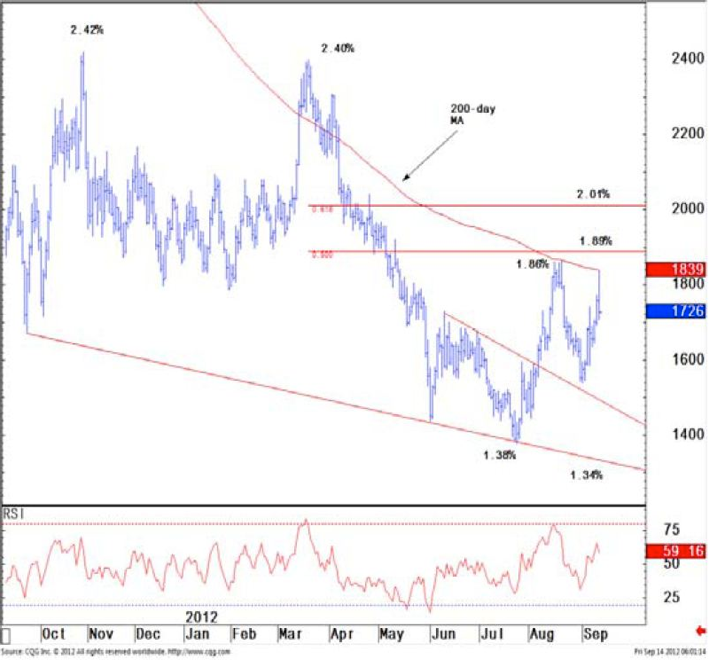

On the heels of the Federal Reserve's announcement to purchase mortgage-backed securities in an effort to stimulate the economy, U.S. Treasury rates had a roller-coaster ride on Thursday. Interest rates fell in early trading and -- after the announcement -- yields spiked higher only to recede back to lower levels.

Given the volatility in the 10-Year yield, Credit Suisse technical analysts David Sneddon, Christopher Hine, Pamela McCloskey and Cilline Bain focus the spotlight on key support areas to determine the next step in their strategy. In Credit Suisse’s latest U.S. Fixed Income Daily, they provided the following color on where the 10-Year may trade:

- Post the FOMC yesterday 10yr US yields staged an early test of key support at 1.84/86% -- the 200-day moving average and the August yield high. Good buying was found here and saw a rally back to initial resistance at 1.71/69%. A break below it would allow a test of 1.645/635%. Below here is needed to ease bearish risks and would aim at 1.60/59% ahead of the 1.54% chart low.

- Above 1.84/86% and follow through 1.89% -- the 50% retracement of the year’s rally -- would see a bigger base and more bearish turn for 2.00/01% next.

Rate Talk

According to Trade Monster’s Bond Trading Center, the 10-Year yield is higher by 13 basis points from Thursday’s close and is currently at the aforementioned key support level of 1.86%. A breakout from there suggests more momentum for higher rates. A bounce provides a respite from bearish pressure.

Another key support is 1.92% while another area of resistance lies at 1.50/1.495%.

Currently, the technical analyst team does not have a position but looks to short the 10-Year U.S. Treasury. Here, they would sell at a higher price, which translates to a yield of 1.65%. Then, they would cover -- or buy back -- at a lower price, which then equates to a yield of 1.84%. A Stop-Loss would be set below 1.635%.

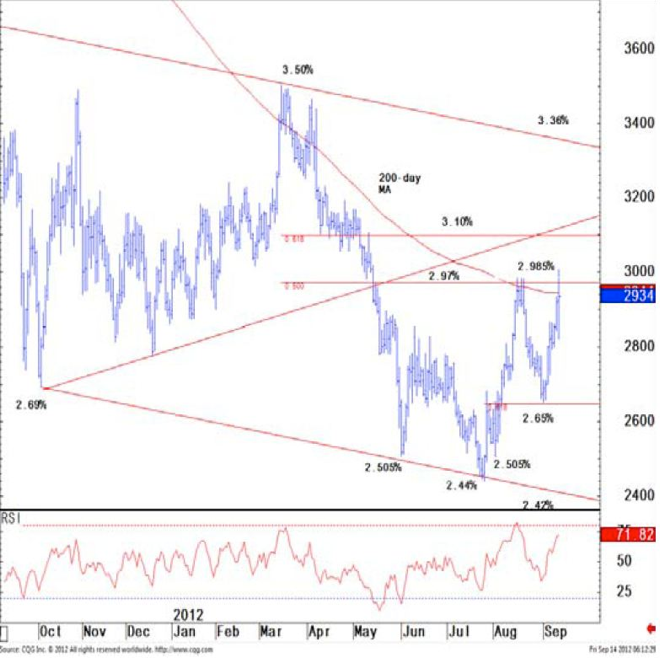

Inflation Fear

If you think that interest rates are entirely correlated, think again. With QE, fear of inflation pressures are unfolding as seen in the greater selloff in the Long Bond. In other words, the spread between the 30-Year and the 10-Year is widening suggesting higher inflation expectations down the road for the U.S. economy. Given that the 30-Year is now trading at 3.07%, it appears we may see a test for higher rates according to the Credit Suisse research team.

- The 30yr extended weakness to stage an intraday foray through key support at 2.94/985%. This marks the August yield highs, 200-day moving average and the 50% retracement of the 2012 rally. Although unable to hold above here the test through it signals bearish intent. Extension through 2.985% would signal a bigger base and allow a test of price and 50% retracement support at 3.10/11% next.

- Resistance shows at 2.90/89% initially, but through 2.80/795% needed to ease immediate bearish pressure for 2.725/71%.

Currently, the team from Credit Suisse is now short with Stop Loss below 2.795% and a target for 3.10%.

Disclaimer

The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.