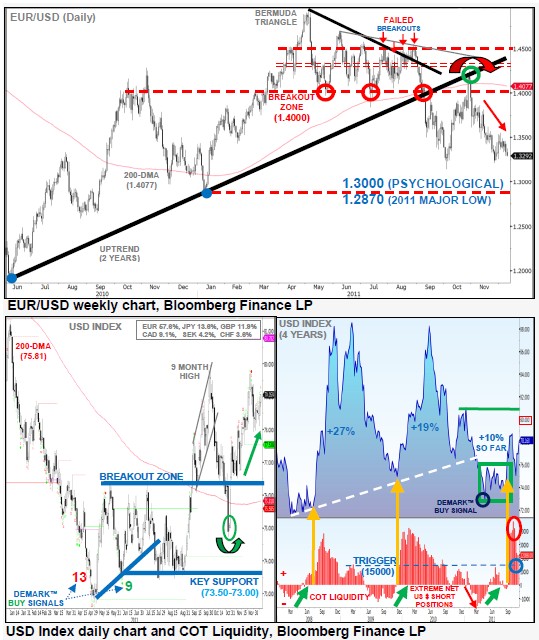

EUR/USD

Bears push lower into 1.3212 after EU Summit.

EUR/USD bears have pushed lower, as expected, following the EU Summit and in price terms, still target support at 1.3212 (25th Nov low) and 1.3146

(Oct swing low).

We have opened a sell trade setup favouring extended downside scope. Our cycle analysis suggests increased volatility over the next two weeks across “risk” proxies, including the equity and commodity markets. A sustained close beneath 1.3146 will re-establish the larger downtrend from April and target 1.3000 (psychological level), then 1.2870 (2011 major low).

Meanwhile, resistance can be found at 1.3550 (02 Dec high), then 1.3610 and 1.3730. Any rebound into these levels is likely to be short-lived.

Inversely, the USD Index is maintaining its recovery higher and still targets its recent 9-month highs near 80, (a move worth almost 10%).

Speculative (net long) liquidity flows have unwound from recent spike highs (3 standard deviations from the yearly average). This will likely remain strong and help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

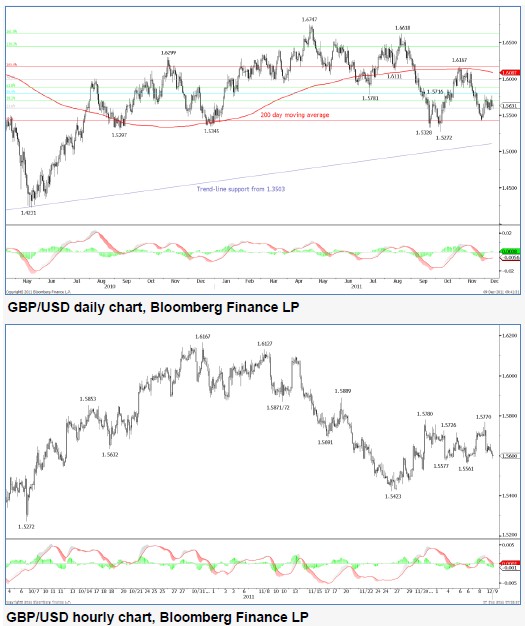

GBP/USD

Sequence of false breaks adds to uncertainty.

GBP/USD has witnessed two failed breaks over recent sessions, which are best viewed in the hourly timeframe. The initial fall under 1.5577 was quickly reversed which led to a push over 1.5726. This failed to gain momentum, seeing a return to the hourly range for the week.

As expected, 10 year Italian sovereign yields have found interim support close to 5.750% and are now trading back above 6.000%. If this deterioration continues then we can expect to see Sterling being adopted as a safe haven again. This may help to explain why we have not broken out of the week’s range yet, whereas, at the time of writing, most other currencies are lower versus the USD from a weekly perspective.

We remain alert to the fact that we are nearing the base of the year long range which, given the short-term relief seen in the Euro-Zone, may offer opportunities to enter long positions.

