Investing.com’s stocks of the week

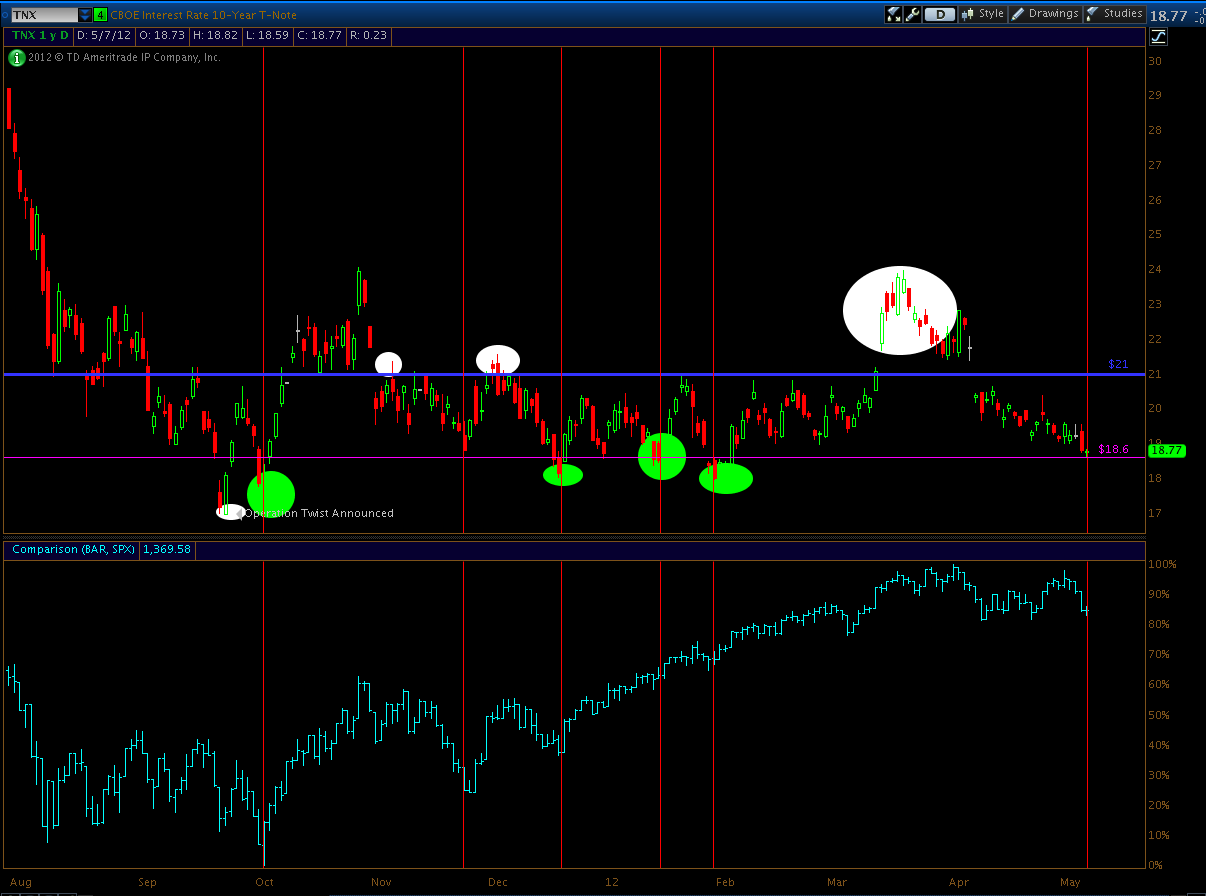

Since good ole operation Twist started, the Ten Year has remained in a tight range giving good buy and sell signals. Whenever TNX went above 2.10 the market sold off.

Whenever the Ten Year yield dipped below 1.86%, the market rallied. Yesterday TNX dipped below 1.86% only to close above above it as the market rallied.

There is a strong pattern here which shows how the market rallies each time it gets to these levels only stopping when it gets above 2.10.

This pattern looks like it will perform again, with TNX at support and the market, a bounce off this level looks likely. Now we are entering the end of Operation Twist so the pattern could be voided. However, till then our plan of a rally into the end of June still looks valid.

