Today I want to discuss reports that global debt levels are at all-time highs, and what this means for your investment decisions going forward.

But first, a few comments about last week. I recently returned from the Oxford Club’s Private Wealth Seminar. While there, I had the privilege of catching up with some old friends and contacts, including Alex Green, the Oxford Club’s chief investment strategist. You might have read some of his wonderful work for Investment U, the group’s educational arm.

Alex reminded me that the difference between Democrats and Republicans, in his view, is that Democrats are for personal freedom and some economic restrictions, while Republicans are for economic freedom and some personal restrictions.

I prefer to focus on policies instead of partisan politics, but Alex has a point. I’m convinced that Donald Trump, a Republican, won the presidential election because his pledge to reform the tax code and deregulate resonated with both white-collar and blue-collar Americans who felt as if the U.S. economy was no longer working for them. U.S. corporate taxes are among the highest in the Organization for Economic Cooperation and Development (OECD), spurring large multinationals to move operations overseas, and out-of-control regulations threaten to strangle business growth.

But just as Green insinuated, the Trump administration has enacted, or has hinted at enacting, policies that rankle Americans of all political stripes, precisely because they could be used to encroach upon personal liberties.

Take Attorney General Jeff Sessions’ recent decision to strengthen the government’s ability to seize private property from suspected criminals. (The operative word here is “suspected.”) Many now are arguing this directive could be abused by police and other officials. It could, in fact, violate the Fourth Amendment, which of course protects Americans against “unreasonable searches and seizures.”

This is just one among numerous policy-making decisions that have members of both political parties, as well as independents, scratching their heads. Trump was elected to reform taxes, slash regulations and generally make business and capital formation run more smoothly. It’s unclear how private-asset seizures fit into that picture.

If this administration resolved to stay on message and on course, and worked to bring fiscal relief to everyday Americans, it might receive greater support from those who voted for Trump—and perhaps even from those who didn’t.

U.S. Dollar in Bear Market, a Boon for Gold

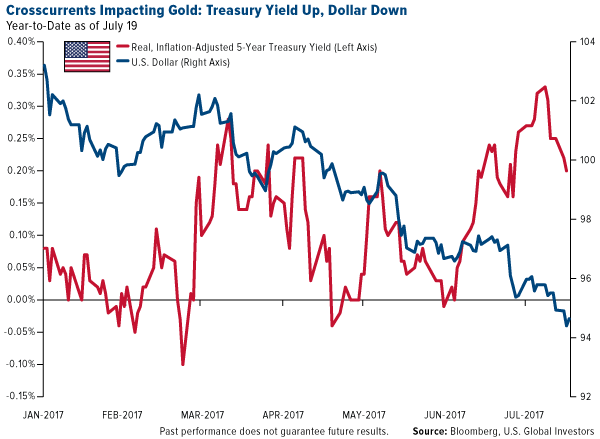

Since the start of the year, the 5-year Treasury yield, adjusted for inflation, has risen about 150 percent. Normally this would put remarkable pressure on the price of gold—higher yields raise the opportunity cost of buying gold—but over the same period, the US dollar has steadily weakened and is now officially in a bear market.

Because gold is priced in dollars, this has been supportive for prices. Year-to-date, the yellow metal is up more than 8 percent.

As I said, the greenback’s been on the decline for most of the year so far, but it slumped to a 13-month low against the euro last week following European Central Bank (ECB) president Mario Draghi’s remark that “monetary accommodation” would continue in the European Union (EU) until at least the end of the year.

“We need to be persistent and patient and prudent, because we’re not there yet,” Draghi said, referring to the fact that EU inflation and wage growth have been disappointingly slow, despite the bloc’s economic recovery since the financial crisis. (Indeed, the June purchasing manager’s indexes for emerging European markets were all above the key 50 mark for the first time in recent memory.)

UBS: We’re Still Constructive on Gold

That gold is still holding at its current level—despite rising rates, despite a stock market that continues to rally—is “encouraging.”

That’s one of the key takeaways from a UBS note last week, in which the Swiss financial services firm maintains its constructive view of the yellow metal. Investor demand this year has been slower than expected, but UBS analyst Joni Teves makes the case that expectations of a good monsoon season in India this summer could help push consumption in the world’s second-largest importer of gold to a new record high by the end of the year. With India having imported a phenomenal 525 metric tons in the first half of 2017 alone, Teves writes that “we expect gold demand in India this year to be around historic averages,” which would be very supportive for prices.

