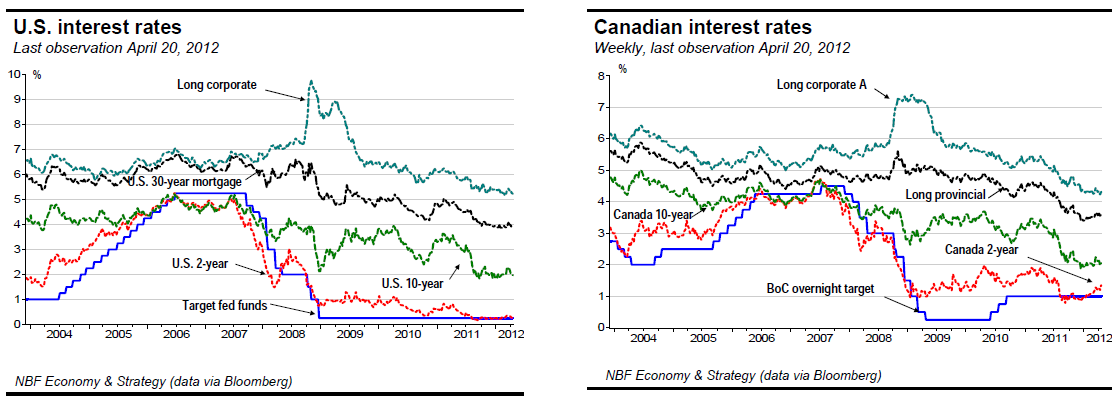

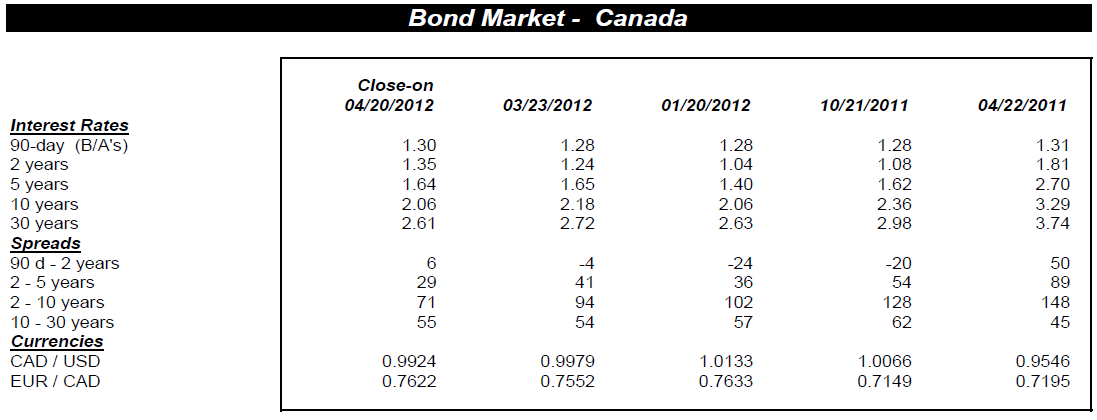

Although the Bank of Canada left its key policy rate unchanged at 1% at its April rate-setting date, it did change its message significantly. Its press release said “some modest withdrawal” of existing stimulus “may” become appropriate. The wording suggests that a rate hike, though not imminent, is not as far down the road as markets were anticipating. The front end of the Canadian yield curve swerved up immediately in reaction to the statement, while the yield of 2-year U.S.

Notes held steady. The new wording also had a significant impact in the foreign exchange market, sending the loonie up one cent in the minutes following the BoC press release.

With the risk of disorderly sovereign debt defaults perceived as less acute than it was a few months ago, and with the longer-term refinancing operations of the European Central Bank having swept away an apprehended bank liquidity squeeze that could have derailed the economic outlook, the Bank of Canada now expects that increased consumer and business confidence will translate into stronger global growth.

The Bank now thinks the eurozone recession will be shallower (−0.6% versus −1.0%) and shorter than in its January view, though it expects only a modest recovery beginning in the second half of 2012. In addition, its April Monetary Policy Report acknowledges that the U.S. economy has been "slightly stronger" than expected over the year to date and projects that this strength will last into 2013.

