- Stagflation remains one of the primary risks for the global economy in 2023.

- The stock market’s trajectory will continue to be dictated by worries over persistently high inflation and fears of an impending recession.

- As such, I highlight ten companies that are relatively safe amid the looming threat of stagflation thanks to their strong fundamentals, reasonable valuations, and healthy dividend payouts.

- Looking for more top-rated stock ideas to protect your portfolio amid the increasingly uncertain economic climate? Members of InvestingPro get exclusive access to our research tools and data. Learn More »

Worries over stagnant economic growth and consistently high inflation will likely be the primary drivers of market sentiment in the months ahead.

Such an environment is referred to as ‘stagflationary’ and may occur if a recession is triggered before inflation is contained to where the Federal Reserve wants it to be.

In general, energy, utilities, healthcare, and consumer staples are some defensive sectors that perform well during stagflation. In contrast, their cyclical counterparts, like technology, financials, and industrials, tend to underperform.

I used the InvestingPro stock screener to identify the 10 best stocks to buy as stagflation fears grow ahead of the latest CPI inflation report, due on Wednesday at 8:30 AM ET.

My Methodology:

Using the InvestingPro stock screener, I ran a methodical approach to filter down the 7,500-plus stocks listed on U.S. exchanges into a small actionable watchlist of established companies expected to provide investors with solid returns, regardless of economic conditions.

My focus was on well-diversified, defensive companies with solid profitability, a healthy balance sheet, high free flow, strong growth prospects, and an attractive valuation.

More importantly, I wanted to identify stocks that offer resilient dividend payouts and have proven that they can sustain a slowing economy thanks to their market-leading position.

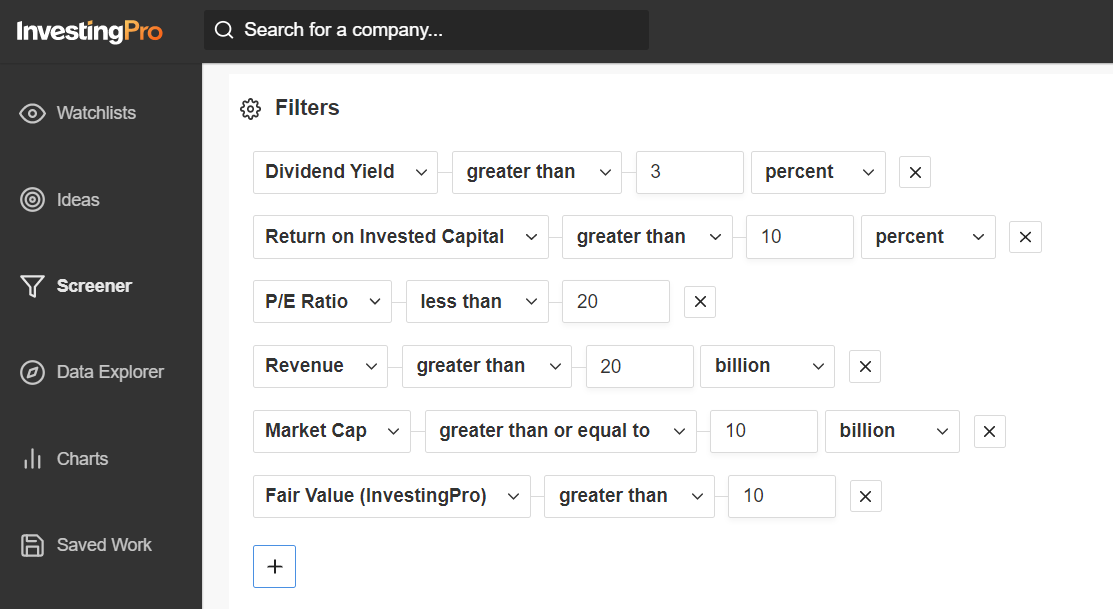

As such, I first scanned for names with a dividend yield above 3% and a greater than 10% return on invested capital (ROIC), which is a capital efficiency ratio used to measure a firm's ability to create value for all its stakeholders.