Taking this approach will need to see levels closer to 1.5400 for a well placed stop. The range bound trade of the last few days is best avoided.

USD/JPY

Weakening beneath 78.24 (DeMark™ Level).

USD/JPY is still weak beneath 78.24 (DeMark™ Level). There is an ever growing probability of unfolding a third price retracement back to preintervention levels (PIR III) and potentially even a new post world war record low beneath 75.35 (PINL).

Sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone continues to try and be the first to call the market bottom.

This may inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40-year cycle upside reversal. Expect key cycle inflection points to trigger into November-December this year, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

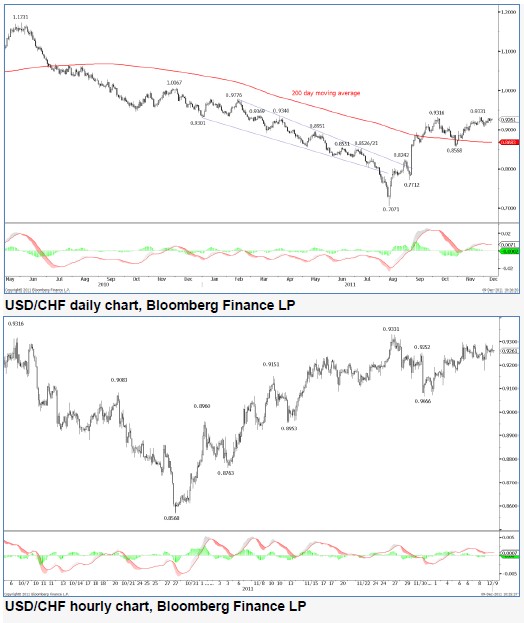

USD/CHF

Further downswing favoured to complete a larger correction.

USD/CHF has a short-term structure that is suggestive of a complete leg higher from the 0.8568 low. This now acts to emphasise the 0.9331 high as being pivotal to further gains. If a break above this level can be achieved, this will warn of a larger swing, to potentially target 0.9776.

However, given events elsewhere, the fall from 0.9331 to 0.9066 is likely the first leg lower in a larger corrective phase which may be affected by a return to rising yields in the core bond markets of the Euro-Zone.

With this in mind, we note that the respite that was offered to 10 year Italian government bond yields following the USD based swap rate cut has likely reached completion. The region near 5.750% has thus far acted as strong support, warning of a return to 7.00% over coming weeks. If upside pressure can be maintained in Italian and Spanish yields then USD/CHF will likely experience a degree of downside pressure too.

Spanish and Italian government bonds have seen a reasonable sized pullback during the last week, currently trading at 5.865% and 6.572% versus 6.478% and 7.355%, before the six party central bank agreement. (These same yields were trading at 5.405% and 5.924% respectively at the same time yesterday.)

USD/CAD

Bulls rebound above 1.0200.

USD/CAD has triggered a sharp bullish rebound above 1.0200. We are watching for further sustained price activity to open a buy trade setup.

A directional confirmation above 1.0658 is still needed to unlock the recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott wave cycle.

Only a sustained close beneath 1.0080 and parity unlocks bearish setbacks into the long-term 200-day MA at 0.9864 and 0.9726 (31st Aug low).

EUR/CAD is unwinding mildly ahead of the base of an important multimonth distribution pattern. A break beneath 1.3393-79 (19th Sept low/61.8% Fib), signals an important breakdown into 1.3140 and would provide substantial correlation pressure onto EUR/USD.

CHF/CAD, which serves as a proxy for “risk appetite”, remains weak beneath its 200-day MA (which had provided support for most of the uptrend since mid-2010). Key support now holds at 1.0893 (61.% Fib retrace). A break here would extend the sharp decline into 1.0332 (01st March low) and help confirm further unwinding of global risk appetite.

AUD/USD

Sharp setbacks beneath 200-day MA at 1.0405.

AUD/USD has triggered has triggered sharp setbacks beneath its 200-day MA which is currently holding at 1.0405. This key level is likely to encourage further downside scope over the multi-day-week horizon.

