On Thursday, the AUD/USD pair was stepping down from its local highs. A decline in the pair resumed amid the publication of not so favorable labour market report for January in Australia.

Thus, Unemployment Rate unexpectedly grew to 6.0% from 5.8%; Employment Change was down by 7.9K while analysts expected a 15K increase.

Macroeconomic data for the US, on the contrary, exceeded the forecasts that led to a growth in the demand for the US currency. Initial Jobless Claims were down to 262K from 269K against the forecast of a rise to 275K.

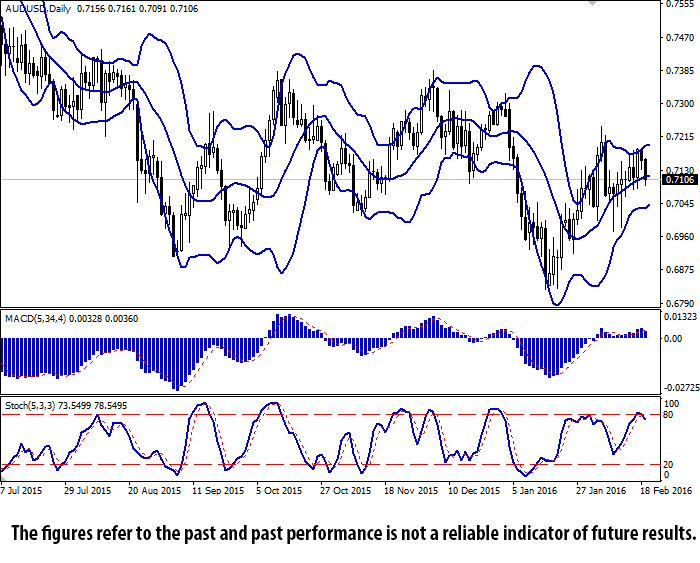

Bollinger Bands indicator on the daily chart is turning horizontally while the price range is narrowing down. MACD is declining and keeping a sell signal. Stochastic has rebounded down from the border of the overbought zone.

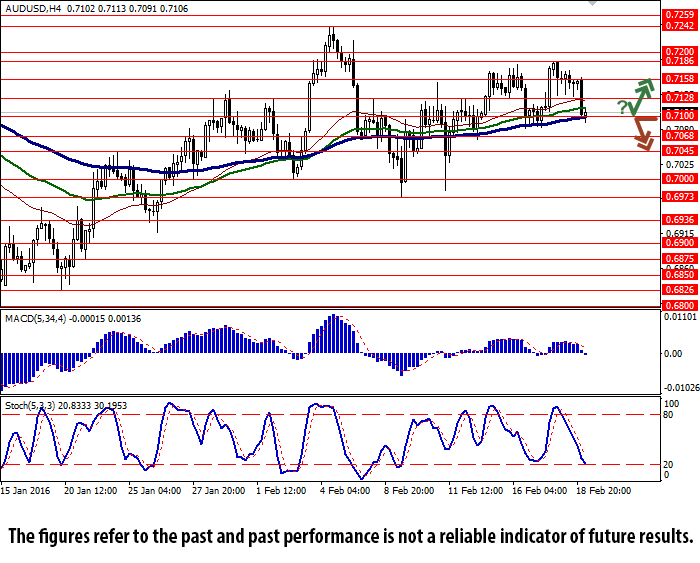

According to the indicators, short positions are preferable.

Support levels: 0.7100, 0.7068, 0.7045, 0.7000 (psychological level), 0.6973 (9 February low), 0.6936, 0.6900.

Resistance levels: 0.7128, 0.7158, 0.7186 (17 February high), 0.7200, 0.7242 (4 February high), 0.7259.