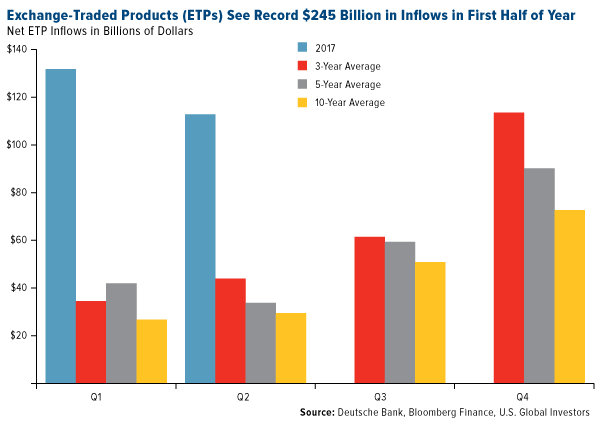

ETPs Attracted a Record $245 Billion in the First Half of 2017

Like gold in India, exchange-traded products (ETPs) also had a knockout first half. As Deutsche Bank) reports, ETPs attracted a record $245 billion in the first six months of 2017, in what has historically been the weaker half of the year. To put into perspective just how impressive this figure is, $245 billion would be the second-largest full-year record amount following 2016’s $283 billion. We could see ETP inflows climb as high as $500 billion by the end of this year, Deutsche estimates.

Of course, runaway demand for ETPs and other risk assets has contributed to muted interest in gold.

Having said that, though, BullionVault—the world’s number one online precious metals market—reported recently that private gold holdings among its users leaped to a record 38 metric tons, as of the beginning of July. That’s enough gold to make more than 10 million 18-carat wedding rings, BullionVault says, or to supply the microchips for 1.5 billion iPhones. The site points out that investor demand has lately been driven by lower prices, following three months of “light liquidation.”

Global Debt on Alert

All of what I’ve said so far pertains to the near-term. Gold’s medium- to long-term investment case, I believe, looks even brighter. Many unsettling risks loom on the horizon—not least of which is a record amount of global debt—that could potentially spell trouble for the investor who hasn’t adequately prepared with some allocation in a “safe haven.”

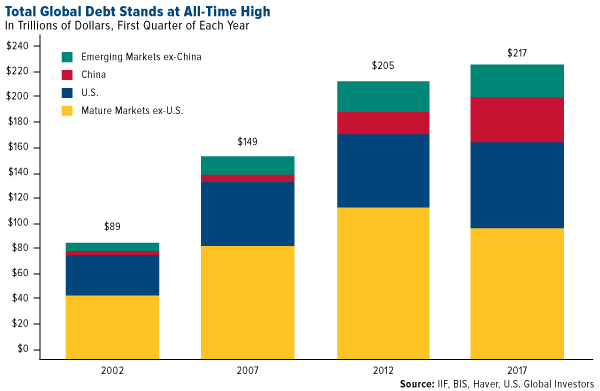

According to the highly-respected Institute of International Finance (IIF), global debt levels reached an astronomical $217 trillion in the first quarter of 2017—that’s 327 percent of world gross domestic product (GDP). Notice that before the financial crisis, global debt was “only” around $150 trillion, meaning we’ve added close to $120 trillion in as little as a decade. Much of the leveraging occurred in emerging markets, specifically China, which is spending big on international infrastructure projects.

It goes without saying that this is a huge risk. Some are calling this mountain of debt “the mother of all bubbles,” and we all remember how the last two bubbles ended, in 2000 (the tech or dotcom bubble) and 2007 (the housing bubble).

Paying down this debt will not be easy. As Scotiabank mentioned in a note last week:

“Higher interest rates are going to make the burden of refinancing the debt considerably heavier, and as more money goes into servicing the debt, it means less money is available to spend on other things, which could lead to less infrastructure spending and increased austerity.”

Add to this the fact that global pension levels are also sharply on the rise, with people living longer and population growth—and therefore workforce growth—slowing in many advanced economies. In May, the World Economic Forum (WEF) estimated that by 2050, the size of the retirement savings gap—unfunded pensions, in other words—could be as much as $400 trillion, an unimaginably large number.

The U.S. alone adds about $3 trillion every year to the pension deficit. I shared with you earlier in the month that the State of Illinois’s unfunded pensions could be as high as $250 billion, putting each Illinoisan on the hook for $56,000.

Central banks’ efforts to promote economic growth through monetary easing haven’t exactly been a raging success, nor can they continue forever. Plus, near-zero interest rates are precisely what encouraged such inflated levels of borrowing in the first place.

You can probably tell where I’m headed with all of this. Another crisis could be in the works. Savvy investors and savers might very well see this as a sign to allocate a part of their portfolios in “safe haven” assets that have historically held their value in times of economic contraction.

Gold is one such asset that’s been a good store of value in such times, and gold stocks have tended to outperform the yellow metal as production costs have fallen, according to Seabridge Gold. I always recommend a 10 percent weighting in gold—5 percent in bars and coins; 5 percent in gold stocks, mutual funds or ETFs.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.