The bears must sustain below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie dollar remains strong against the New Zealand dollar. However, near-term price activity is mean reverting back into the 200- day MA. Expect a sharp setback to ensue over the multi-day/week horizon.

The Aussie dollar pairing back its mild recovery against the Japanese yen, while holding above the neck-line of its two-year distribution pattern. Watch for further downside scope into support at 72.00 which would signal further unwinding of global risk appetite.

GBP/JPY

Rangebound trade continues.

GBP/JPY has a structure in the hourly timeframe similar to GBP/USD. Our medium-term bias remains for a strong recovery given the longer-term structure. However, the rise seen since 116.84 is deemed corrective in nature suggesting scope for a return to 119.38 and then 116.84 in the nearterm.

As noted in prior reports, should this pair reach the 123.00 level a degree of resistance would be anticipated. In the meantime, we remain wary of the short-term range bound environment but are re-instating the sell strategy at 123.00.

If the recent range bound trade is resolved to the downside, then the 120.00 level should provide a degree of support, from where a further leg higher would be favoured to develop.

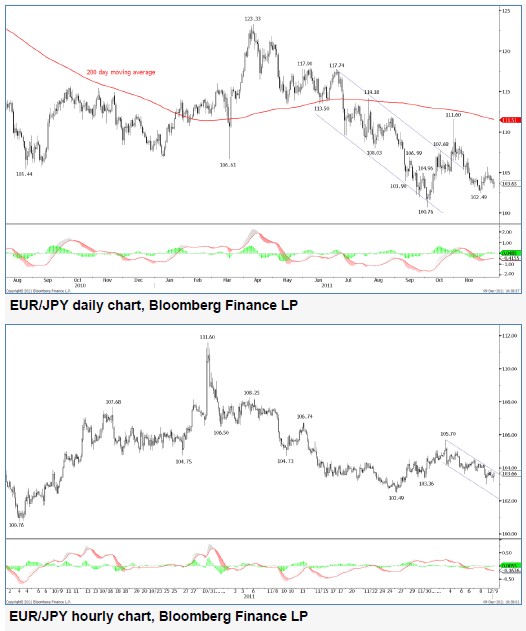

EUR/JPY

Minor short-term down-trend develops.

EUR/JPY is exhibiting many of the same characteristics as a host of

currency pairs in the approach to the Christmas holidays. Most importantly

the recent bout of intervention by various central banks warns of a period of

coordinated intervention to maintain the stability of the Euro as a currency.

This acts as a manipulation of the market, making technical analytics

harder.

We view the fall that has taken place since 111.60 as being corrective in

nature, suggesting potential for a return to this same level. However, in the

shorter-term timeframe a corrective phase appears to have completed at

105.70, which has been followed by a short-term downswing in the hourly

timeframe that has been contained within the confines of a falling channel.

Thus we have a directional clash in two timeframes.

The EUR component of this pair is clearly affected by the movement in

EUR/USD. A break under 1.3146 in EUR/USD will end the rising phase

seen since 2010. This would likely be associated with a fall back down to

100.76 and potentially lower.

Given the above clash between the structure and events in the Euro-Zone,

we prefer to wait on the side lines.

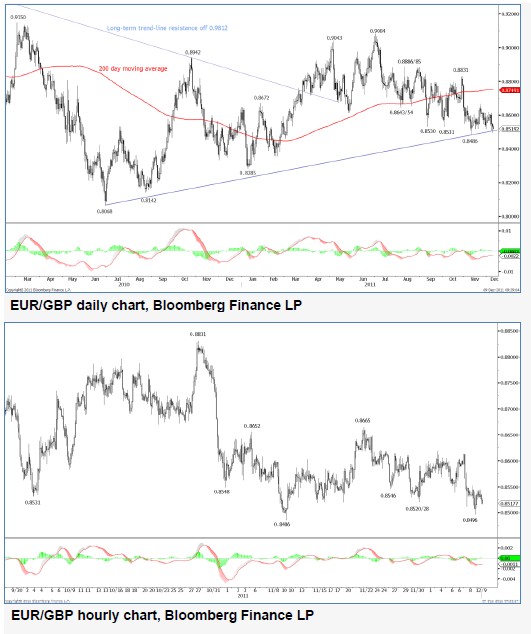

EUR/GBP

Above 0.8486 is suggestive of a larger corrective phase.

