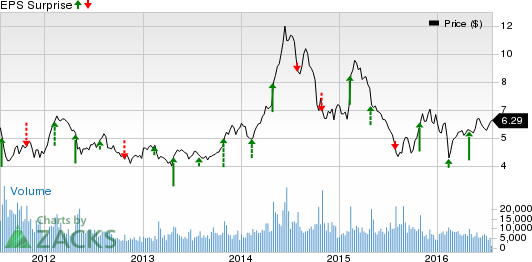

Amkor Technology, Inc. (NASDAQ:AMKR) is expected to report second-quarter 2016 results on Jul 25. Last quarter, the company posted a positive earnings surprise of 100%.

Let us see how things are shaping up for this announcement.

Factors to Consider

Amkor’s first-quarter results were in line with management expectations driven by positive cash flows resulting from reduction in capital and operational budgets.

During 2015, Amkor made noticeable progress in some of its key areas. The company’s System-in-Package (SiP) business grew significantly fetching revenues of $725 million. Automotive sales were up 10%. Furthermore, Greater China revenues grew 20%.

In December last year, Amkor completed the acquisition of J-Devices Corporation to strengthen its foothold in the automotive market. The acquisition made Amkor the world’s largest OSAT provider for automotive ICs. Management said that the acquisition would add $800 million to the company’s revenue this year.

While end market demand is expected to remain stable with particular strength in China where the company is picking up market share, earthquakes in Japan have disrupted operations at Amkor’s Kumamoto factory. Repair work was expected to take 11 weeks, so results will also be affected this quarter.

The company expects second-quarter revenues in the range of $875 million. Operating expenses are expected to remain at around $100 million. Interest expenses are expected to be around $22 million a quarter for the rest of the year.

The Japan earthquake will have a $35 million impact on revenue, $20 million in additional cost related to repairs and damaged inventory and an 11 cent impact on second-quarter EPS. But management also expects insurance proceeds of $25 million in the second half when it will be set off.

Earnings Whispers

Our proven model does not conclusively show that Amkor will beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Both the Most Accurate estimate and the Zacks Consensus Estimate stand at - 8 cents. Hence, the difference is 0.00%.

Zacks Rank: Amkor carries a Zacks Rank #2, which increases the predictive power of ESP. But the company’s 0.00% ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies which you may consider, as our model shows that they have the right combination of elements to post an earnings beat this quarter:

Open Text Corp. (NASDAQ:OTEX) , with an Earnings ESP of +1.10% and a Zacks Rank #1. The company is slated to release its earnings on Jul 27, 2016.

Charter Communications, Inc. (NASDAQ:CHTR) , with an Earnings ESP of +404.76% and a Zacks Rank #2. The company is slated to report second-quarter 2016 earnings results on Aug 9, 2016.

Black Knight Financial Services, Inc. (NYSE:BKFS) , with an Earnings ESP of +3.45% and a Zacks Rank #2. The company is set to report second-quarter 2016 earnings results on Oct 25, 2016.

OPEN TEXT CORP (OTEX): Free Stock Analysis Report

AMKOR TECH INC (AMKR): Free Stock Analysis Report

CHARTER COMM-A (CHTR): Free Stock Analysis Report

BLACK KNGHT FIN (BKFS): Free Stock Analysis Report

Original post

Zacks Investment Research