My Registered Investment Adviser, Pacific Park Financial, Inc. manages assets for 185 families. And while it is probable that as many as half of my clients have heard something about Cyprus in the last 5 days, we have received a mere 3 inquiries.

Is the lack of interest in the island country’s debt crisis due to limited media coverage? Probably not. Most in the financial and non-financial media have diligently discussed the issues. The lack of curiosity probably has more to do with crisis burnout. In spite of the headlines — sequestration, fiscal cliff, debt ceiling, “Grexit,” euro-zone debt calamity — the Dow is still setting all-time highs.

On the other hand, it may be premature to dismiss the troubles in Cyprus on the strength in U.S. equities alone. After all, isn’t it possible that the whole might be greater than the sum of its parts? What if a significant market sell-off ultimately results by adding an unanticipated decision (i.e., European Central Bank effectively decides that it is quite willing to let Cyprus go belly-up) to a wave of anti-austerity anger (e.g., Greece tells European officials that it will not fire 25,000 government employees, Italian election sweeps aside Mario Monti’s coalition, etc.)?

I am not predicting doom-n-gloom due to the latest page in the saga. In fact, there is a skeptical part of me that believes that the latest drama/tragedy is little more than an effort by the fiscally sound countries to send a message to Portugal, Italy, Greece and Spain; that is, bailouts require changes in financial behavior.

Why are European Central Bank (ECB) ministers suddenly trying to send a message to anyone? Didn’t the president of the ECB, Mario Draghi, promise that his institution would do “whatever it takes” to protect the euro? Some believe that German leaders pressured the ECB after witnessing both the Athens government as well as the Italian citizens push back against austerity programs to reduce out-of-control spending.

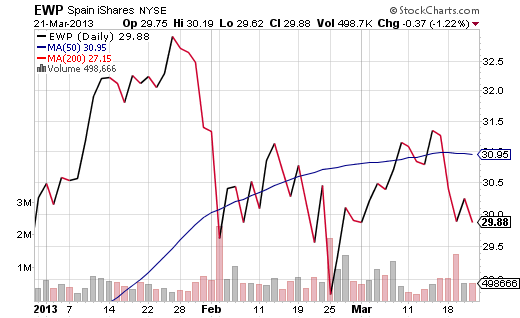

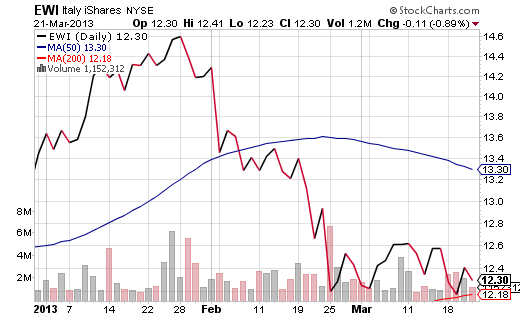

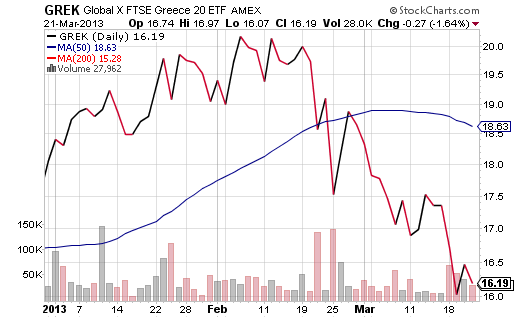

It follows that the new equation may very well be: Anti-austerity backlash + “We will hold your feet to the austerity fire” = Significant sell-off for stocks around the world. Indeed, ETFs like iShares MSCI Spain (EWP), iShares MSCI Italy (EWI) and Global X FTSE Greece (GREK) have already tumbled in 2013.

The countries themselves may be “Too Big To Fail.” However, the exchange-traded funds that purport to represent them are not too big too falter.

Investors genuinely need to consider the possibility that the sovereign debt mess in Europe could cause unhedged European ETFs to slide. For that matter, when a much-anticipated pullback in U.S. stocks does strike, it might be a little more volatile than we all had been bargaining for.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

'Too Big To Fail' Countries And The ETFs That Represent Them

Published 03/22/2013, 03:05 AM

'Too Big To Fail' Countries And The ETFs That Represent Them

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.