positions in the 10-Year Note futures markets higher this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of 10-Year Note futures, traded by large speculators and hedge funds, totaled a net position of 345,172 contracts in the data reported through Tuesday June 20th. This was a weekly advance of 71,203 contracts from the previous week which had a total of 273,969 net contracts.

Speculative 10-year note positions have rebounded strongly in the past two weeks and by over at total of +130,000 contracts after falling sharply on May 30th (-104,336 contracts) and June 6th (-46,099 contracts). Overall spec positions are now at the highest level in a month and back over the +300,000 contract mark for the second time in five weeks.

10-Year Note Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -200,875 contracts on the week. This was a weekly drop of -84,582 contracts from the total net of -116,293 contracts reported the previous week.

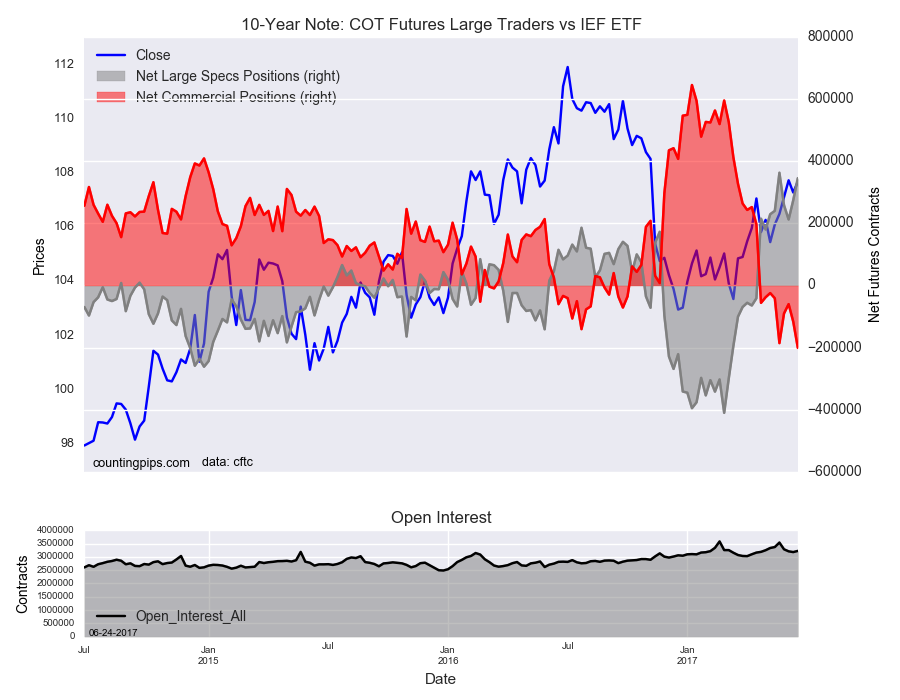

IEF (NYSE:IEF) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the 7-10 Year Treasury Bond ETF (IEF) closed at approximately $107.68 which was a boost of $0.40 from the previous close of $107.28, according to unofficial market data.