EUR/GBP saw a re-test of the 0.8486 level yesterday. While above 0.8486, the entire structure seen since this same level is viewed as being corrective in nature, with scope for a further recovery leg higher back to 0.8665 and then potentially on to 0.8700, our favoured target zone. An earlier break under 0.8486 may finally signal a breakdown of the prior long-term rising trend, which is shown on the Daily chart to the left. However, we are wary of breaks lower in any timeframe in EUR/GBP as they have proved hard to sustain in recent weeks and months.

The message that we take away from the recent six party central bank coordination is that there is a demand for US Dollars amongst European banks. This fact is a warning sign and a clear weakness, suggesting scope for a credit contractionary phase. We continue to expect a return to rising yields within the Euro-Zone and it is within this environment that we see the potential for Sterling to be perceived as a safe haven.

Our bias remains mildly bearish and is supported by trade continuing under both the 200 day and 50 week moving averages. As mentioned in prior reports the 1.3146 level in EUR/USD remains key. A push under this level will likely lead to weakness in all EUR crosses, as it will mark a breakdown in confidence in the EUR and also end the rising trend that has been witnessed since the 1.1876 low seen in the middle of 2010.

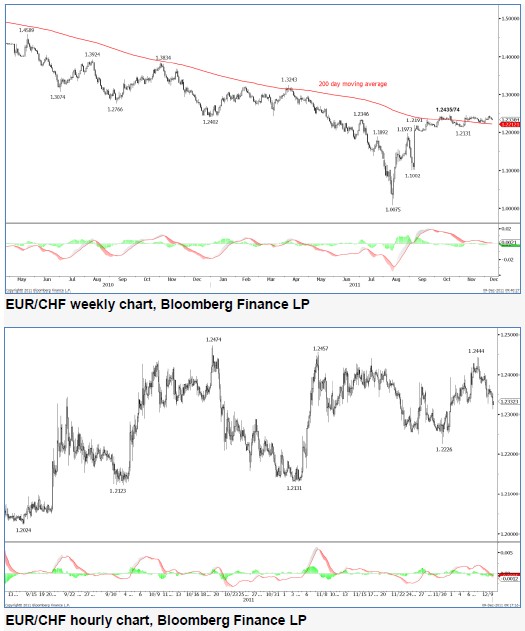

EUR/CHF

Fails again close to 1.2500 .

EUR/CHF has formed a sequence of lower highs close to the ceiling at 1.2500. We will maintain our sell limit strategy at 1.2480 for now as this represents a decent trade location during thin Christmas markets. However, we look to see if a break under 1.2226 can be achieved.

By using 1.2226 as a filter we will swap our current sell limit strategy to a sell stop strategy at 1.2130, with objectives at 1.2030/1.1526/1.1002 and a stop at 1.2230.

A rising sovereign yield environment may now be returning within the Euro- Zone, as discussed in other parts of this report. We look to see if Italian 10 year sovereign yields can return to the 7.000% handle. It is these kinds of pressures that may assist a return to and break of 1.2123/31. This represents the real goal of a lasting breakdown in the recent range bound structure.

The repeated failure of this pair to break over the 50 week moving average over recent weeks is also an initial warning that the prior downtrend may not be over. The large cluster of stops that is likely to be placed around the 1.2000 level is also anticipated to aid any short positioning, questioning the ability of the SNB to hold back the possible flow of funds into Swiss Francs.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

09.12.2011 Daily Technical Report

Published 12/12/2011, 04:22 AM

Updated 03/09/2019, 08:30 AM

09.12.2011 Daily Technical Report

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.