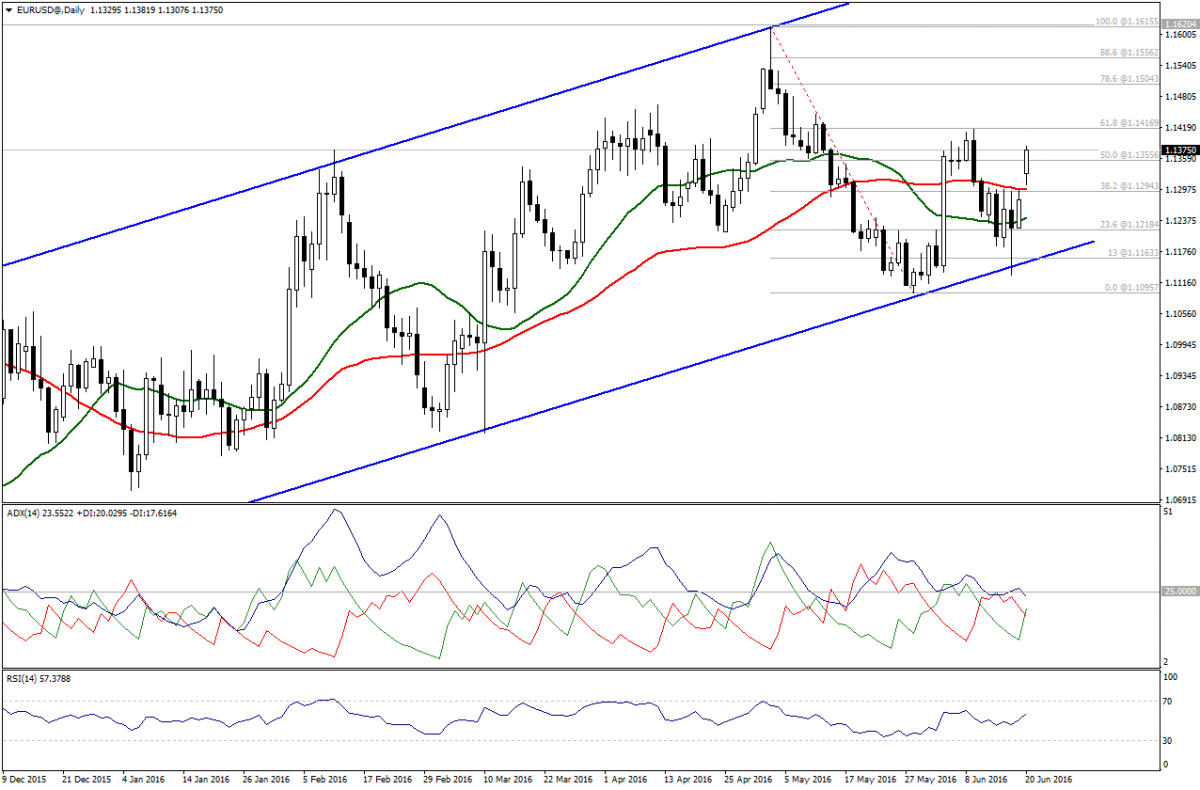

EUR/USD rose and stabilized above 1.1355 level, and this may be a reason for an extension of the upside wave. However, the extension of the upside wave will depend on the ability to achieve breakout above 1.1415.

Technical indicators become positive, while trading above the moving averages are also positive, but the breakthrough of 1.1415 will be required to prove the extension of the upside intraday. Trading above 1.1295 is needed to keep the bullishness today.

- Support: 1.1355 – 1.1295 – 1.1315

- Resistance: 1.1415- 1.1505 – 1.1555

Direction: positive attempt above 1.1355, targeting 1.1415 and 1.1500, as long as trading is above 1.1290.

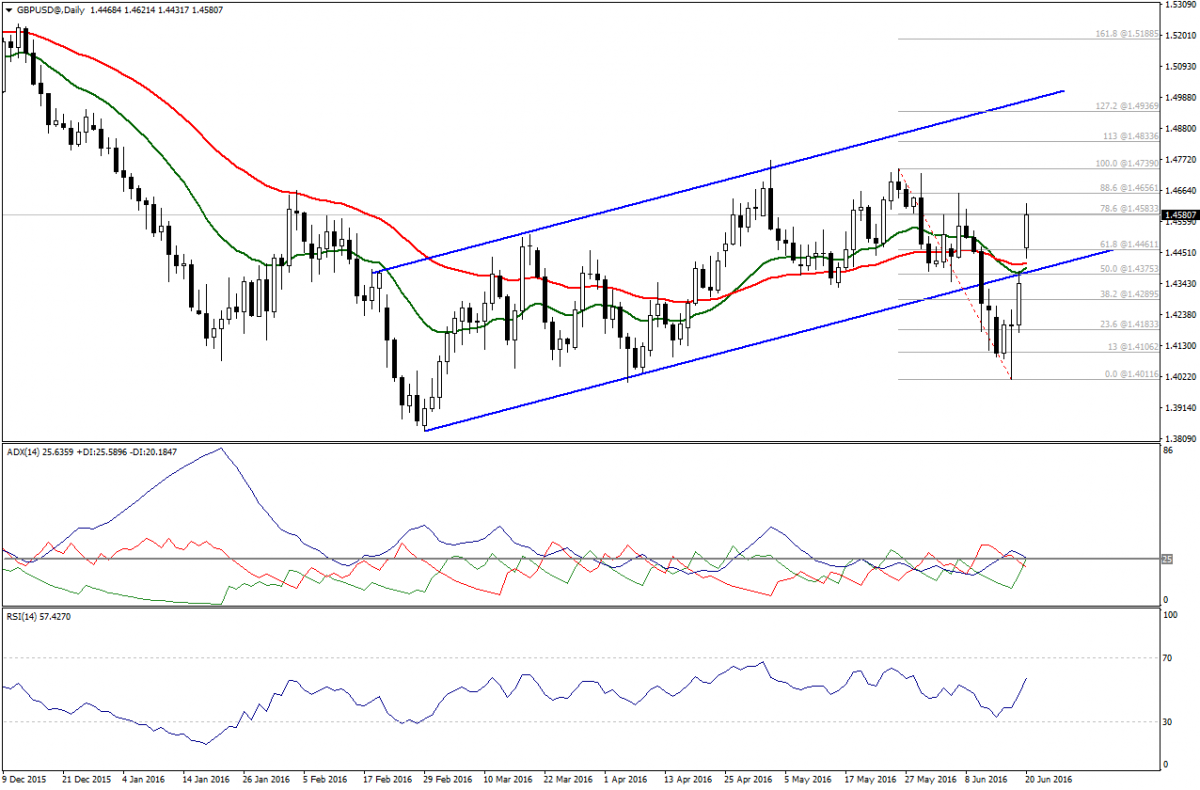

GBP/USD is trying to prove its stability above 1.4585, and stability above this level could trigger further bullishness over intraday basis today. In fact, we must be cautious today, as the risk is so high.

Technically, price stability above 1.4460 could cause more attempts to rise today. Breaking through 1.4655 will be a reason extension of the upside intraday.

- Support: 1.4500 – 1.4460 – 1.4375

- Resistance: 1.4655 – 1.4740 – 1.4835

Direction: positive above 1.4500, targeting 1.4655 and 1.4740, as long as trading is above 1.4460.