Today kicks off the annual forum in Davos. This lavish gathering in the snowy mountains of Switzerland brings together the world's most wealthy and famous, to try and tackle the problem of inequality.

Ten years ago, in the throes of the financial crisis, the theme for the Davos convention was "what must industry do to prevent broad social backlash?"

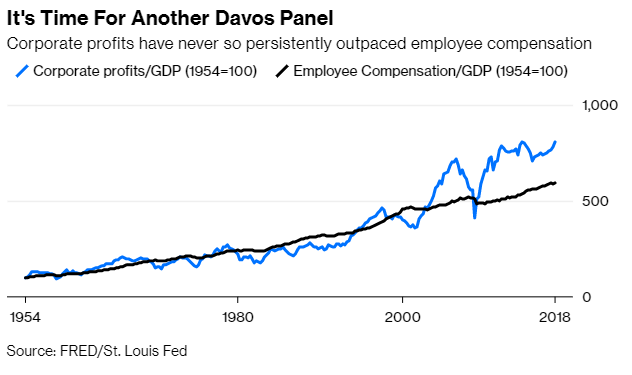

Since then, the world's most fortunate have seen their fortunes soar even though global GDP and average working wages have remained stagnant. This interactive chart on Bloomberg tells quite a tale.

Last year I had the pleasure of attending this event and as a crypto enthusiast, I was quite pleased to see a vibrant showing of activists and blockchain builders. On the main stage of the World Economic Forum, however, the attitude towards distributed ledger technologies was more tepid.

This year there will be a panel called Building a Sustainable Crypto-Architecture, which is scheduled for tomorrow at 10:00 AM CET. This will be particularly interesting as it pits known bitcoin skeptics Gillian Tett from the Financial Times and Ken Rogoff from Harvard against the founders of Circle (the Goldman Sachs (NYSE:GS) backed owners of Poloniex Exchange) and BitPesa.

You can watch all of the WEF keynotes and panels at this link. There are several that look interesting and can give some good investment insights.

Today's Highlights

- Shutdown: Day 32 | Days to Brexit 66

- 10 Years Market Challange

- Crypto Decade

Please note: All data, figures and graphs are valid as of January 22nd. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

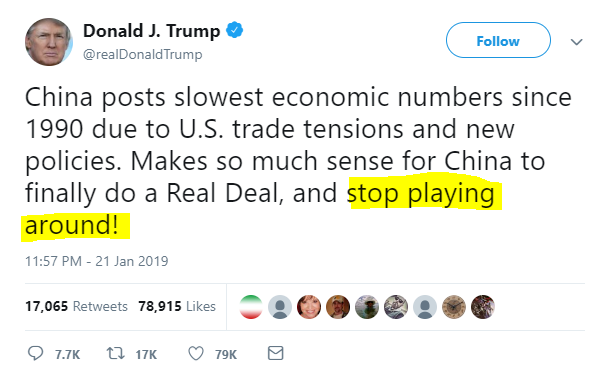

The clock ticks slowly on our two headline political snafus. In an apparent response to the weak Chinese GDP data, Xi Jinping has urged for calm and warned of financial risks.

Never missing an opportunity to gain the upper hand, President Trump has also responded to the Chinese figures.

Needless to say, global stocks are playing defense today. The CHINA50 is leading the pack with modest declines of 1.36%.

Ten Year Challange

If you're not familiar, the 10-year challenge is a new internet fad that has people posting a pic of themselves 10 years ago next to a current glamour shot. Though many have criticized this as just another excuse to post selfies, I thought it'd be fun to look at a few markets. :)

As far as the stocks are concerned the last 10 years have been stunning. Here's a quick reminder of what the Dow Jones looked like in 2009 Vs today.

As far as Emerging Markets are concerned, time was not as good to them as it was in the USA and other developed economies. There have been some good times and some bad but overall is aging nicely. Kind of like Morgan Freeman.

Gold was in the thralls of a massive bull run in 2009. Its peak was in 2011 though.

Crude oil looks exactly the same.

King dollar had just one radical change. For better or worse depends on your personal politics and point of view.

Chart credits for this segment go to tradingview.com.

What about Crypto??

We have an entire new emerging and thriving industry now that's grown up around bitcoin and blockchain.

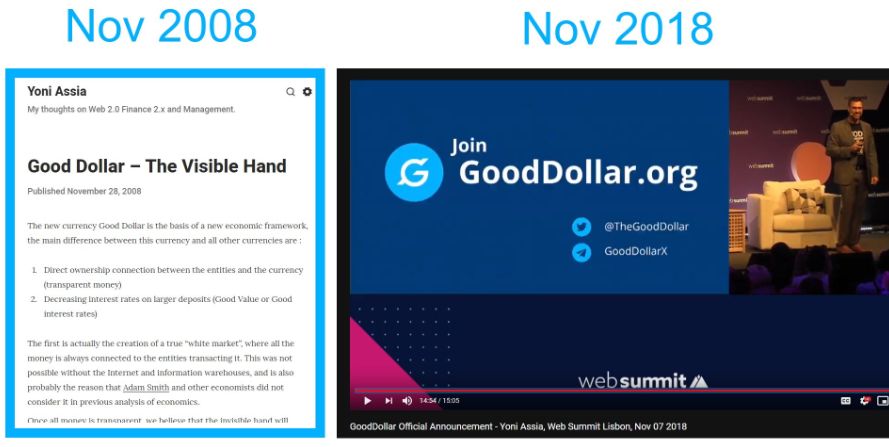

The kicker for us at eToro is this post about our CEO and Co-founder at eToro Yoni Assia who wrote this post about income equality through the introduction of a new currency to help bridge the gap between the rich and poor.

10 years, nearly to the day, we've introduced the Good Dollar project as a spinoff of eToro for the betterment of economic justice.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.