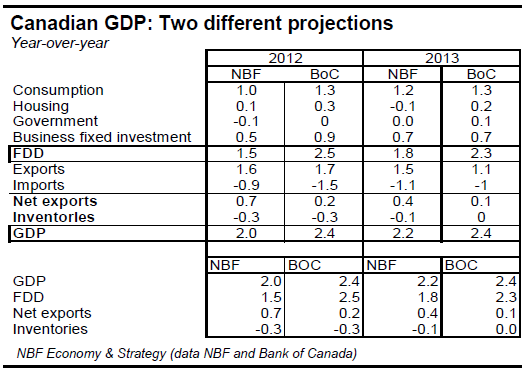

The Bank also revised its Canadian GDP forecast for 2012 up four ticks to 2.4%. However, growth in 2013 will not be as robust as previously projected, 2.4% compared to 2.8% in January. Given this revised outlook, the Bank now projects that the output gap will close in the first half of 2013 (instead of the third quarter of 2013 as in the January MPR) and that both headline and core CPI will hover near 2% "over the balance of the projection horizon." If things unfold over the coming quarters as the Bank of Canada anticipates, the possibility of a rate hike this year cannot be dismissed.

As the table above shows, our own domestic outlook is somewhat less upbeat. We see GDP growth of 2.0% this year, four ticks lower than the Bank. In our view, the current record home-ownership rate, high debt ratios and moderate job creation are ingredients for a cocktail that will limit consumer spending and housing starts in the coming quarters.

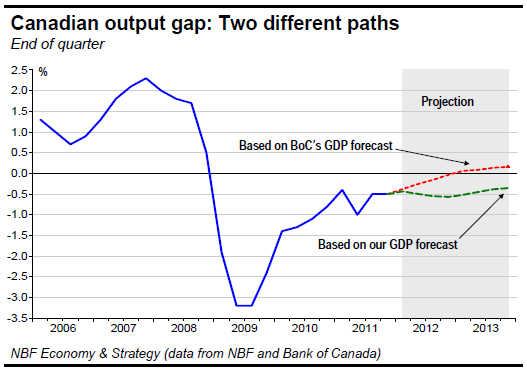

When we draw the paths of the output gap implied respectively by the Bank of Canada GDP forecast and by our own, using as a starting point the BoC's current gap estimate, we find, not surprisingly, that the differences are significant.

As can be seen, the timing of closure of the output gap is highly sensitive to even a moderate downward revision of the economic outlook.

With downside risks to the projection still significant, the bank was well-advised to show caution in its statement that some modest withdrawal of existing stimulus may become appropriate. Yet despite this caution, the loonie reacted sharply.

It is worth noting that under current conditions, even modest rate hikes by the BoC would push the yield of Canadian 2-year bonds, which are AAA-rated, to a level quite attractive relative to the current 1.96% of AA-rated 10-year Treasurys. The Bank would certainly like to refrain from turbocharging the Canadian dollar. But how much longer can it wait before sending a price signal to households that they ought to scale down their appetite for borrowing? The answer depends largely on one’s expectations for the international economy and its impact on business and consumer confidence.

Europe, one of the potential downside risks mentioned by the BoC, remains quite significant in our eyes. Many European banks are planning to shrink their balance sheets. In January they significantly tightened their lending standards, creating headwinds for consumer spending and business activities. Further, as the International Monetary Fund recently noted: “a synchronized, large-scale, and aggressive shedding of bank assets could have severe consequences for the real economy in the euro area and beyond.”

Moreover, fears about Spain’s banking system have resurfaced at a time when the health of its public finances is also questionable. As Mathieu Arseneau notes in our Monthly Economic Monitor, Spain’s debtto- GDP ratio is far from under control. Given the current yield to maturity of its 10-year sovereign bonds, the country would need to run a primary surplus of close to 10% of GDP to stabilize its debt-to-GDP ratio. Yet the IMF projects that Spain will instead run a primary deficit equal to 3.6% of GDP in the coming year.

We do not want to downplay the heft of the firewall that has been put in place, including the recent commitment of the G20 countries to boost the resources available to the IMF by more than $430 billion. But in our opinion, the consensus view of eurozone economic growth is too optimistic. With CDSs on Spain and Italy putting the odds of default by either country over the next five years at more than 30%, we think investors and policymakers need to remain on the watch.

