Permanently bullish commentators have dismissed the monstrous sell-off on the final day in May as a profit taking exercise. They maintain that rising bond yields as well as momentum in non-defensive stock segments confirm underlying strength in the U.S. economy. Unfortunately, those who ignore the true nature of the interconnected global economy — one that is under an increasing amount of stress — may find themselves falling victim to a summertime portfolio slaughter.

Consider what actually transpired in May. Officials speaking on behalf of the U.S. Federal Reserve intentionally (or carelessly) suggested that they might begin tapering their $85 million-per-month bond purchasing program. Intermediate-term and longer-term bond yields catapulted, damaging all yield-sensitive assets along the risk spectrum; dividend-payers, the telecom sector and real estate investment trusts were particularly hard-hit.

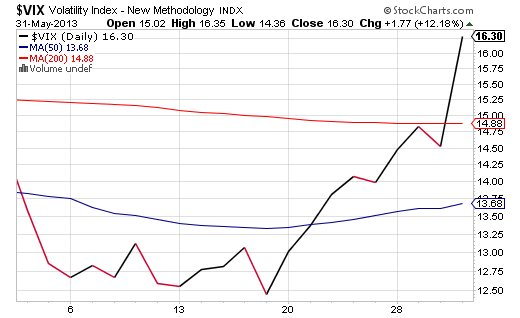

Eventually, the S&P 500 SPDR Trust (SPY) relinquished 3.5% from an intra-day record. Meanwhile, heavier-than-average selling volume contributed to a 30% spike in the CBOE S&P 500 VIX Volatility.

A spike in volatility does not mean the end of a rally. For that matter, rising interest rates are not necessarily a bad omen for stock assets. However, previous domestic economies in U.S. history were self-sustaining (or closer to it) and thereby more capable of absorbing mild changes in monetary policy. The problem here is that in today’s global economy, where gross domestic product (GDP) is sinking, the world desperately needs the U.S. to stay afloat.

How can the U.S. stay afloat in the near-term? Real estate has to remain hot. And the only way real estate continues contributing to the wealth effect is if the Fed manipulates mortgage rates through its bond-buying endeavors. In the era of quantitative emergency easing (QE), a move towards tapering would be difficult for global stock investors to swallow. Nor would U.S. equities escape unscathed.

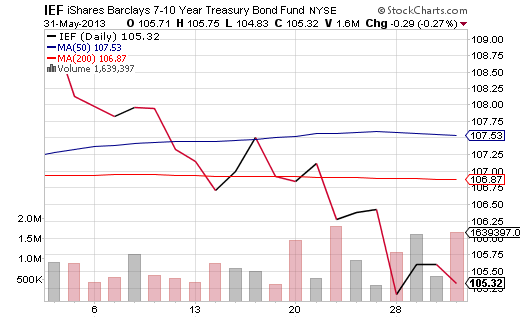

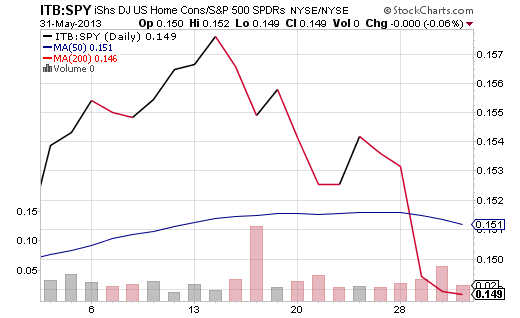

Keep in mind, iShares 7-10 Year Treasury (IEF) experienced a near free-fall; 30-year fixed mortgages jumped from 3.5% to 4% practically overnight. In addition, refinancing has already slowed considerably, while iShares DJ Home Construction (ITB) is weakening relative to the S&P 500 SPDR Trust (SPY).

A reader may feel that I am presenting an ultra-bearish case for owning stock ETFs. On the contrary. I believe that the same yield-sensitive stock ETFs that have been beaten to a pulp over the last few weeks will be terrific to own… once Bernanke’s Fed unequivocally reaffirms its QE commitment. Until that time, stocks will waffle or correct.

Whether the 10-year yield retreats on global economic weakness or greater clarity from the Fed, price gains in Bond ETFs will favor toe-in-the-water buying of WisdomTree Equity Income (DHS), Cambria Shareholder Yield (SYLD) as well as Vanguard High Dividend Yield (VYM).

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

'Sell On May 31' Provides Lesson To ETF Investors

Published 06/02/2013, 02:22 AM

Updated 03/09/2019, 08:30 AM

'Sell On May 31' Provides Lesson To ETF Investors

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.