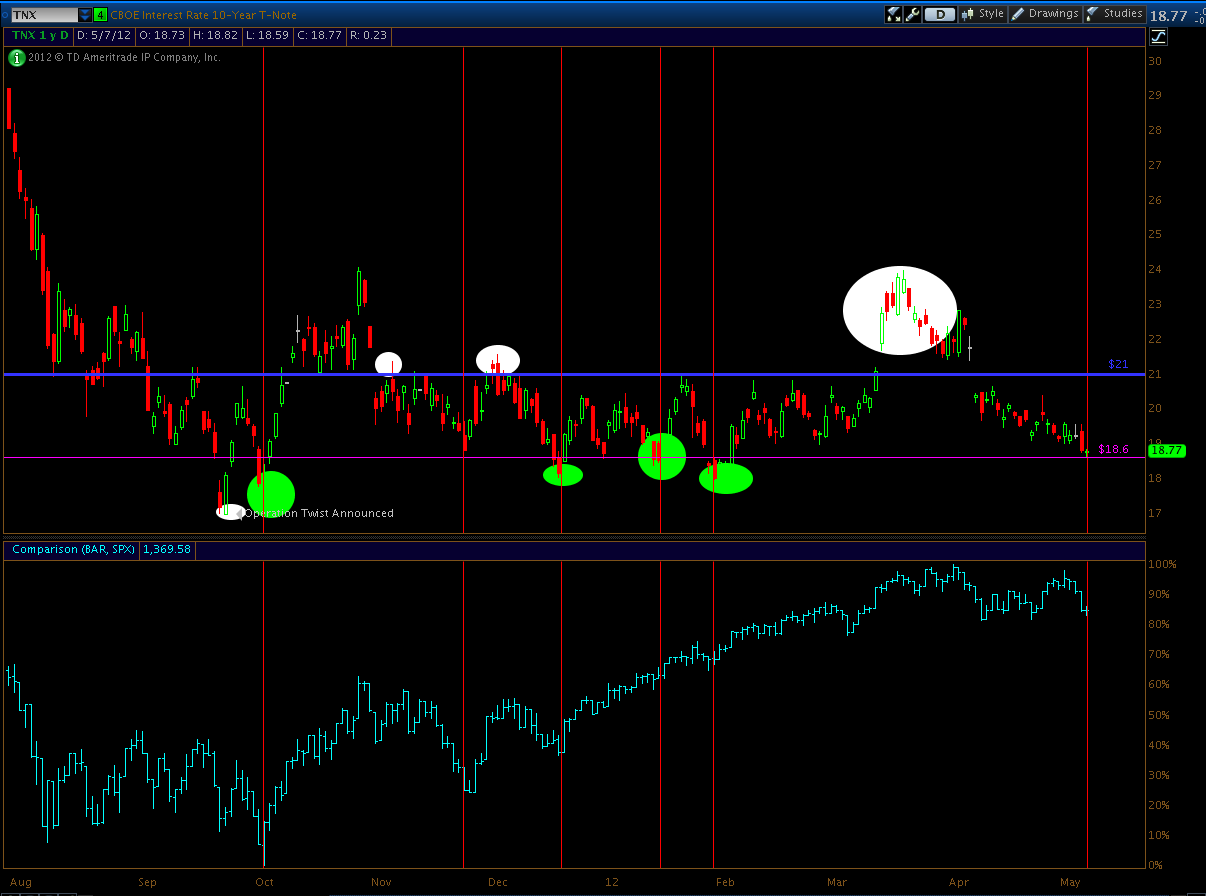

Whenever the Ten Year yield dipped below 1.86%, the market rallied. Yesterday TNX dipped below 1.86% only to close above above it as the market rallied.

There is a strong pattern here which shows how the market rallies each time it gets to these levels only stopping when it gets above 2.10.

This pattern looks like it will perform again, with TNX at support and the market, a bounce off this level looks likely. Now we are entering the end of Operation Twist so the pattern could be voided. However, till then our plan of a rally into the end of June still looks valid.