EUR/USD

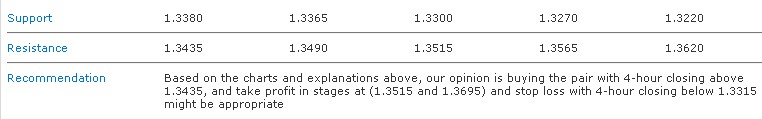

As we mentioned in our previous report, we indicated that we need for 4-hour closing above 1.3435 in order to confirm our positive outlook; however, the pair didn’t provide this closing. But, as long as the pair is stable above 78.6% as shown above, we will wait for the mentioned closing above 1.3435 which if seen could trigger an upside move today. Our bullish expectations depend on the falling wedge pattern, which is a bullish pattern shown above on the chart.

The trading range for today is among the major support at 1.3080 and the major resistance at 1.3620.

The short-term trend is to the upside with steady daily closing above 1.2795 targeting 1.5135

GBP/USD

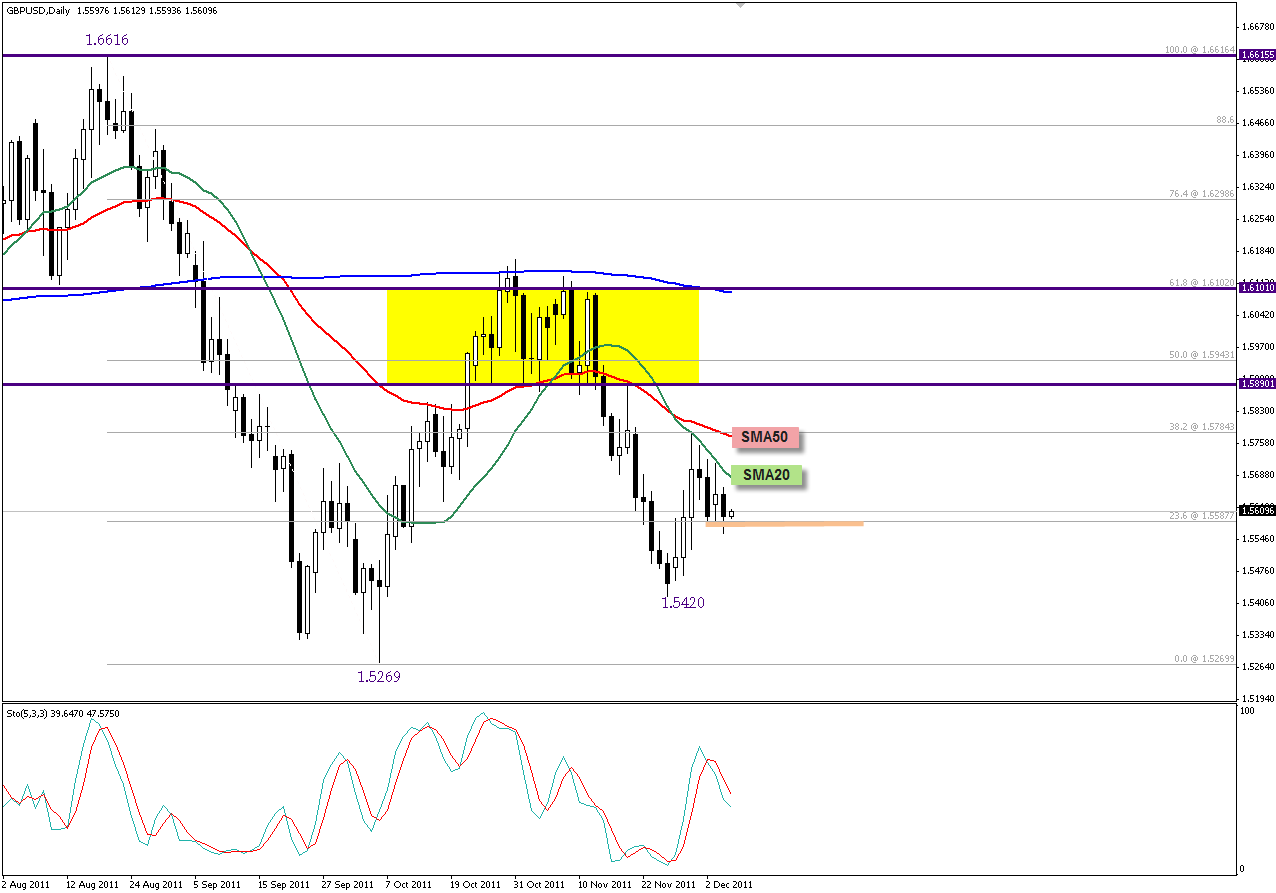

The struggle continued around the pivotal support zones of 1.5590 where 23.6% Fibonacci retracement of the entire downside rally from 1.6615 to 1.5270 exists. Trading is still well capped below SMA 20 as seen on the provided daily graph, while Stochastic didn't change its bearish direction. Thus, the bearishness remains favored over intraday basis; noting that a new technical attempt to take 1.5590 may succeed this time. On the upside, areas around 1.5780 should remain intact in order to protect our bearish anticipations.

The trading range for today is among key support at 1.5375 and key resistance at 1.5820.

The general trend over short term basis is to the downside, targeting 1.4225 as far as areas of 1.6875 areas remain intact.

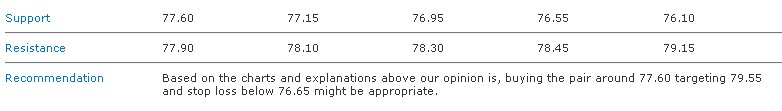

USD/JPY

The pair was taken towards our yesterday's detected support of 77.60 assisting Stochastic to overlap positively as seen on the provided four-hour graph. All what we need now is to witness a sustained breakout above the initial resistance of 77.80 to make sure that the correction from 78.30 has been completed and the pair is on its way to resume the bullishness started at 76.55 which represents our risk limit.