The BoC likes to note that monetary policy action takes time to work its way through the economy – typically six to eight quarters. This suggests that if the Bank’s actions were driven only by its forecast, some of Mr. Carney’s advisers would be arguing that at least a modest move should be made sooner rather than later. But inflation expectations, the main driver of realized inflation, remain well-anchored in Canada, and recent experience suggests that expectations do indeed trump the gap.

If inflation were the only concern, the Bank would probably not be in a hurry to raise rates. It is the need to send a warning signal to consumers lured into indebtedness by its current low-interest-rate policy that argues for some action by the Bank.

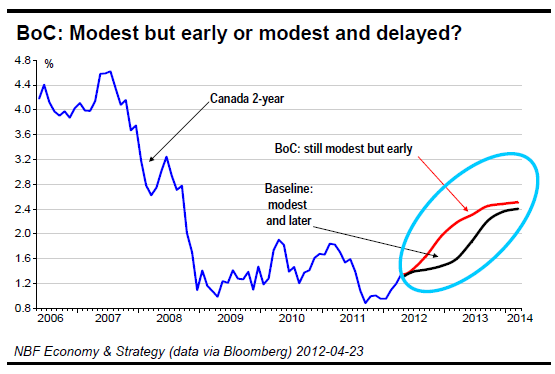

Bottom line: The Bank of Canada will have a tough balancing act to perform in coming months. How to use monetary policy to slow Canadian household borrowing without sending the loonie off like a rocket and crushing manufacturing exports? A Fed on the sidelines, more or less, guarantees that any early adjustments by the BoC will be indeed modest.

Adding to the complexity of monetary policy management are high housing prices that could prove sensitive to even a modest adjustment in the overnight rate. If concerns about Europe intensify, the Bank may wait till 2013 to start walking the tightrope. Otherwise a few steps could be taken later in 2012.

These two scenarios obviously imply quite different paths for the yield of 2-year Canadas. Our baseline scenario remains one of modest but delayed rate adjustments.

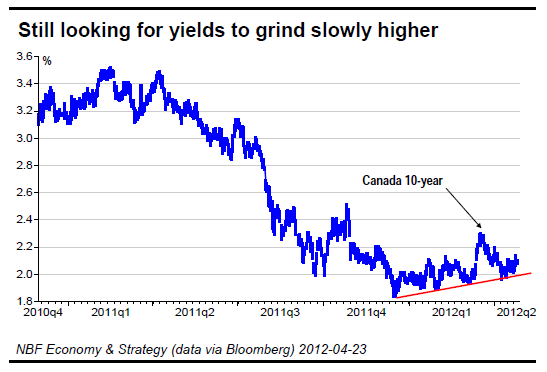

We accordingly expect the 2-year yield to end the year roughly unchanged from the current 1.43%. For 10-year Canadas, our year-end forecast of 2.59% is unchanged from last month.