Essentially, these two metrics show how well a company uses its capital to generate profits. Source: InvestingPro

Source: InvestingPro

I then narrowed that down to companies with over $20 billion in annual revenue. Digging deeper, I also filtered for names with a market cap of $10 billion and above and a price-to-earnings (P/E) ratio below 20.

Finally, I scanned for companies with InvestingPro Fair Value upside greater than 10%. The estimate is determined according to several valuation models, including price-to-earnings ratios, price-to-sales ratios, and price-to-book multiples.

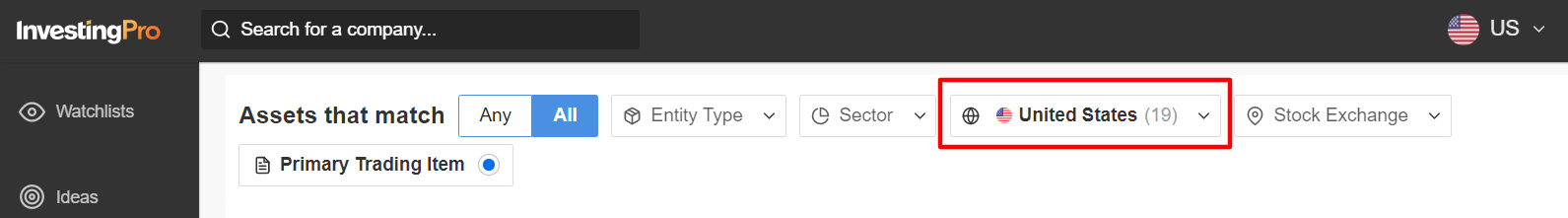

After I applied these criteria, I was left with a total of 19 companies on my watchlist.

Source: InvestingPro

Not surprisingly, 16 of them currently enjoy a Financial Health score higher than 2.75 on InvestingPro. That should bode well for the future as companies with health scores greater than 2.75 have outperformed the broader market by a wide margin, dating back to 2016.

