It’s been a whopping 558 days since we’ve endured a perfectly healthy and normal 10% selloff in the stock market. The streak is all but guaranteed to extend into 2014, given that there are only a handful of trading days left in the year.

But a year without a correction isn’t the only thing that we’ll remember about 2013…

As you’ll recall, on Friday, we started looking back at the most memorable developments in the market in 2013.

It’s time to finish the job. So let’s get to it…

Con #1: Real Estate is Forever Doomed

Ridiculed. Rejected. Ignored. That pretty much sums up the response to my February 2012 insistence that “the real estate market just hit rock bottom.”

Lo and behold, the market did bottom out at that time. The good news is, the recovery gained steam in 2013.

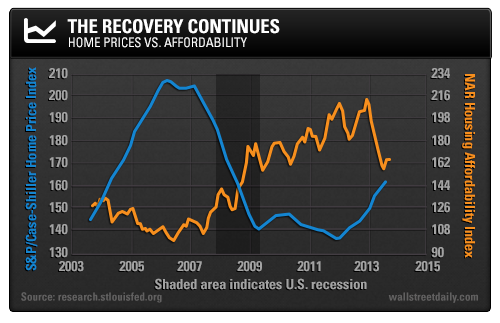

The most telling sign? Home prices. They’re up almost 15% in the last year, based on the S&P/Case-Shiller Composite-20 Home Price Index.

The sharp rise naturally pushed down affordability. But don’t fret…

The latest National Association of Realtors Housing Affordability Index reading indicates that the typical American family has 165.4% of the income necessary to qualify to purchase a median-priced, single-family home (with a 20% down payment and a 30-year fixed-rate mortgage).

So any talk about another bubble forming is utter nonsense. The classic sign of a bubble is when prices get out of reach. And that’s obviously not the case here.

As Goldman Sachs’ (GS) analysts pointed out in a recent research note: “We see the dataflow as consistent with growing momentum in the housing sector, in line with our view that higher interest rates will not prevent a solid increase in housing activity in 2014.”

I expect the recovery to continue in 2014, too. Feel free to disagree with me (again) at your own risk…

Con #2: The Bull Market Doesn’t Have Legs

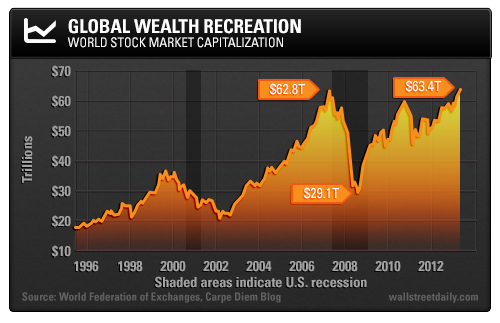

Forget real estate for a moment. Global equity markets also rebounded mightily in 2013, trading at new all-time highs, according to the World Federation of Exchanges data.

The combined market cap of the world’s 58 major stock markets rose to $63.4 trillion in November.

To put that in perspective, global equity values plummeted to $29.1 trillion in the depths of the financial crisis. So we’re talking about some serious wealth (re)creation here.

I’ll take it! How about you?

Con #3: Invest in the BRICs

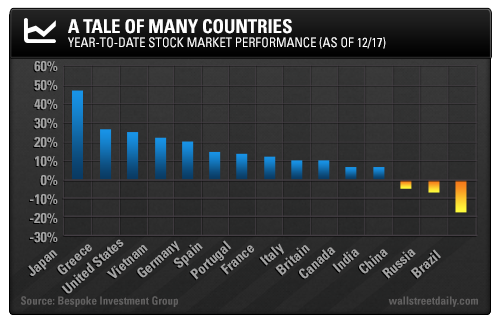

Now, if we dissect stock performance on a country-by-country basis, it’s clear that not every market enjoyed boom times.

The over-hyped emerging markets of Brazil, Russia, India and China fared the worst. Only India registered a gain. But certainly not a big one – only 6.1%. And Brazilian stocks got absolutely clobbered, dropping nearly 20%.

Meanwhile, Japan, the United States and many European countries topped the leaderboard.

Japan? Who’d have thunk it? Oh, that’s right, we called for Japanese stocks to rally in December 2012. Hope you listened.

Con #4: The Next Crisis is Coming!

This is perhaps the most telling chart of all. It shows the correlation among all asset classes, which got cut in half in 2013.

What’s the big whoop? I’ll let Business Insider’s Joe Weisenthal explain: “One of the characteristics of a crisis is extreme correlation between multiple asset classes: Everything trades up or down together.”

The financial press famously referred to this as the risk on/risk off environment. But it’s over, as is the financial crisis, which means we’re in a stock picker’s market more than ever.

What type of stocks should we be focusing on, though? Glad you asked…

Con #5: Small Caps Are Maxed Out

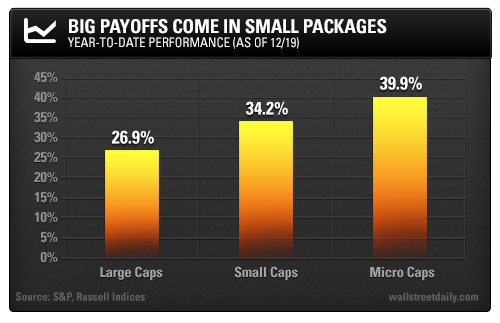

Talk about staying power! For 13 years in a row, small-cap stocks have outperformed their larger-cap brethren.

In 2013, they rallied 34.2%, compared to a 26.9% rise for large caps, as represented by the S&P 500 Index.

Micro-cap stocks, which my MicroCap Tech Trader subscribers know all too well, performed best, rising an average of nearly 40%.

I recommend you stick to the same script in 2014 – bet big on small-cap (and micro-cap) stocks!

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

2013: 10 Shocking Charts - Part 2

Published 12/23/2013, 05:43 AM

Updated 05/14/2017, 06:45 AM

2013: 10 Shocking Charts - Part 2

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.