Focus Of The Day

"Weak US data, a bounce in oil prices and a pick-up in European growth: None of it came as a huge surprise, but it all weighed on positioning and the fallout has been seen in higher Bund yields, a stronger euro, a weaker U.S. dollar and a bounce in the commodity-currency bloc.

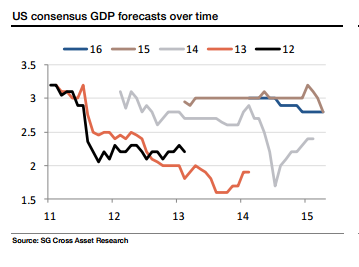

The US economy has consistently failed to reach the growth rates that forecasters have been looking for, but there is enough momentum in both employment and real income to suggest yet another year of soggy growth is more likely than a downturn. But even 2½% GDP growth would point to further policy divergence, supporting the dollar.

Short EUR/USD is no longer the best way to trade the upside in the dollar, but long USD/JPY will pay dividends again in due course and tactically, these are attractive levels to short GBP/USD a week before the UK election.

Now we are back to waiting to see if the US economic slowdown will reverse in the coming months. While we do that, we want to be short AUD and NZD vs USD, and short EUR, CHF and GBP against NOK and SEK."