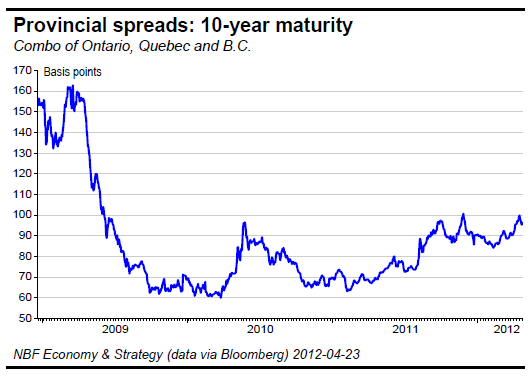

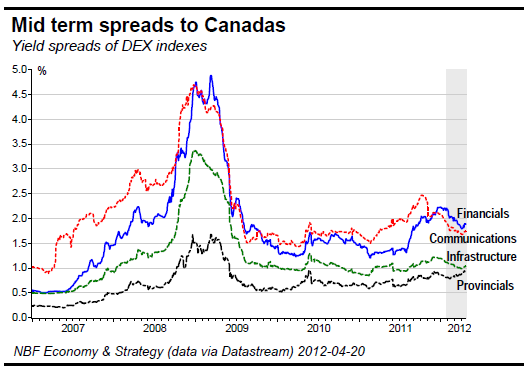

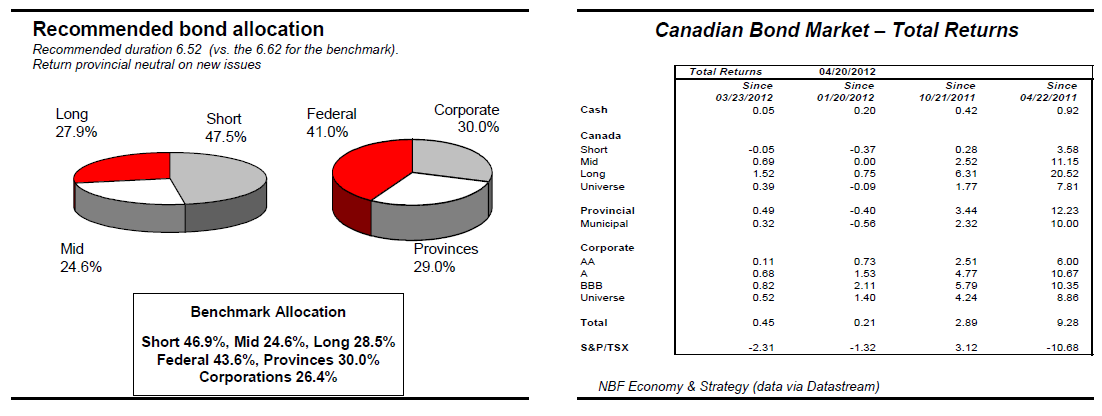

To calculate the spread of provincials to Canadas, we use a combination of B.C., Ontario and Quebec bonds maturing in 2021. As the following chart illustrates, provincial spreads did narrow 4 basis points recently after testing 100 basis points.

Ontario credit rating was downgraded by Moody’s to Aa2, with a stable outlook, and Standard & Poor’s sees at least a one-in-three likelihood that they could lower by one notch the Province credit rating within two years. Obviously at this stage, the success of Ontario’s path to sustainable lower deficits and stable credit rating remains largely dependent upon its success in public sector wage negotiations.

However, there is room to manoeuvre on the revenue side (sales taxes). In this context and taking into account the rating agencies warning, spreads on short- to mid-term Ontarios would look reasonable to us if they were closer to levels seen few weeks ago.

If new issues were brought to market in coming weeks with some concessions, we would take the opportunity to cover our underweight in provincial bonds and scale down our overweight in corporate bonds by the same amount.

As for duration, last month we suggested shortening if 10-year Canadas sank to 2%. Since they did, briefly, during the week of April 10, our portfolio duration is now 0.10 years shorter than benchmark duration. We would cut duration another 0.15 years if 10-year yields were to dip to 1.95%. A rapid move above 2.48% would prompt us to lengthen duration slightly.

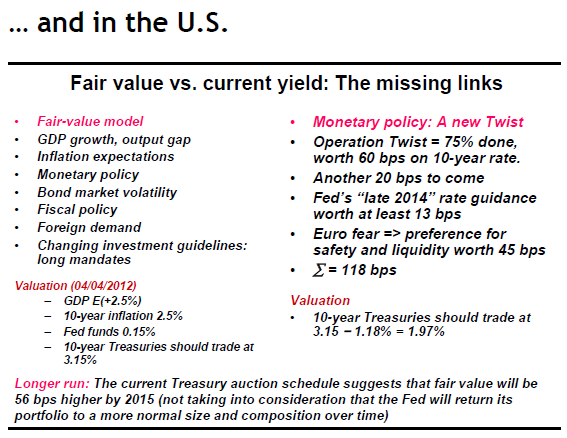

From 2005 until recently, we gauged the fair value of 10-year Treasurys by a model that emphasized international flows of funds as well as traditional variables such as inflation expectations, GDP and the target fed funds rate.

In the current environment, where monetary policy is no longer defined by a single variable such as the target fed funds rate, that model has become incomplete. We have been left making adjustments that, to a greater extent than we liked, were judgment calls. Drawing on the work of Jack Meaning and Feng Zhu on the impact of the Federal Reserve asset purchase programs (BIS Quarterly Review, March 2012), we have added a few explanatory variables to our model.

Nonetheless, in periods when safe-haven flows can be volatile, we will still have to make some judgment calls. For example, with Spain’s fiscal position back in the headlines and uncertainty about the European fiscal compact rekindled by the French presidential election and political developments in the Netherlands, we assume that a preference for safe and liquid assets is shaving 45 basis points from the yield at which 10-year Treasurys would otherwise trade.

