These are my thoughts on the SPY ETF“All our dreams can come true, if we have the courage to pursue them.” Walt Disney

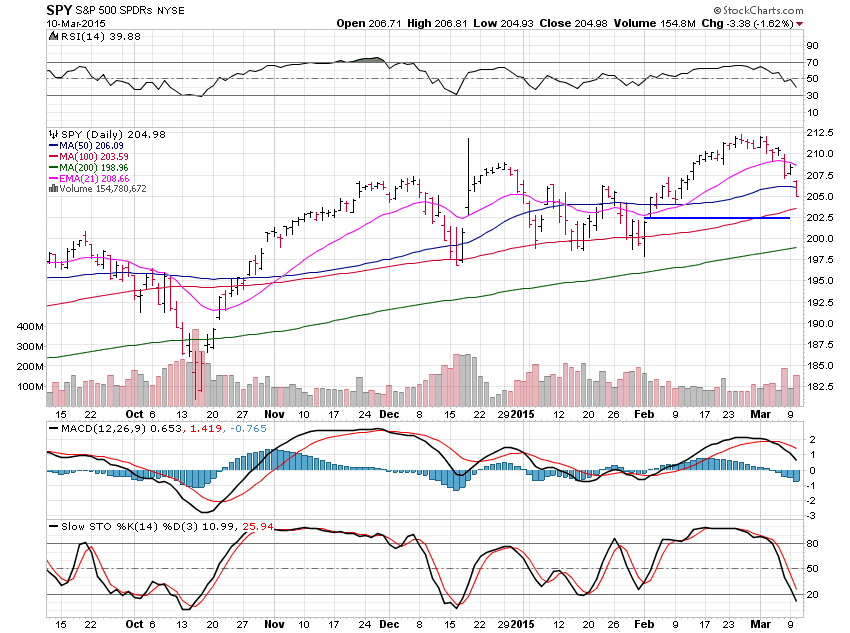

The weakness continued yesterday on schedule and now we are near oversold levels where we often see bounces begin. We should see some nice weakness today with a bounce taking place at some point during the day or Thursday. I’m focused now that we are nearing a low most likely.

These short corrections have been nothing but chances to build your profits and buy companies that you may have missed out on and we should see many strong buy points emerge as the week rolls on. We’ve got to be quick or we’ll miss the low.

(ARCA:SPY) is moving nicely lower now and we are near a bounce from what I can see.

The 100 day average isn’t far now at 203.60 and there is support at 202.50 as well so let’s see what plays out today but I will be looking to nail a low very soon for myself.