The trading range for today is among key support at 76.55 and key resistance now at 79.55.

The general trend over short term basis is to the upside, targeting 87.45 as far as areas of 75.20 remain intact.

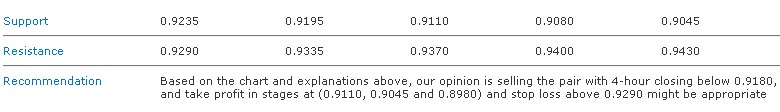

USD/CHF

The pair didn’t provide any 4-hour closing below 0.9180 yesterday, and now the exponential moving average moved to areas around 23.6% Fibonacci correction as shown above at 0.9195. Consolidation above 0.9235 should weaken the harmonic structure but will not negate it, but at the same time trading below 0.9195 should bring the negativity back, supported by the bearish Butterfly pattern.

The trading range for today is among the major support at 0.8980 and the major resistance at 0.9430.

The short-term trend is to the upside with steady weekly closing above 0.8020 targeting 0.9400.

USD/CAD

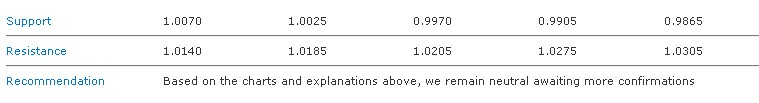

The pair attempts to breach the ascending main support level as shown above, which threatens the upside move, yet the pair is not stable below 1.0070 to confirm the negativity. At the same time, the RSI is negative and trades below the 50-point level, which is also a negative sign. Our previous positive expectations require consolidation above the critical support level shown in blue; however, as long as the pair attempts to breach this support level, we remain neutral now, awaiting more signs to confirm the bearishness

The trading range for today is among the major support at 0.9865 and the major resistance at 1.0275.

The short-term trend is to the downside as far as 1.0665 remains intact targeting 0.9000.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Triggers for an Upside Move

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.