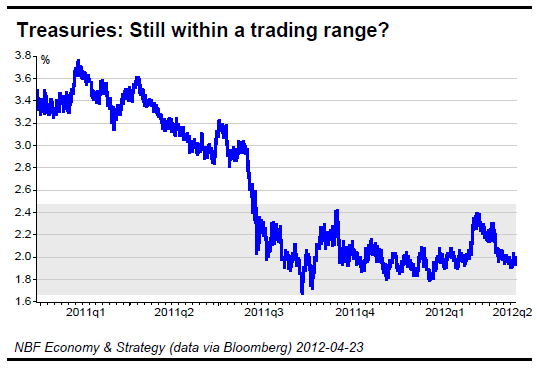

Operation Twist is still under way. Our extended model suggests that its effect so far has been to reduce the fair-value 10-year yield by 60 basis points, while the Fed guidance that its policy rate is likely to stay low at least through late 2014 is worth 13 basis points in our view. So if 10-year Treasurys would be trading in more normal times at about 3.15%, given the current inflation environment and zero-interest-rate policy, the factors noted above suggest that a yield marginally below 2% should not come as a surprise (Σ factors = −118 bps, + 3.15% = 1.97%).

By the time Operation Twist winds up, the Fed program of portfolio maturity extension is likely to have added another 20 basis points of headwind against a rise in the 10-year yield. So in an environment where safe haven flows had eased, 10-year Treasurys could still trade around 2.25% by the end of June – assuming that U.S. domestic data comes out in line with the current expectation of moderate but sustained expansion.

However, given our below consensus view of eurozone economic growth, we expect that the current riskon risk-off environment will be with us for some time. Accordingly, it appears that the range in which 10-year Treasurys have traded since August will last longer.

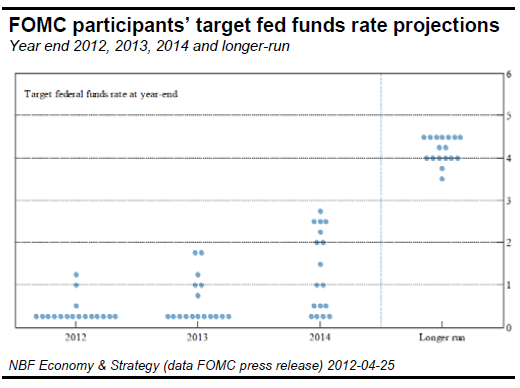

As expected, the Fed left interest rates unchanged near zero in April and reiterated that exceptionally low levels for the fed funds rate can be expected through late 2014. No new initiatives were announced, which wasn't really a surprise since the economy continues to improve. The Fed sees growth remaining moderate over the coming quarters and then gradually picking up. Yet its updated central-tendency projection of GDP growth (Q4/Q4) showed slight downgrades for 2013 and 2014.

The estimates are 2.4–2.9% in 2012 (previously 2.2–2.7%), 2.7–3.1% in 2013 (previously 2.8–3.2%) and 3.1–3.6% in 2014 (previously 3.3– 4.0%). The projection of the unemployment rate was revised down: 7.8–8.0% in 2012 (previously 8.2–8.5%), 7.3–7.7% in 2013 (previously 7.4–8.1%) and 6.7–7.4% in 2014 (previously 6.7–7.6%).

There were upward revisions to the inflation projections (both PCE and core), though they remain close to the Fed's 2% target. The FOMC also presented its participants’ views of the future pace of policy firming. Seven members (versus five in January) now see rates between 2% and 2.75% by the end of 2014. Four still expect no policy firming before 2015. No longer do any participants expect no policy firming before 2016. In January, two members were in that camp.

All in all, given our own forecast and the distribution of participant views, we remain comfortable with our call of a first rate hike in June 2014. Obviously, if the central-tendency forecasts do not materialize or bond yields become incompatible with Fed objectives, the FOMC will be ready to use its balance sheet as appropriate to promote a stronger economic recovery.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

“Modest” And “May”: Enough To Send The Loonie Up One Cent

Published 05/01/2012, 09:51 AM

Updated 05/14/2017, 06:45 AM

“Modest” And “May”: Enough To Send The Loonie Up One Cent

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.