It’s rare to see two bad years in a row. I have a hunch that 2023 may rhyme with 2009. Bear markets don’t usually last longer than a year. A spectacular shakeout early in the year could set the stage for a steady grind higher later on.

That said, we contrarians don’t buy hunches. Until we see an edge, we’ll remain cautious—and follow these rules:

Rule #1: Don’t fight the Fed

Print this rule out and tape it next to your computer. Or the backside of your phone. Or whatever device you use to make trades.

As long as the Federal Reserve is tightening, the obvious path for all stock and bond prices is down.

“Don’t Fight the Fed” was chapter four in investing wizard Martin Zweig’s legendary Winning on Wall Street. He devoted 40 thoughtful pages to teaching readers why they should “go with the flow” with respect to the Fed’s trend.

We stayed cautious through ’22 by “backing up the truck” on one of the few assets that didn’t get creamed. Greenbacks.

Rule #2: Cash is king—for a little while longer

We did see a Fed pivot in December—to an even more hawkish stance! Yikes. This means more trouble for bonds and stocks in the coming months.

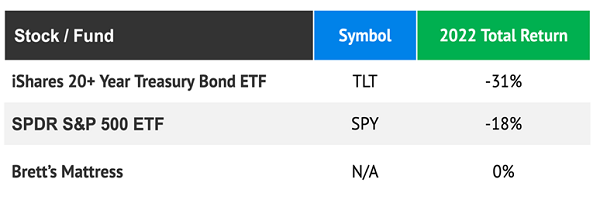

Cash, meanwhile, may not pay a dividend. But my mattress sure had a great year in relative terms:

Long-term I don’t love the mattress as a retirement vehicle. But it’s the safest place to start the year.

Rule #3: Buy bonds for bounces (not forever… yet)

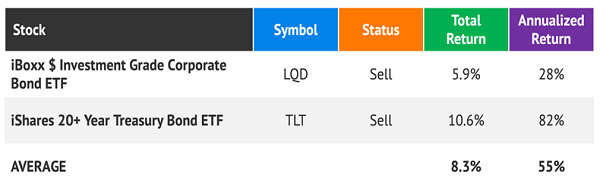

We nailed the short-term bottom in US Treasuries. The bounce didn’t last long.

CIR subscribers, I hope you followed our Flash Alert advice to book profits, which annualized to a whopping 82% and 28% on two safe bond trades:

Rule #4: Cash now, bonds again later this year

We will have a great opportunity in bonds soon that should last longer than weeks. With the economy slipping into a recession, rates will eventually top—which is bullish for bond prices.

When it’s time to buy, my premium subscribers will be the first to know.

Rule #5: High-yield bonds will be in play, too

Usually we’d avoid risky debt heading into a recession. But bond credit spreads—which typically widen as trouble approaches—remain under control thanks to the Fed’s past actions.

Remember 2020? Uncle Jay Powell went bananas and started buying anything and everything high yield, including ETFs!

Rule #6: Watch the “Bond God”

Jeffrey Gundlach’s DoubleLine Income Solutions Fund (DSL) should roar back when interest rates top. The Fed will be DSL’s friend if anything goes astray in the credit markets. DSL dishes an amazing 11.9% dividend in the meantime.

Rule #7: Closed-end stock funds may sink, then soar.

Remember old friend Gabelli Dividend & Income (GDV)? We pounded the table on GDV back in September 2020 and the fund soared 40%+ in months.

GDV yields 6.4% today and trades at a 14% discount to fair value. I wouldn’t buy GDV just yet but would consider it on a big broad market selloff.

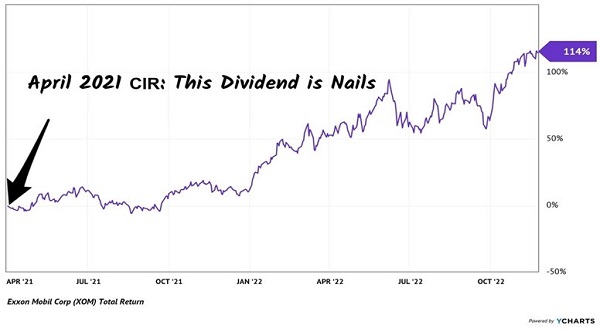

Rule #8: Buy energy dividends on pullbacks. The “Crash ‘n Rally” pattern in energy payers still has years to run. Let’s keep buying the dips.

We Bought This Dip in XOM

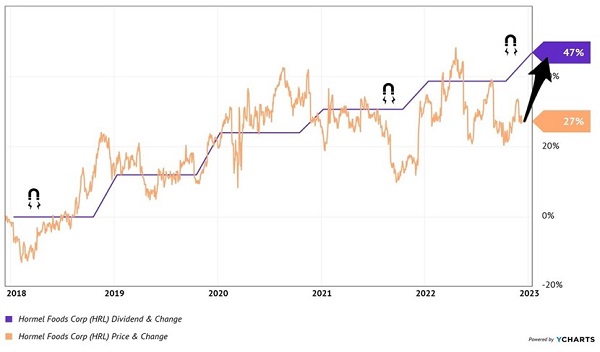

Rule #9: Buy high-quality dividend growers. Take Hormel (HRL), which is ready to profit in a 2023 slowdown. Whether it’s a recession or a full-blown financial crisis, Hormel’s SPAM always sells.

Each can of SPAM sold benefits our dividends. We just received our fifth dividend increase since adding Hormel to our Hidden Yields portfolio in October 2018. Our payout today sits 47% higher than it was then.

This dividend magnet is due to pull the stock price, which has lagged its payout this year. This price is poised to “catch up” once the Fed eases up on its tightening.

HRL’s Dividend Magnet is Due: 5-Year View

HRL won’t stay low forever. This is the type of stock we want to be buying cheap. We’re going to empty out our mattress stash to get rich on high-quality dividend growers like HRL.

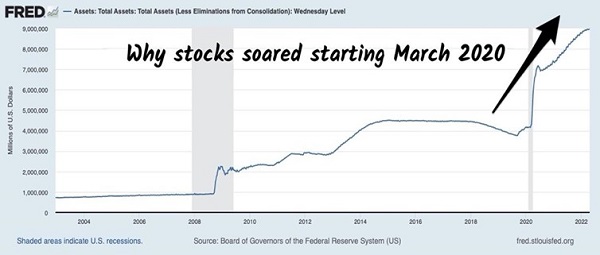

Rule #10: Get ready to get greedy. Longtime HY subscribers will fondly recall our April 2020 Flash Alert. The news headlines were terrible—even worse than today!—but we knew that the Federal Reserve “had our backs.” Chairman Jay Powell had just fired up his printing press on his way to creating $4+ trillion out of thin air:

Money Printing Worthy of a Flash Alert

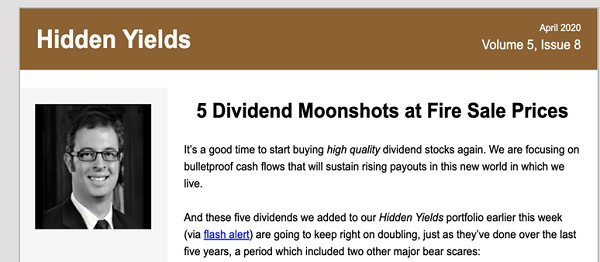

We saw this setup and didn’t want to wait until our next scheduled issue of HY. So, we fired off this Alert to great dividend deals on April 14, 2020:

These five timely buys delivered average returns of 24%. Nice.

April 2020 HY Buys “Where Are They Now?”

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."