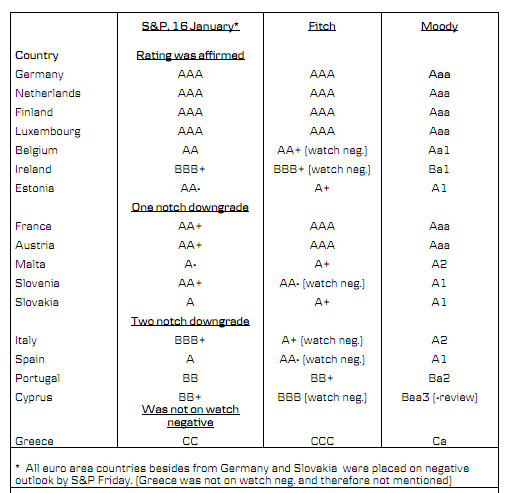

S&P downgraded nine euro area countries on Friday night after the US close. France and Austria were downgraded by one notch, while Italy and Spain were downgraded two notches. Germany, Finland and the Netherlands‟ AAA rating was affirmed.

Rumours of the rating verdict triggered negative sentiment on Friday, sending

EUR/USD sharply lower and stock indices down, while „safe-haven‟ bonds rose. Stock indices are also trading in negative territory in Asia this morning.

Friday‟s downgrades could mark the end of the more positive period of declining financial stress that we have seen since mid-December. In particular, if some of the many event risks in the euro area materialise in the coming days.

Following the move on France and Austria, a downgrade of the EFSF is to be

expected, while the EIB might keep its rating, in our view. Many financial institutions, in particular in Italy and France, could face downgrades too.

France lost its AAA rating

Standard & Poor‟s downgraded nine euro area countries Friday night after the US close, including France and Austria, which lost their AAA rating, but were “only” downgraded one notch, although S&P had warned that France could face a two-notch downgrade.

Malta, Slovenia and the Slovak Republic were also downgraded by one notch, while Italy, Spain, Portugal and Cyprus were downgraded two notches. The AAA rating of Germany, Finland, the Netherlands and Luxembourg was affirmed. Belgium, Ireland and Estoniawere not downgraded either.

S&P‟s main reason for the downgrades is that it sees that “the policy initiatives that have been taken by European policy makers in recent weeks may be insufficient to fully address ongoing systemic stresses in the euro zone”. S&P would like to see more elaborated growth strategies and is concerned that a strategy based primarily on a pillar of fiscal austerity risks becoming self-defeating. Chancellor Merkel and President Sarkozy did put emphasis on a second pillar of growth, jobs and productivity, after their recent meeting on 9 January, but details were lacking. S&P is also concerned that reform fatigue could be mounting.

Over the weekend, Chancellor Merkel used the S&P move to reinforce that the euro area leaders must intensify their efforts to solve the debt crisis. She also said that “the decision confirms my conviction that we have a long way ahead of us before investor confidence returns”.

The verdict from S&P has been expected since 5 December, when S&P placed 15 euro area countries on negative watch. The negative watch indications have now been changed back to 'stable' outlook for Germany and Slovakia and 'negative outlook' for the rest.Negative outlook indicates a one in three risk of a downgrade within two years.

Is this a game changer?

Market sentiment has been fairly positive since mid-December (following the ECBs announcement of 36 months LTROs) and financial stress has been declining since. There is a risk that Friday‟s downgrades will mark the end to this somewhat more upbeat period if more negative news materialises in the coming days. Unfortunately, this could very well be the case as there is plenty of event risk. Negotiations on a voluntary Greek debt swap is facing difficulties, we have a lot of potentially difficult government bond auctions from Italy and Spain coming up, S&P will likely strip EFSF of its AAA rating and also downgrade many financial institutions and Fitch will most likely publish its sovereign downgrades before the end of this month. We do not think that we are entering a prolonged period of very negative sentiment as we saw from August until early December last year. After all, there are plenty of signs that the global economy is entering a period of moderate recovery. The ECB‟s 3-year LTRO has so far been very supportive for the

sovereign bond market, in particular in shorter maturities, and we see no reason why a partially expected move from rating agencies should necessarily change this picture.

EFSF likely to be downgraded in coming days

Rating verdicts on banks and other financial institutions from the S&P are expected to follow in the coming days. Following the move on France and Austria, a downgrade on the EFSF seems very likely. France is the second largest contributor to the EFSF. This weekend, chancellor Merkel said that “I was never of the opinion that the EFSF necessarily has to be AAA” and also that “AA+ is also not a bad rating”. So Merkel seems prepared for the next verdict from the S&P.

In contrast, the European Investment Bank might be able to keep its AAA rating and only be placed on “negative outlook”, due to support from the non-euro countries, such as the UK, Denmark and Sweden.

Italy‟s two-notch downgrade means that a number of Italian banks are likely to be downgraded. This could further drive up their funding costs and make it more difficult to find purchasers for Italian government bonds. French financial institutions will probably face some downgrades too.

Rating moves from Moodys and Fitch

Fitch has six countries including Spain, Italy and Belgium on “Rating Watch Negative”. The Fitch review is set to be finished by the end of this month. France is “only” on negative outlook” and last week Fitch said that a downgrade of France was unlikely this year, so it seems that France keeps its AAA rating from Fitch for now. Moody‟s has France on stable outlook, so this AAA rating is probably safe for now, although Moody‟s is also reviewing its ratings.

Market reaction and outlook

Rumours of the rating verdict triggered negative sentiment in the European trade Friday.EUR/USD fell sharply to a session low of 1.2623. In addition, US stock indices traded in negative territory on Friday. S&P500 ended the session down 0.5%. In Asia, stock indices are also trading in negative territory as we enter the week. Nikkei is down by 1.5% and Hang Seng by 1.0% this morning.

EUR/USD

We could see EUR/USD go lower in the coming days and weeks if some of the many risks for the euro area materialise. However, we would like to point to positioning in the FX market as a supportive factor especially for EUR/USD. Bets against the euro have surged to a new record high. The market has never been this bearish on EUR/USD before.

Hence, the market is already positioned for a very negative euro-outcome and the potential for an abrupt short-covering in EUR/USD continues to grow day by day.

EU government bonds.

We are likely to see a short negative reaction on the spread between the peripherals and Germany, but it is likely to be selective rather than a general widening as e.g. Ireland was not downgraded, while Italy was downgraded to BBB+, a similar rating to Ireland. Furthermore a country like Belgium was unchanged, while Portugal got downgraded to junk-status.

One major reason why a general move should be modest is that all countries involved in the rating action by S&P are off the negative watch list and are either on stable or negative outlook. Hence, a further rating action should be further down the road.

The support from investors to the nordic countries should be intact, and thus we could see the Nordic government bonds gain against their EU peers despite an expensive pricing. Furthermore, we have seen a tremendous steepening of, for example, the Italian curve between 2-10Y after the announcement of the 3Y LTRO by the ECB. Here, we expect to see some flattening in the peripheral curves, such as Spain and Italy. Finally, Portugal had a strong start to 2012; again we could see Portugal lose a bit on Monday. However, as we do not expect either Ireland or Portugal to be hit by a PSI as in Greece, then a widening of the spread between Portugal and EU peers should be used to buy Portugal.

Furthermore, our top trades for 2012 - tighter schatz- and Bobl-spreads as well as lower volatility, should not be hurt by the downgrade.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

S&P Downgrade and Implications

Published 01/16/2012, 04:22 AM

Updated 05/14/2017, 06:45 AM

S&P Downgrade and Implications

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.