The past week saw St. George, Utah-based SkyWest, Inc. (NASDAQ:SKYW) report impressive numbers for the second quarter of 2016, comfortably beating earnings and revenue estimates. Allegiant Travel Company (NASDAQ:ALGT) also trumped both the estimates but the revenue beat was quite marginal. Meanwhile, low-cost carrier Spirit Airlines (NASDAQ:SAVE) revealed mixed results, beating on earnings but missing revenues.

On the non-earnings front, Delta Air Lines (NYSE:DAL) and Alaska Air Group (NYSE:ALK) reported traffic data for the month of July. Delta’s reported a 7% decline in consolidated passenger revenue per available seat mile (PRASM: a key measure of unit revenue) in July, which has hurt the stock significantly.

Moreover, the travel warning issued by the Centers for Disease Control and Prevention (CDC) pertaining to the mosquito-borne Zika virus led to a widespread decline in airline stocks.

(Read the last Airline Stock Roundup for Jul 27, 2016).

Recap of the Past Week’s Most Important Stories

1. Spirit Airlines beat on earnings, aided by low fuel costs. The carrier’s second-quarter 2016 earnings (on an adjusted basis) came in at $1.11 per share, beating the Zacks Consensus Estimate of $1.07. Earnings also improved 7.8% on a year-over-year basis. Spirit Airlines reported operating revenues of $584.1 million, missing the Zacks Consensus Estimate of $586 million. An increase in non-ticket revenues led to a 5.5% year-over-year increase in the top line. In the reported quarter, operating revenue per available seat mile fell 14.3% year over year while load factor (% of seats filled by passengers) increased to 86.4% from 86% in the year-ago quarter. The rise in load factor was driven by a 23.8% growth in traffic which outpaced capacity expansion of 23.1%. Average economic fuel price per gallon declined 29.3% to $1.47.

2. SkyWest’s second-quarter earnings of 77 cents per share were well ahead of the Zacks Consensus Estimate of 68 cents. Earnings also improved approximately 26.2% from the year-ago figure. Quarterly revenues of $801 million comfortably beat the Zacks Consensus Estimate of $765 million and expanded 1.65% on a year-over-year basis. Results were aided by lower operating costs due to fewer aircraft in service apart from maintenance cost savings.

3. Allegiant Travel Company’s second-quarter 2016 earnings per share of $3.68 beat the Zacks Consensus Estimate by 14 cents. Quarterly revenues increased 7.1% year over year to $345 million, edging past the Zacks Consensus Estimate of $344 million. Air traffic rose 15.5% year over year on an 18.2% rise in capacity, while load factor stood at 83.9% compared with 85.7% recorded in the year-ago quarter. Fuel expense declined 34% to $1.36 per gallon in the reported quarter.

For the third quarter of 2016, the company expects cost per available seat mile (CASM), excluding fuel, to grow in the range of 4% to 6% primarily driven by the implementation of the new pilot agreement. The five-year deal has taken effect from Aug 1, 2016. Total revenue per available seat mile (TRASM) in the third quarter is likely to decline in the band of 10.5% to 8.5%. In a separate development, the company inked a deal to buy 12 new Airbus A320ceo Aircraft, in line with its objective to maintain an all-Airbus fleet by 2019.

4. Alaska Air Group, the parent company of Alaska Airlines, posted a significant rise in air traffic for Jul 2016. Revenue passenger miles (RPMs) – a measure of air traffic – improved 7.8% on a 9.6% capacity expansion. Load factor decreased to 86.7% from 88.1% in Jul 2015 as capacity expansion outpaced the increase in traffic.

5. Delta revealed a 1.2% increase in RPMs for the month of July while capacity improved 2.1%. Load factor decreased to 87.1% from 87.9% in Jul 2015 as capacity expansion outweighed the increase in traffic. However, Delta witnessed a 7% drop in PRASM in the month, due to foreign exchange woes apart from the ongoing supply-demand imbalance in the Transatlantic and softness pertaining to domestic yield.

6. Airline stocks are faced with multiple headwinds at present. The latest blow came from the Zika outbreak in Miami which has led to fears of declining travel demand to Florida. The breakout has prompted the CDC to issue an advisory for pregnant women to avoid the Zika-affected Miami neighborhood. Naturally, airline stocks are feeling the pinch as reduced travel is likely to weigh on their top lines.

Performance

The following table shows the price movement of the major airline players over the past week and during the last 6 months.

Company | Past Week | Last 6 months |

HA | -3.43% | 32.28% |

UAL | -5.32% | -6.66% |

GOL | -5.19% | 195.00% |

DAL | -5.28% | -16.92% |

JBLU | -8.58% | -18.38% |

AAL | -7.19% | -10.66% |

SAVE | -10.03% | -9.33% |

LUV | -5.33% | -3.53% |

VA | -0.76% | 82.43% |

ALK | -3.08% | -3.54% |

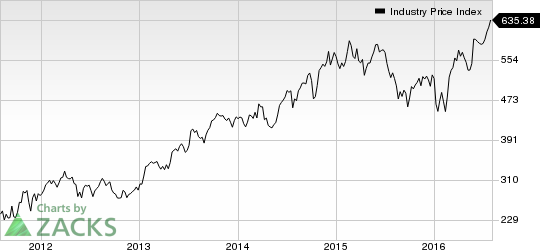

The table above shows that all airline stocks traded in the red over the past week, leading to the NYSE ARCA Airline index declining 5.27% to $84.60 mainly due to the bearish PRASM performance in July at Delta apart from Zika fears. Shares of Spirit Airlines depreciated the most (10.03%).

Over the course of six months, the NYSE ARCA Airline index appreciated 9% on the back of huge gains at GOL Linhas and Virgin America (NASDAQ:VA) .

What's Next in the Airline Space?

We expect airline heavyweights Southwest Airlines (NYSE:LUV) and United Continental Holdings to report their July traffic numbers in the coming days. Focus will also remain on earnings reports from the likes of Virgin America. Meanwhile, Southwest Airlines’ ongoing dispute with some of its labor groups (pilots and flight attendants), demanding the removal of the carrier’s top executives, is likely to be in the news.

SOUTHWEST AIR (LUV): Free Stock Analysis Report

DELTA AIR LINES (DAL): Free Stock Analysis Report

SKYWEST INC (SKYW): Free Stock Analysis Report

ALLEGIANT TRAVL (ALGT): Free Stock Analysis Report

ALASKA AIR GRP (ALK): Free Stock Analysis Report

SPIRIT AIRLINES (SAVE): Free Stock Analysis Report

VIRGIN AMERICA (VA): Free Stock Analysis Report

Original post

Zacks Investment Research