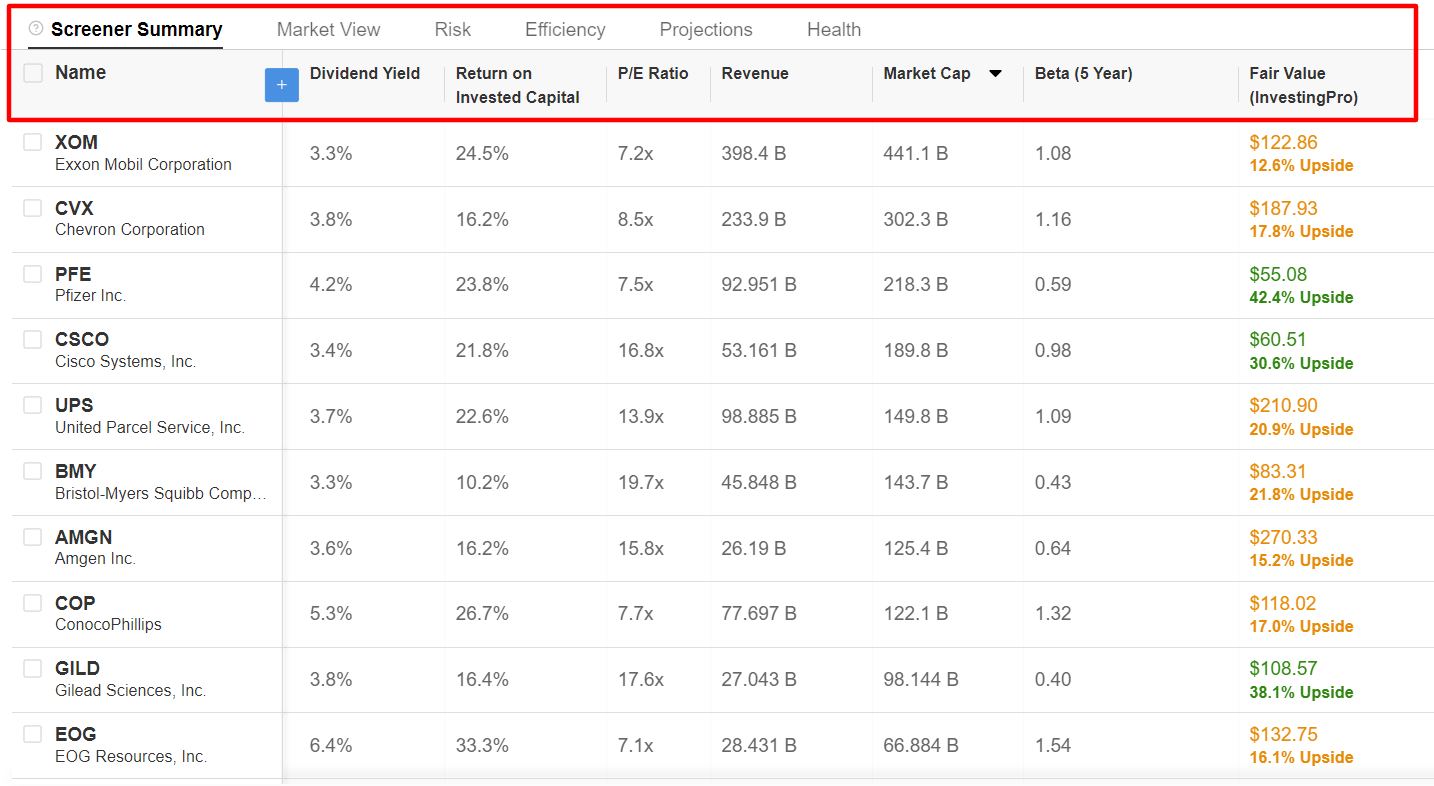

Here are the 10 most promising stocks expected to provide some of the highest returns in the months ahead based on the InvestingPro models.

All companies mentioned offer strong market visibility and have displayed a long-standing history of surviving volatile market environments, making them solid investments amid the current economic climate of elevated inflation and slowing growth.

10 Best Stagflation Stocks To Buy Now

- ExxonMobil (NYSE:XOM) (Fair Value Upside: +12.6%)

- Chevron (NYSE:CVX) (Fair Value Upside: +17.8%)

- Pfizer (NYSE:PFE) (Fair Value Upside: +42.4%)

- Cisco Systems (NASDAQ:CSCO) (Fair Value Upside: +30.6%)

- United Parcel Service (NYSE:UPS) (Fair Value Upside: +20.9%)

- Bristol-Myers Squibb (NYSE:BMY) (Fair Value Upside: +21.8%)

- Amgen (NASDAQ:AMGN) (Fair Value Upside: +15.2%)

- ConocoPhillips (NYSE:COP) (Fair Value Upside: +17.0%)

- Gilead Sciences (NASDAQ:GILD) (Fair Value Upside: +38.1%)

- EOG Resources (NYSE:EOG) (Fair Value Upside: +16.1%)

Source: InvestingPro

Not surprisingly, eight of the 10 stocks mentioned above hail from the energy and healthcare sectors, as their products and services are essential to people’s everyday lives.

These companies usually produce and sell a range of products consumers need regardless of the economy's condition, making them smart buys amid the current environment.

For the full list of the 19 stagflation stocks that made my watchlist, start your 7-day free trial with InvestingPro. If you're already an InvestingPro subscriber, you can view my selections here.

Are you seeking more actionable trade ideas to navigate market volatility? The InvestingPro tool helps you easily identify winning stocks at any given time.

Start your 7-day free trial to unlock must-have insights and data!

Here is the link for those who would like to subscribe to InvestingPro and start analyzing stocks yourself.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of the macroeconomic environment and companies' financials. The views discussed in this article are solely the author's opinion and should not be taken as investment advice.