Those that view the message of the market on a daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Sugar's overall trend, revealed by trends of price, leverage, and time, defined and are discussed in the COT Matrix for subscribers.

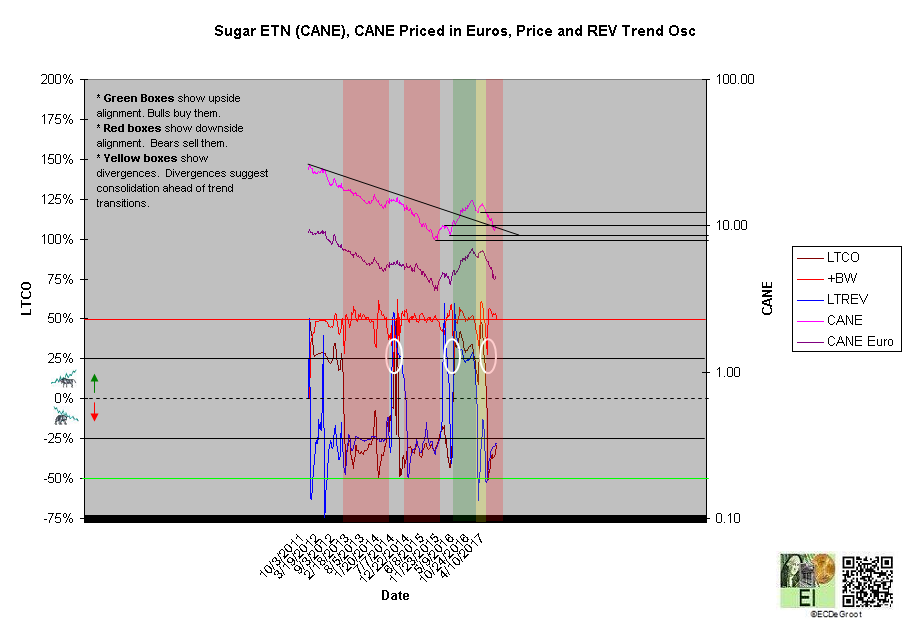

Chart 1

LTCO and LTREVO define a profitable aligned down impulse since March 2017 (Chart 1). The bears that withdrew initial as far back as April are letting their profit run. Letting profits runs is based on the principle of using other people's money (OPM) rather than your money for big profits. Compression (+BW) and/or TIME (BrST > 1 or 2) will close out the remaining position.

These trends are monitored weekly in Trading Notes.

LTCO and LTLO define focused bear opportunity since March 2017. The trade has been extremely profitable.

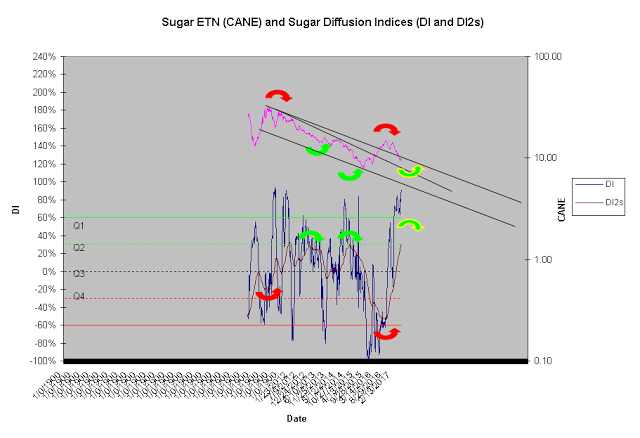

A Q1 DI = 91% not only favors the onset of bullish oscillation/cycle in the coming months but also advises growing caution for the bears (chart 2).

Chart 2