Happy New Year Traders!

2016 was a great year and we look forward to sharing our thoughts on the market with you. Let's start with crude.

It is interesting to note that for the past few weeks that though the price of crude oil keeps increasing, the value of Canadian dollar that is touted to have positive correlation with the commodity has indeed fallen. This is to show how strong the value of the greenback is post US presidential election. Mr President elect Trump, who has vowed to make America great again through expansionary fiscal policy, is no doubt going to benefit the commodities market in particular.

Oil being the primary source to lubricate the economic engine of the United States of America post Trump is seen poised for a further rally, albeit OPEC deal that pledged to cut output by more than 1 million barrels per day in an attempt to clear oversupply concerns back in November. Indeed, Kuwait was cited to consider cutting more production than agreed in the OPEC deal as Saudi Arabia started to cut it’s production by at least 486,000 barrels a day since October. Right now, one OPEC nation remains that can spoil the deal – Iran.

Iran was exempted from the deal, and has been reported to clear more than half of its floating storage at sea. Thomson Reuters Oil Flows data showed that Iran’s loads has dropped from 29.6 million barrels in October to 16.4 million barrels in recent reports. Prior to that, the stock has barely changed in 2016 as the data showed 29.7 million barrels at the beginning of last year. This could frustrate some OPEC members as Iran was also reported to be actively seeking buyers in Asia and Europe in an attempt to gain market share.

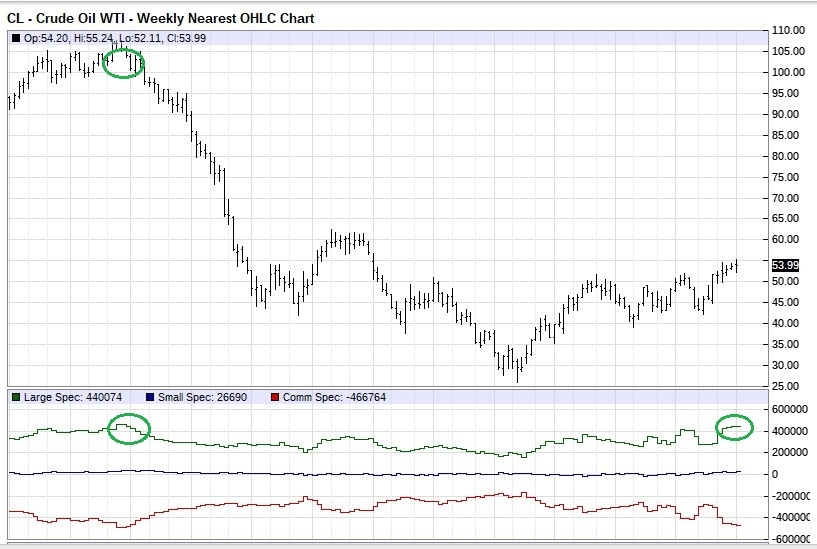

Nevertheless, looking at the futures market, sentiment is bullish with February and March delivery received more than 300,000 open interests and large speculators are net long at the same level when price was $100 a barrel. HalalTraders look to deploy a buy on dip strategy for a long term buy.